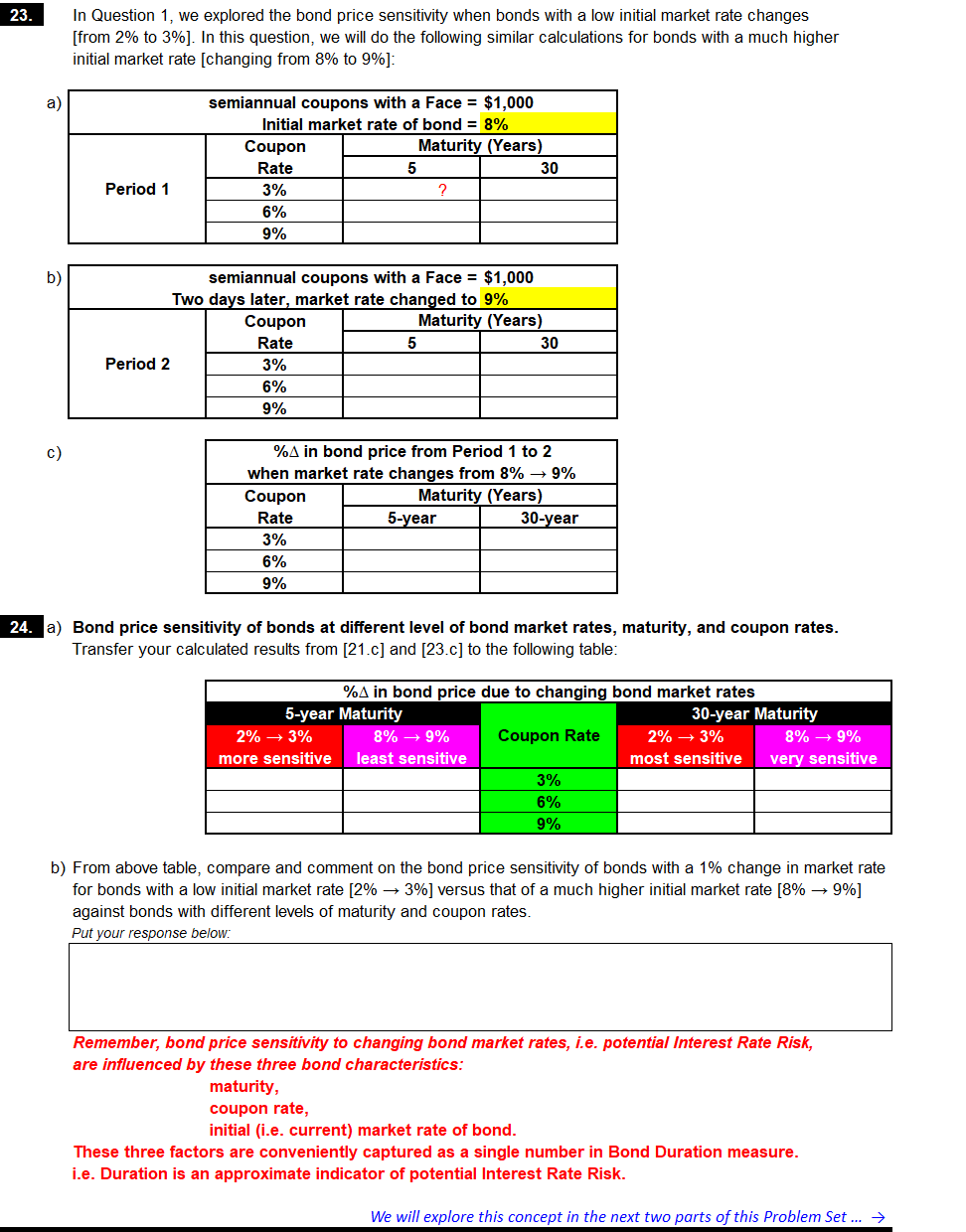

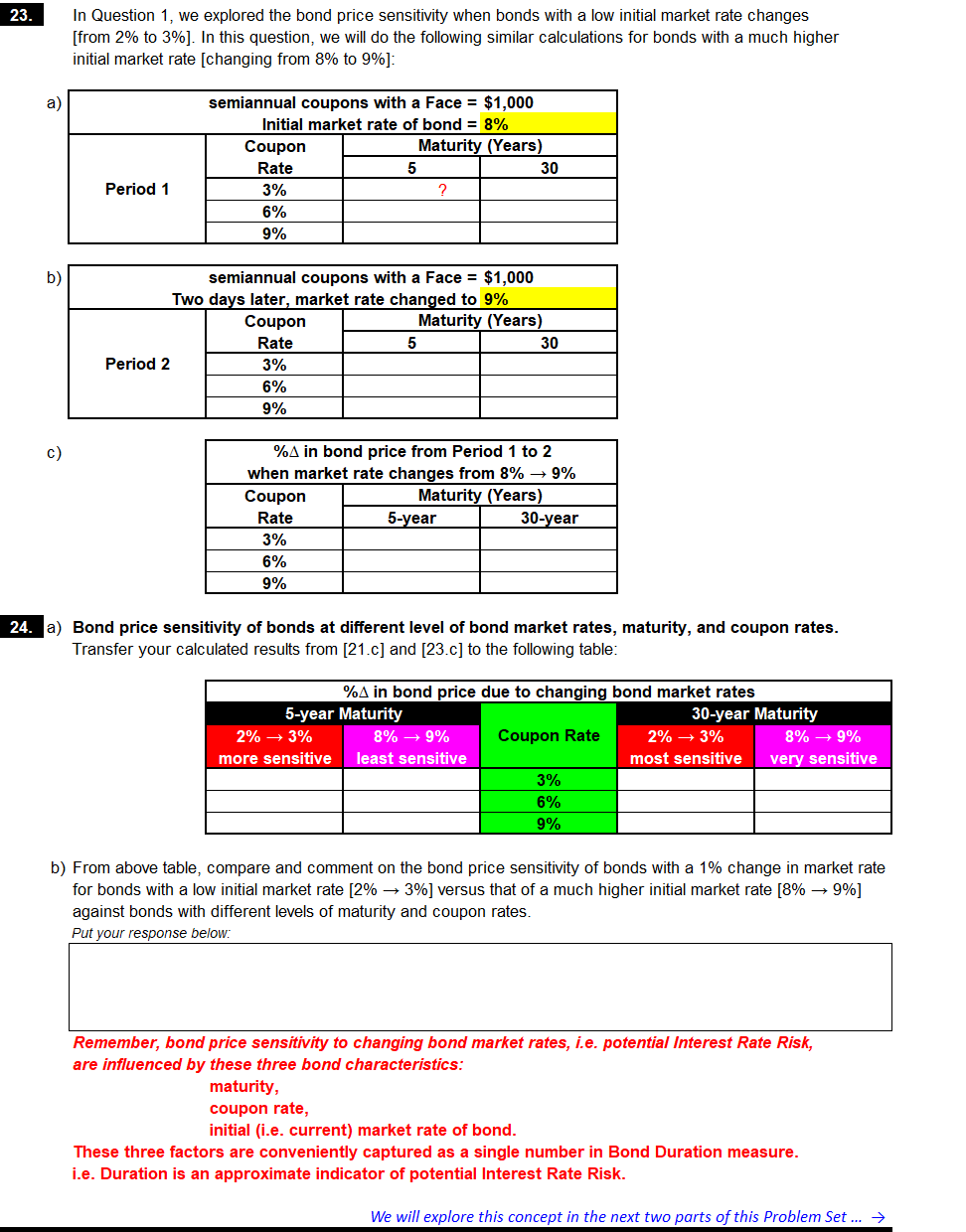

| In Question 1, we explored the bond price sensitivity when bonds with a low initial market rate changes |

| [from 2% to 3%]. In this question, we will do the following similar calculations for bonds with a much higher |

| initial market rate [changing from 8% to 9%]:

