Question

In return for property sold, an entity got a 7-year zero-interest-bearing note on February 1, 2020. The property had no fixed exchange price, and the

In return for property sold, an entity got a 7-year zero-interest-bearing note on February 1, 2020. The property had no fixed exchange price, and the note had no ready market. The prevailing interest rate on a note of this kind was 7% on February 1, 2020, 6% on December 31, 2020, 8% on February 1, 2021, and 9% on December 31, 2021. What interest rate should be utilized to compute the transaction's interest revenue for the financial year ending December 31, 2020 and 2021, respectively?

An business acquired a two-year 8% note receivable for services provided on July 1 of the current year. The market rate of interest at the time was 10%. The face amount of the note, as well as the full amount of interest, is payable on the maturity date. What is the interest receivable on December 31st of the current year?

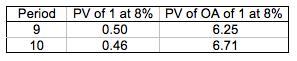

On December 31, 2019, Boy Company sold a machine to Abunda Company in return for a non-interest bearing note with 10 yearly installments of $20,000. The first payment was paid by Abunda Company on December 31, 2019. At the time of issue, the market interest rate for similar notes was 8%. The following is information on present value factors:

In its December 31, 2019 balance sheet, what is the amount that Boy Company should report as note receivable?

In its December 31, 2019 balance sheet, what is the amount that Boy Company should report as note receivable?

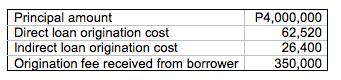

On January 1, 2019, Treasure Bank made a loan to a borrower. The loan has a ten percent interest rate that is due yearly beginning December 31, 2019. The loan will be paid off in five years, on December 31, 2023. The loan data are as follows:

What is the loan's effective interest rate?

5. On December 31, 2019, the loan receivable's carrying amount is?

Abunda Corporation sold an old piece of equipment with an initial cost of $80,000 and a carrying value of $50,000 for $100,000 on December 31, 2019. The following were the conditions of the sale: • $40,000 down payment; $30,000 payable on December 31 of each of the next 2 years.

The sale agreement included no mention of interest; nevertheless, 12% would be a reasonable rate for this kind of transaction. (Hint: PV of OA of 1 at 12% for two periods is 1.6901)

6. How much should be recorded as gain on equipment sale?

7. How much interest income should be recorded in 2020 as a result of the preceding transaction?

Period 9 10 PV of 1 at 8% PV of OA of 1 at 8% 6.25 0.50 0.46 6.71

Step by Step Solution

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Lets tackle these questions one by one 1 The interest rate to be used for the first transaction the 7year zerointerestbearing note should ideally be the rate at the time of the transaction as it repre...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started