Question

In relation to stock price returns, various derivatives (e.g., ELS and options) are priced based on stock price movements until a specific maturity, but in

In relation to stock price returns, various derivatives (e.g., ELS and options) are priced based on stock price movements until a specific maturity, but in many cases it is difficult to calculate their theoretical prices mathematically. Stock price simulation techniques are widely used for fundamental price calculation of these derivatives. This model analyzes the method of utilizing the geometric brown motion technique, which is widely used in such stock price simulations.

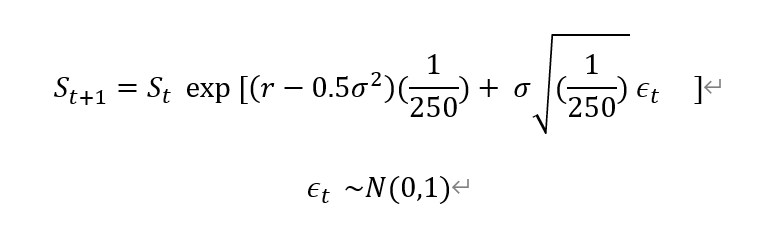

1 Today's time point is called 0 days, and the expiration date of the derivative is defined as T days. Every week between 0 and T is S0, S1, and...The model that creates a scenario for the stock price path for the ,St,ST day can be determined as follows according to the geometric Brownian motion. Here, r is the (risk-free) interest rate of the market, and means the historical volatility of the stock price return. 1/250 is a constant used to correct the volatility of interest rates and stock price returns expressed on an annual basis to daily returns.

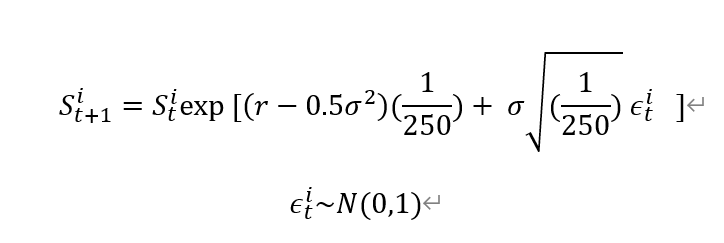

2 However, in order to utilize the scenario technique by such simulation, it is necessary to write a number of scenarios. When writing a total of N scenarios, i means the i-th scenario. This i-th scenario creation method is the same as the one stock price path scenario presented above, which means repeating it N times.

Write 10,000 scenarios of the stock price path for S0=100, T=30, ==0.1, and rf=0.04 and find the mean and variance for the written 10,000 ST values.

1 = + o St+1 = St exp [(r 0.502) (250) 2.50 et ] Et ~N(0,1) 1 S*+1 = S{exp [(r 0.502) 250 1 (250) +O t1 ] -N(0,1) 1 = + o St+1 = St exp [(r 0.502) (250) 2.50 et ] Et ~N(0,1) 1 S*+1 = S{exp [(r 0.502) 250 1 (250) +O t1 ] -N(0,1)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started