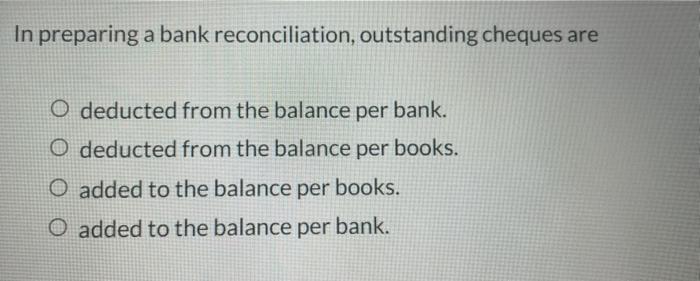

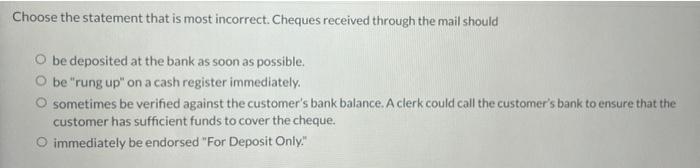

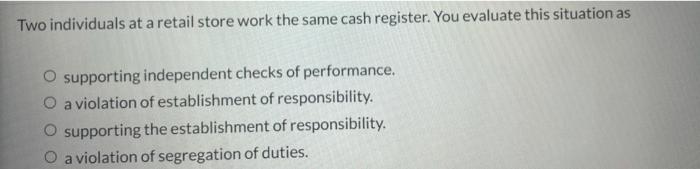

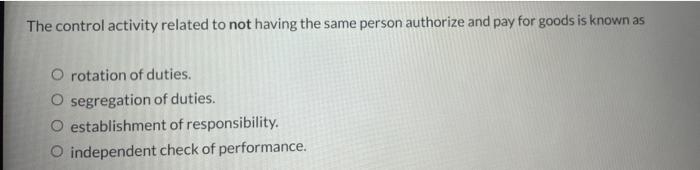

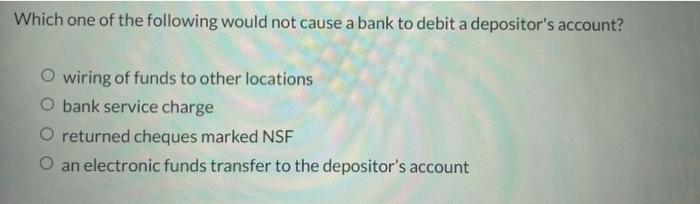

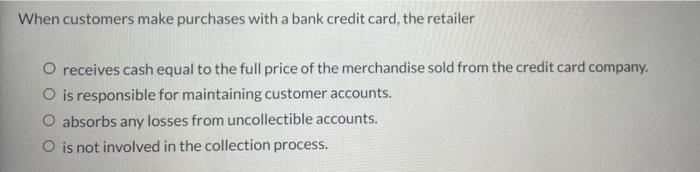

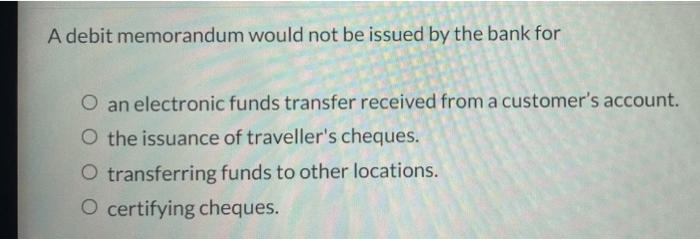

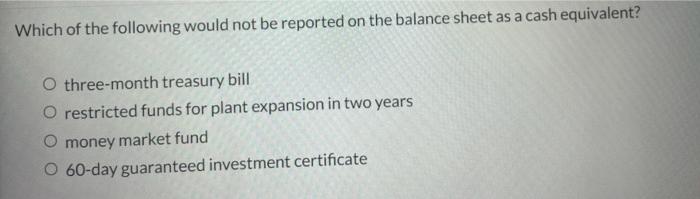

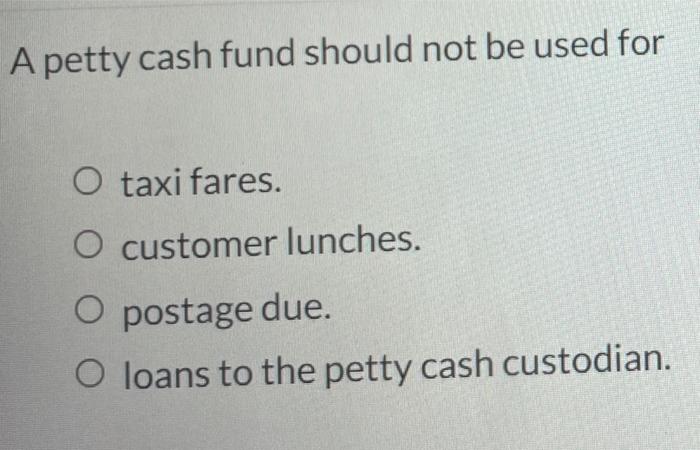

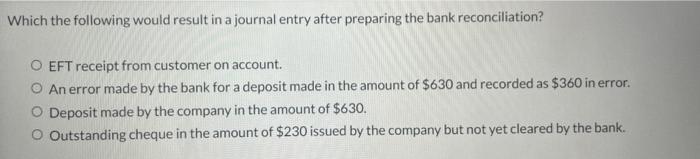

In preparing a bank reconciliation, outstanding cheques are O deducted from the balance per bank. O deducted from the balance per books. O added to the balance per books. O added to the balance per bank. Choose the statement that is most incorrect. Cheques received through the mail should O be deposited at the bank as soon as possible. be "rung up on a cash register immediately. O sometimes be verified against the customer's bank balance. A clerk could call the customer's bank to ensure that the customer has sufficient funds to cover the cheque. immediately be endorsed "For Deposit Only." Two individuals at a retail store work the same cash register. You evaluate this situation as O supporting independent checks of performance. O a violation of establishment of responsibility. O supporting the establishment of responsibility, O a violation of segregation of duties. The control activity related to not having the same person authorize and pay for goods is known as O rotation of duties. O segregation of duties. O establishment of responsibility. O independent check of performance. Which one of the following would not cause a bank to debit a depositor's account? O wiring of funds to other locations O bank service charge O returned cheques marked NSF O an electronic funds transfer to the depositor's account When customers make purchases with a bank credit card, the retailer O receives cash equal to the full price of the merchandise sold from the credit card company. O is responsible for maintaining customer accounts. O absorbs any losses from uncollectible accounts. O is not involved in the collection process. A debit memorandum would not be issued by the bank for O an electronic funds transfer received from a customer's account. O the issuance of traveller's cheques. O transferring funds to other locations. O certifying cheques. Which of the following would not be reported on the balance sheet as a cash equivalent? O three-month treasury bill O restricted funds for plant expansion in two years O money market fund O 60-day guaranteed investment certificate A petty cash fund should not be used for O taxi fares. O customer lunches. O postage due. O loans to the petty cash custodian. Which the following would result in a journal entry after preparing the bank reconciliation? O EFT receipt from customer on account. An error made by the bank for a deposit made in the amount of $630 and recorded as $360 in error. Deposit made by the company in the amount of $630. O Outstanding cheque in the amount of $230 issued by the company but not yet cleared by the bank