Question

In Problem 17C the statement At the end of year 6 some and just after the 6 th interest payment should read At

In Problem 17C the statement " At the end of year 6 some and just after the 6th interest payment" should read " At the end of year 5 some and just after the 5th interest payment".

Also, when you do 17A-C any past cash flows can be ignored. You should always only be looking at future cash flows. This means you can re-start the time line with zero. This means that in 17C there are only 5 years of interest that remain to be paid since 5 years have already been paid. Then there is the bond payoff of $10k in year 5. But in this case you buy the bond for $9,180 (in year zero) not $10,000 since the bond is trading (can be bought) for $9,180.

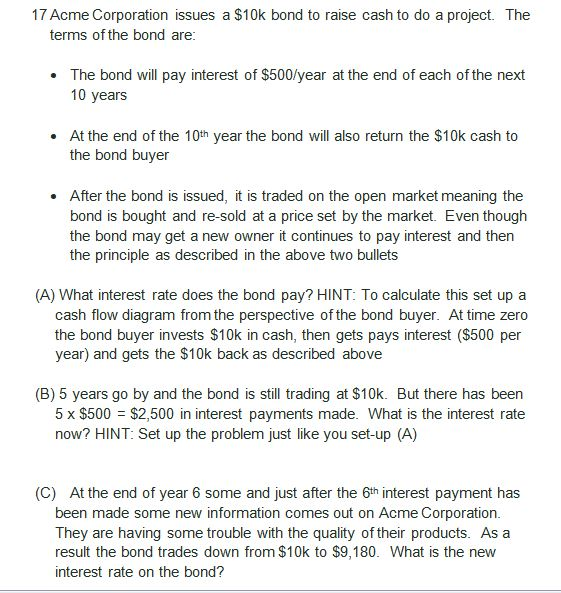

17 Acme Corporation issues a $10k bond to raise cash to do a project. The terms of the bond are: The bond will pay interest of $500/year at the end of each of the next 10 years At the end of the 10th year the bond will also return the $10k cash to the bond buyer After the bond is issued, it is traded on the open market meaning the bond is bought and re-sold at a price set by the market. Even though the bond may get a new owner it continues to pay interest and then the principle as described in the above two bullets (A) What interest rate does the bond pay? HINT: To calculate this set up a cash flow diagram from the perspective of the bond buyer. At time zero the bond buyer invests $10k in cash, then gets pays interest ($500 per year) and gets the $10k back as described above (B) 5 years go by and the bond is still trading at $10k. But there has been 5 x $500 = $2,500 in interest payments made. What is the interest rate now? HINT: Set up the problem just like you set-up (A) (C) At the end of year 6 some and just after the 6th interest payment has been made some new information comes out on Acme Corporation. They are having some trouble with the quality of their products. As a result the bond trades down from $10k to $9,180. What is the new interest rate on the bondStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started