Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In step 9, the total cash from current policies is $ (Type a whole number.) The amount in retirement savings and investments is $ (Type

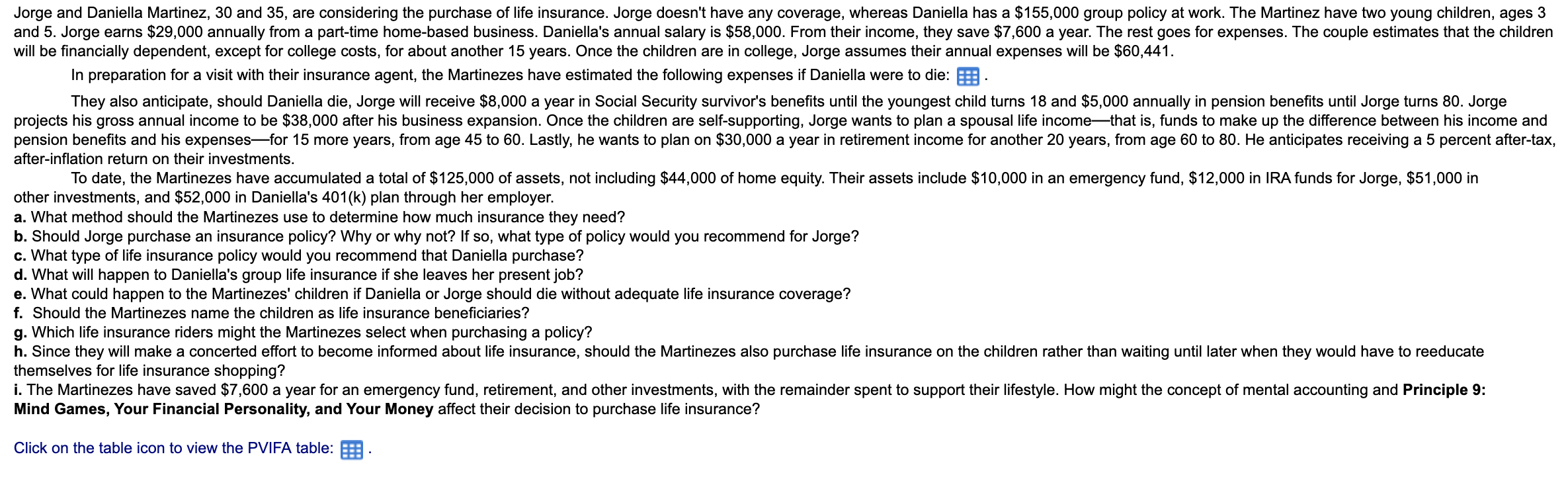