| | | |

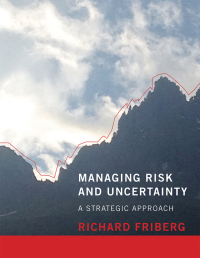

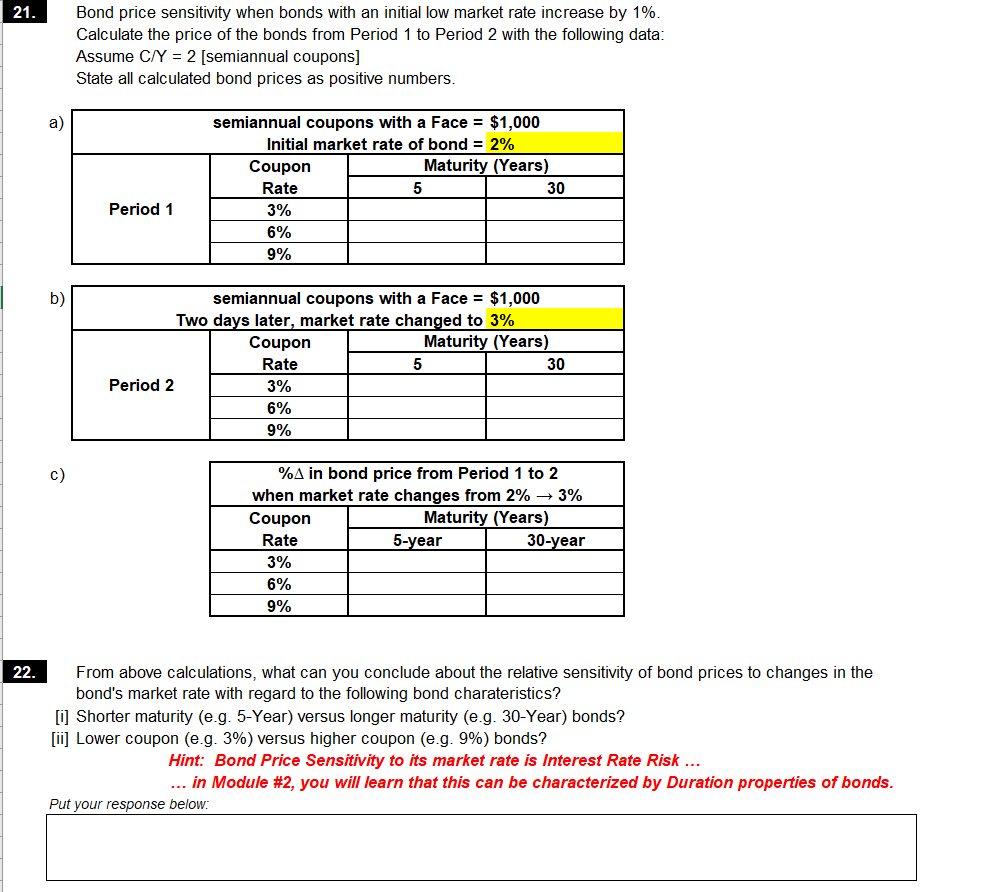

21. Bond price sensitivity when bonds with an initial low market rate increase by 1%. Calculate the price of the bonds from Period 1 to Period 2 with the following data: Assume C/Y = 2 (semiannual coupons] State all calculated bond prices as positive numbers. semiannual coupons with a Face = $1,000 Initial market rate of bond = 2% Coupon Maturity (Years) Rate 5 30 Period 1 3% 6% 9% semiannual coupons with a Face = $1,000 Two days later, market rate changed to 3% Coupon Maturity (Years) Rate 5 30 Period 2 3% 6% 9% %A in bond price from Period 1 to 2 when market rate changes from 2% + 3% Coupon Maturity (Years) Rate 1 5 -year 30-year 3% 6% 9% 22. From above calculations, what can you conclude about the relative sensitivity of bond prices to changes in the bond's market rate with regard to the following bond charateristics? [i] Shorter maturity (e.g. 5-Year) versus longer maturity (e.g. 30-Year) bonds? [ii] Lower coupon (e.g. 3%) versus higher coupon (e.g. 9%) bonds? Hint: Bond Price Sensitivity to its market rate is Interest Rate Risk ... ... in Module #2, you will learn that this can be characterized by Duration properties of bonds. Put your response below: 23. In Question 1, we explored the bond price sensitivity when bonds with a low initial market rate changes [from 2% to 3%]. In this question, we will do the following similar calculations for bonds with a much higher initial market rate (changing from 8% to 9%]: semiannual coupons with a Face = $1,000 Initial market rate of bond = 8% Coupon Maturity (Years) Rate 3% 6% 9% 5 30 Period 1 semiannual coupons with a Face = $1,000 Two days later, market rate changed to 9% Coupon Maturity (Years) Rate 15 Period 2 3% 6% 9% 1 30 %A in bond price from Period 1 to 2 when market rate changes from 8% 9% Coupon Maturity (Years) Rate 5-year 30-year 3% 6% 9% 24. a) Bond price sensitivity of bonds at different level of bond market rates, maturity, and coupon rates. Transfer your calculated results from [21.c] and [23.c] to the following table: %A in bond price due to changing bond market rates 5-year Maturity 30-year Maturity 2% 3% 8% 9% Coupon Rate 2% 3% 8% 9% more sensitive least sensitive most sensitive very sensitive 3% 6% 9% b) From above table, compare and comment on the bond price sensitivity of bonds with a 1% change in market rate for bonds with a low initial market rate [2% 3%] versus that of a much higher initial market rate [8% 9%] against bonds with different levels of maturity and coupon rates. Put your response below: Remember, bond price sensitivity to changing bond market rates, i.e. potential Interest Rate Risk, are influenced by these three bond characteristics: maturity, coupon rate, initial (i.e. current) market rate of bond. These three factors are conveniently captured as a single number in Bond Duration measure. .e. Duration is an approximate indicator of potential Interest Rate Risk. We will explore this concept in the next two parts of this Problem Set ...