Question

In Reference to Team Assignment #2 - Inventory Methods Change from FIFO to LIFO Review what you have learned about the effects of LIFO and

In Reference to Team Assignment #2 - Inventory Methods Change from FIFO to LIFO Review what you have learned about the effects of LIFO and FIFO on net income and use the above information to answer the following questions. Please answer in complete sentences and show your calculations for numerical answers. 6. We can assume that Senecas top management gave careful thought and consideration to the change from FIFO to LIFO. Do you think their decision was based primarily on matching current costs with current revenues, or on achieving tax savings? Why?

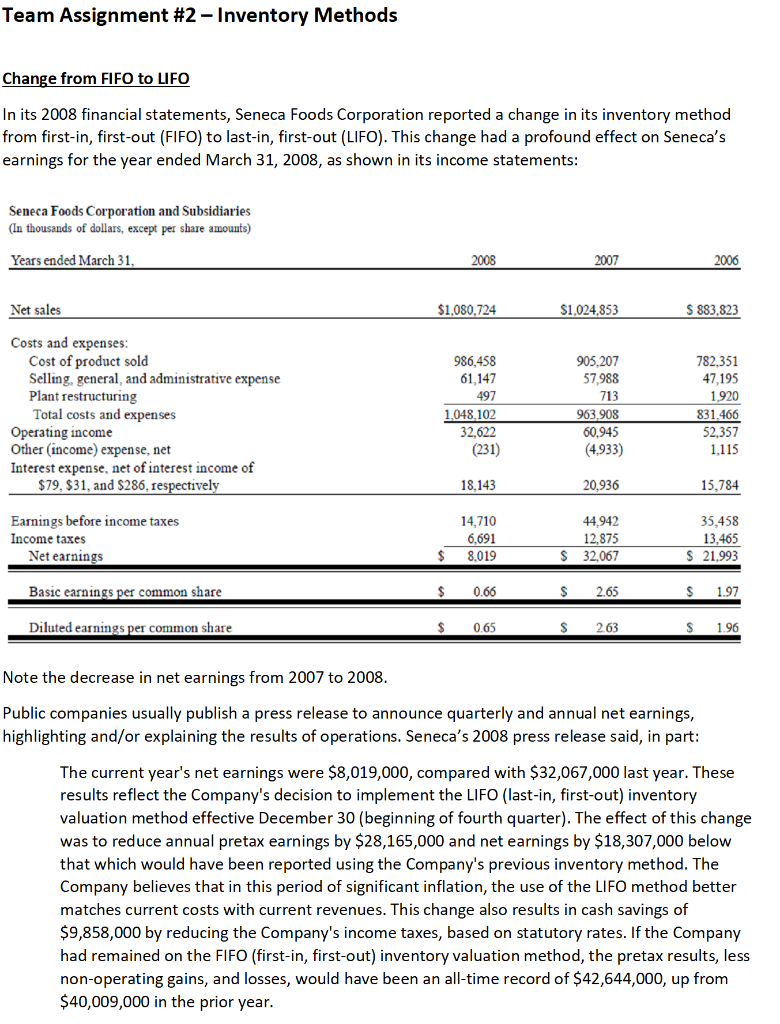

Team Assignment #2 - Inventory Methods Change from FIFO to LIFO In its 2008 financial statements, Seneca Foods Corporation reported a change in its inventory method from first-in, first-out (FIFO) to last-in, first-out (LIFO). This change had a profound effect on Seneca's earnings for the year ended March 31, 2008, as shown in its income statements: Seneca Foods Corporation and Subsidiaries (In thousands of dollars, except per share amounts) Years ended March 31, 2008 2007 2006 Net sales $1,080,724 $1,024,853 $ 883,823 Costs and expenses: Cost of product sold Selling, general, and administrative expense Plant restructuring Total costs and expenses Operating income Other (income) expense, net Interest expense, net of interest income of $79, $31, and $286, respectively 986,458 61,147 497 1.048.102 32,622 (231) 905.207 57988 713 963.908 60,945 (4.933) 782,351 47,195 1920 831.466 52.357 1.115 18.143 20.936 15,784 Earnings before income taxes Income taxes Net earnings 14,710 6.691 8.019 44,942 12,875 32,067 35,458 13,465 $ 21,993 S Basic earnings per common share $ 0.66 $ 2.65 $ 1.97 Diluted earnings per common share $ 0.65 S 2.63 S 1.96 Note the decrease in net earnings from 2007 to 2008. Public companies usually publish a press release to announce quarterly and annual net earnings, highlighting and/or explaining the results of operations. Seneca's 2008 press release said, in part: The current year's net earnings were $8,019,000, compared with $32,067,000 last year. These results reflect the Company's decision to implement the LIFO (last-in, first-out) inventory valuation method effective December 30 (beginning of fourth quarter). The effect of this change was to reduce annual pretax earnings by $28,165,000 and net earnings by $18,307,000 below that which would have been reported using the Company's previous inventory method. The Company believes that in this period of significant inflation, the use of the LIFO method better matches current costs with current revenues. This change also results in cash savings of $9,858,000 by reducing the Company's income taxes, based on statutory rates. If the Company had remained on the FIFO (first-in, first-out) inventory valuation method, the pretax results, less non-operating gains, and losses, would have been an all-time record of $42,644,000, up from $40,009,000 in the prior year. Team Assignment #2 - Inventory Methods Change from FIFO to LIFO In its 2008 financial statements, Seneca Foods Corporation reported a change in its inventory method from first-in, first-out (FIFO) to last-in, first-out (LIFO). This change had a profound effect on Seneca's earnings for the year ended March 31, 2008, as shown in its income statements: Seneca Foods Corporation and Subsidiaries (In thousands of dollars, except per share amounts) Years ended March 31, 2008 2007 2006 Net sales $1,080,724 $1,024,853 $ 883,823 Costs and expenses: Cost of product sold Selling, general, and administrative expense Plant restructuring Total costs and expenses Operating income Other (income) expense, net Interest expense, net of interest income of $79, $31, and $286, respectively 986,458 61,147 497 1.048.102 32,622 (231) 905.207 57988 713 963.908 60,945 (4.933) 782,351 47,195 1920 831.466 52.357 1.115 18.143 20.936 15,784 Earnings before income taxes Income taxes Net earnings 14,710 6.691 8.019 44,942 12,875 32,067 35,458 13,465 $ 21,993 S Basic earnings per common share $ 0.66 $ 2.65 $ 1.97 Diluted earnings per common share $ 0.65 S 2.63 S 1.96 Note the decrease in net earnings from 2007 to 2008. Public companies usually publish a press release to announce quarterly and annual net earnings, highlighting and/or explaining the results of operations. Seneca's 2008 press release said, in part: The current year's net earnings were $8,019,000, compared with $32,067,000 last year. These results reflect the Company's decision to implement the LIFO (last-in, first-out) inventory valuation method effective December 30 (beginning of fourth quarter). The effect of this change was to reduce annual pretax earnings by $28,165,000 and net earnings by $18,307,000 below that which would have been reported using the Company's previous inventory method. The Company believes that in this period of significant inflation, the use of the LIFO method better matches current costs with current revenues. This change also results in cash savings of $9,858,000 by reducing the Company's income taxes, based on statutory rates. If the Company had remained on the FIFO (first-in, first-out) inventory valuation method, the pretax results, less non-operating gains, and losses, would have been an all-time record of $42,644,000, up from $40,009,000 in the prior yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started