Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In relation to initial recognition: a) How would the initial recognition of the above transactions be reported, and why? b) What factors are used to

In relation to initial recognition:

a) How would the initial recognition of the above transactions be reported, and why?

b) What factors are used to determine the cost that can be capitalized and those that are expensed?

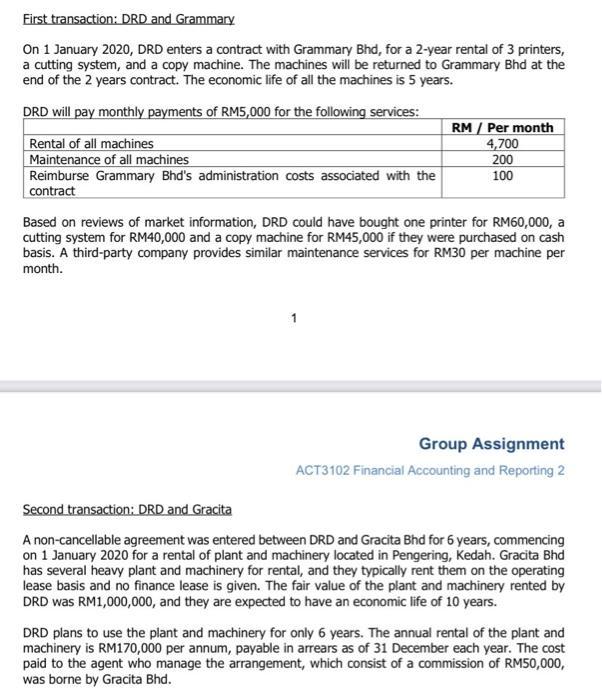

Eirst transaction: DRD and Grammary On 1 January 2020, DRD enters a contract with Grammary Bhd, for a 2-year rental of 3 printers, a cutting system, and a copy machine. The machines wili be returned to Grammary Bhd at the end of the 2 years contract. The economic life of all the machines is 5 years. DRD will pay monthly payments of RM5,000 for the following services: Rental of all machines Maintenance of all machines Reimburse Grammary Bhd's administration costs associated with the contract RM / Per month 4,700 200 100 Based on reviews of market information, DRD could have bought one printer for RM60,000, a cutting system for RM40,000 and a copy machine for RM45,000 if they were purchased on cash basis. A third-party company provides similar maintenance services for RM30 per machine per month. Group Assignment ACT3102 Financial Accounting and Reporting 2 Second transaction: DRD and Gracita A non-cancellable agreement was entered between DRD and Gracita Bhd for 6 years, commencing on 1 January 2020 for a rental of plant and machinery located in Pengering, Kedah. Gracita Bhd has several heavy plant and machinery for rental, and they typically rent them on the operating lease basis and no finance lease is given. The fair value of the plant and machinery rented by DRD was RM1,000,000, and they are expected to have an economic life of 10 years. DRD plans to use the plant and machinery for only 6 years. The annual rental of the plant and machinery is RM170,000 per annum, payable in arrears as of 31 December each year. The cost paid to the agent who manage the arrangement, which consist of a commission of RM50,000, was borne by Gracita Bhd.

Step by Step Solution

★★★★★

3.49 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Transaction 1 The lease contract is an operating lease as the lease period is 2 years and the economic life of the asset is 5 years which means the lease period is less than 75 of the life of the asse...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started