Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In problems where no equity risk premium or tax rate are provided, please use an equity risk premium of 5.5% and a tax rate of

In problems where no equity risk premium or tax rate are provided, please use an equity risk premium of 5.5% and a tax rate of 40%.

Show work and answers in an excel spreadsheet.

Thank you very much

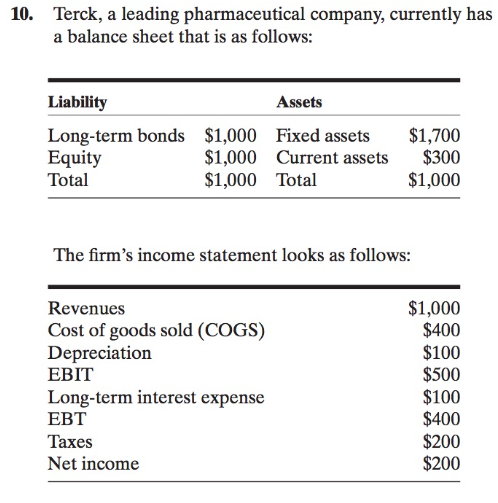

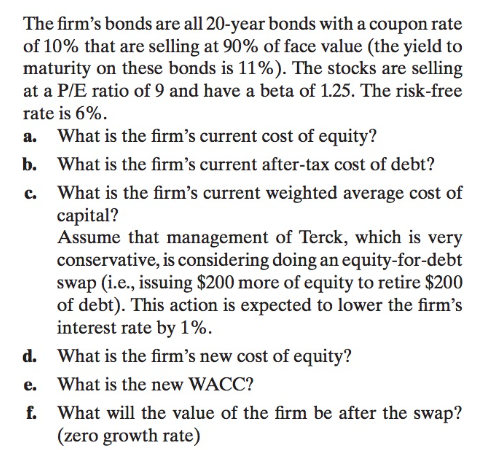

0. Terck, a leading pharmaceutical company, currently has a balance sheet that is as follows: The firm's income statement looks as follows: The firm's bonds are all 20-year bonds with a coupon rate of 10% that are selling at 90% of face value (the yield to maturity on these bonds is 11%). The stocks are selling at a P/E ratio of 9 and have a beta of 1.25 . The risk-free rate is 6%. a. What is the firm's current cost of equity? b. What is the firm's current after-tax cost of debt? c. What is the firm's current weighted average cost of capital? Assume that management of Terck, which is very conservative, is considering doing an equity-for-debt swap (i.e., issuing $200 more of equity to retire $200 of debt). This action is expected to lower the firm's interest rate by 1%. d. What is the firm's new cost of equity? e. What is the new WACC? f. What will the value of the firm be after the swap? (zero growth rate)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started