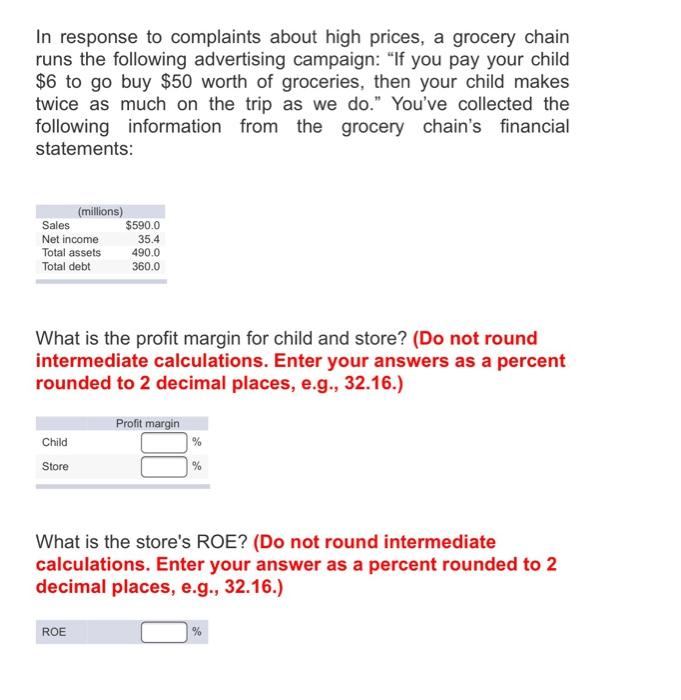

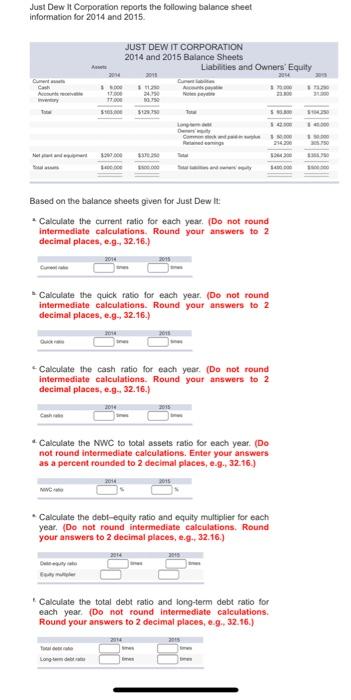

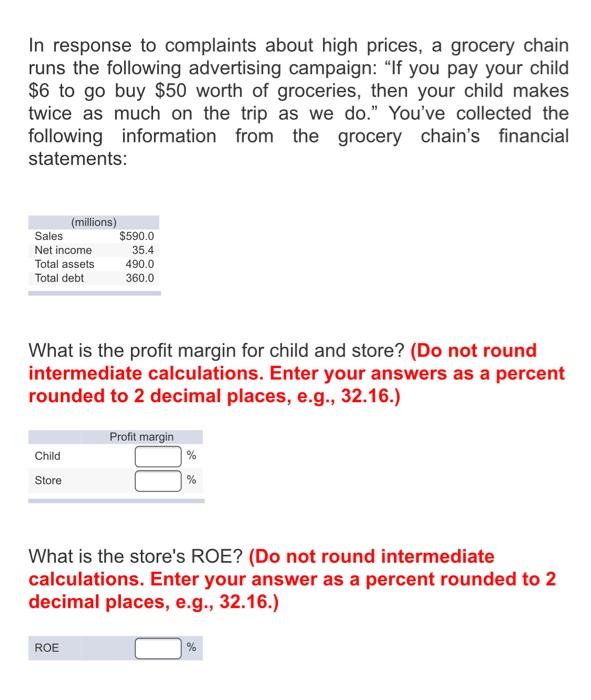

In response to complaints about high prices, a grocery chain runs the following advertising campaign: "If you pay your child $6 to go buy $50 worth of groceries, then your child makes twice as much on the trip as we do." You've collected the following information from the grocery chain's financial statements: (millions) Sales $590.0 Net income 35.4 Total assets 490.0 Total debt 360.0 What is the profit margin for child and store? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Profit margin Child % Store % What is the store's ROE? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) ROE % Just Dew It Corporation reports the following balance sheet information for 2014 and 2015 JUST DEW IT CORPORATION 2014 and 2015 Balance Sheets Liabilities and Owners' Equity 2011 20 Casi A 17.00 17.00 De CM Metal Based on the balance sheets given for Just Dew it - Calculate the current ratio for each year. (Do not round interm te calculations. Round your answers to decimal places, e.g. 32.16.) Calculate the quick ratio for each year. (Do not round intermediate calculations. Round your answers to 2 decimal places, e.g., 32.16.) Calculate the cash ratio for each year. (Do not round intermediate calculations. Round your answers to 2 decimal places, e.g. 32.16.) Calculate the NWC to total assets ratio for each year. (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places, e... 3216.) MIC Calculate the debt-equity ratio and equity multiplier for each year. (Do not round intermediate calculations. Round your answers to 2 decimal places, e.g. 32.16.) 2014 Calculate the total debt ratio and long-term debt ratio for each year. (Do not round intermediate calculations, Round your answers to 2 decimal places, e.g. 32. 16.) 2015 2014 Long In response to complaints about high prices, a grocery chain runs the following advertising campaign: "If you pay your child $6 to go buy $50 worth of groceries, then your child makes twice as much on the trip as we do." You've collected the following information from the grocery chain's financial statements: (millions) Sales $590.0 Net income 35.4 Total assets 490.0 Total debt 360.0 What is the profit margin for child and store? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Profit margin Child Store % What is the store's ROE? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) ROE %