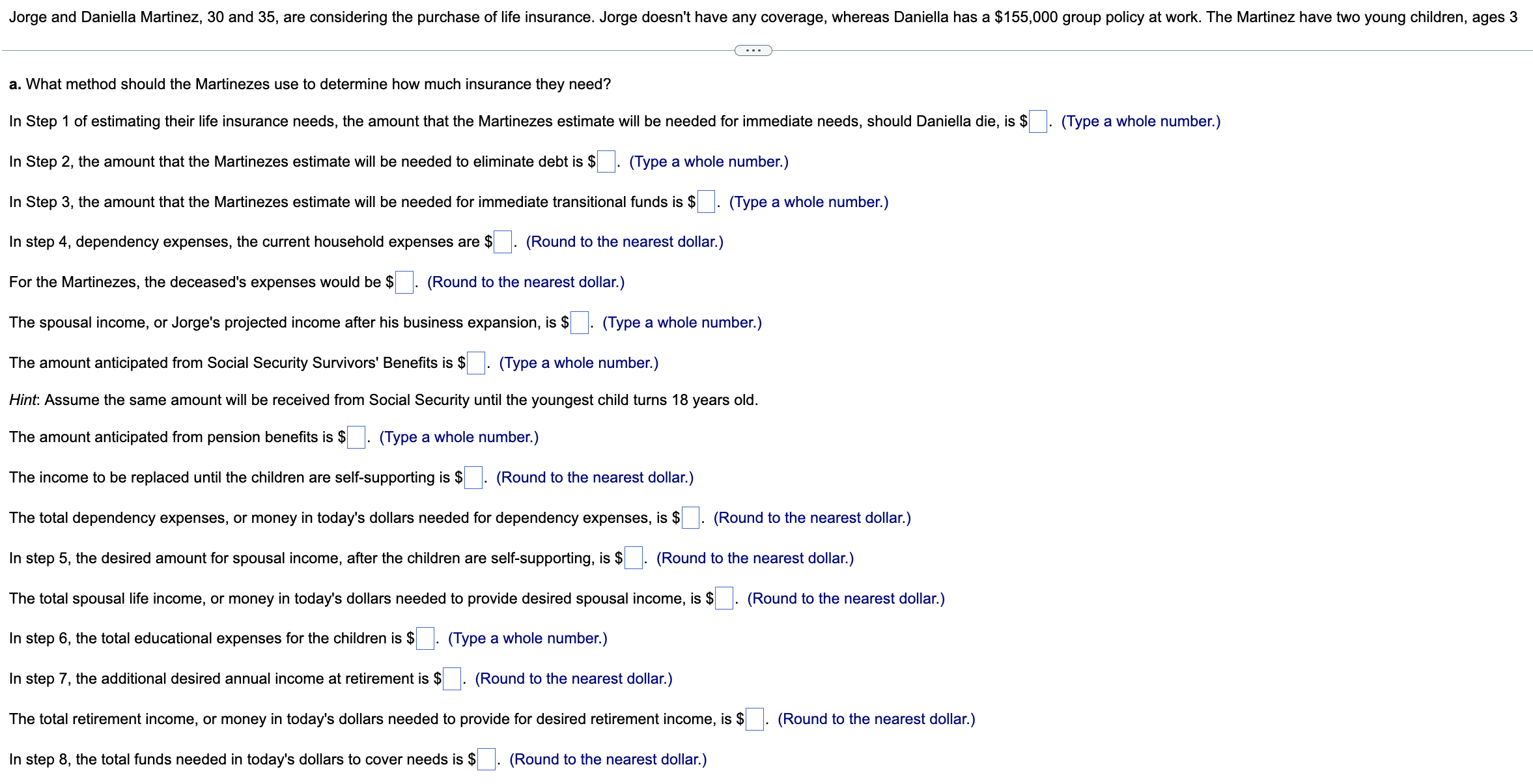

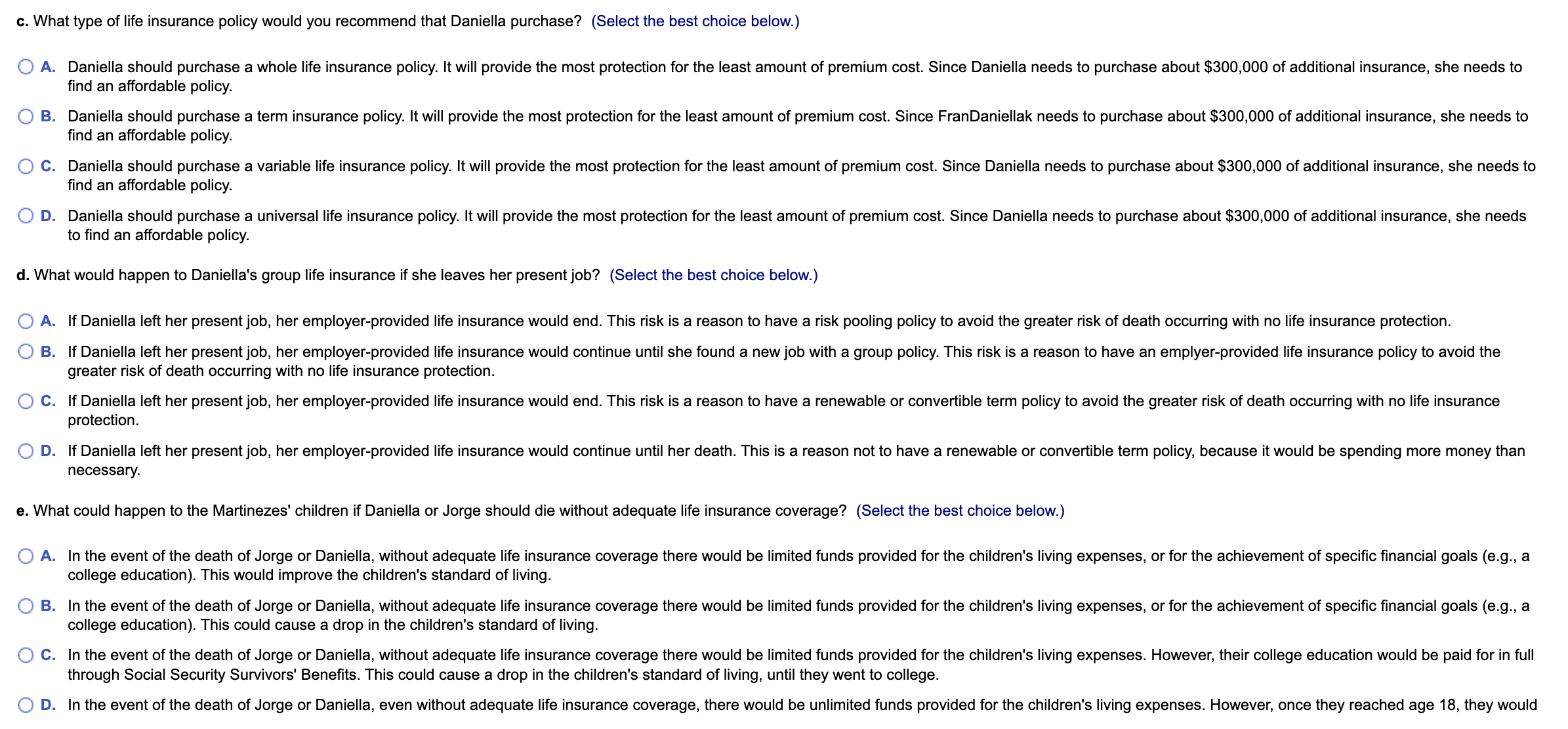

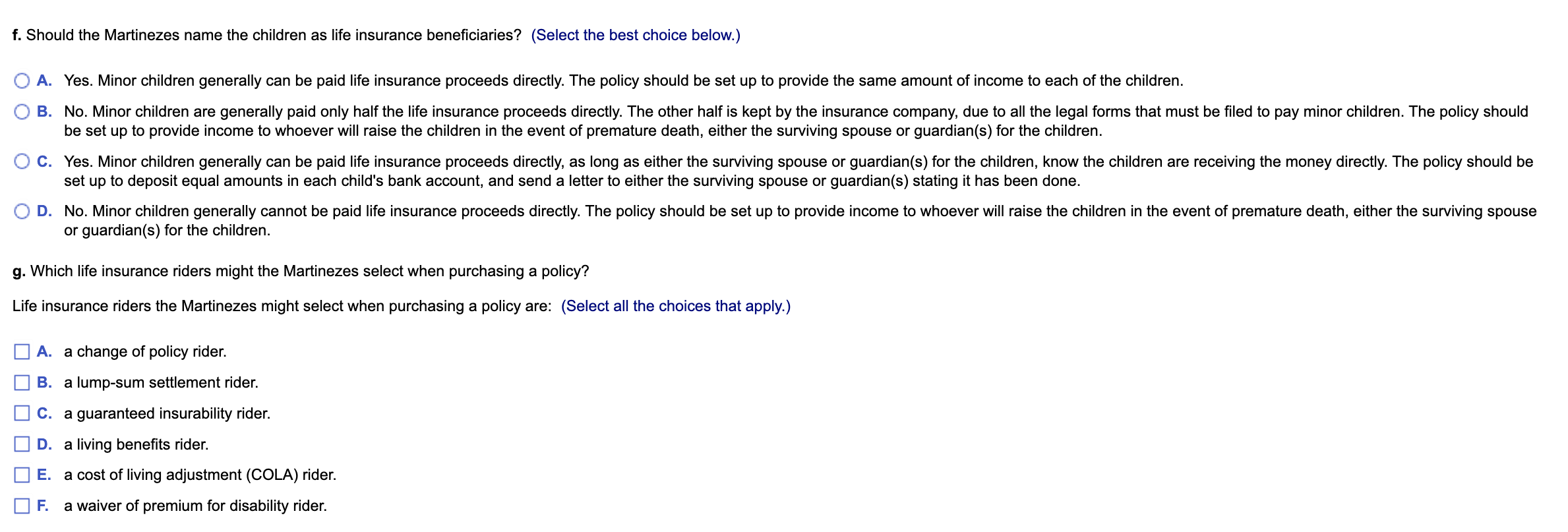

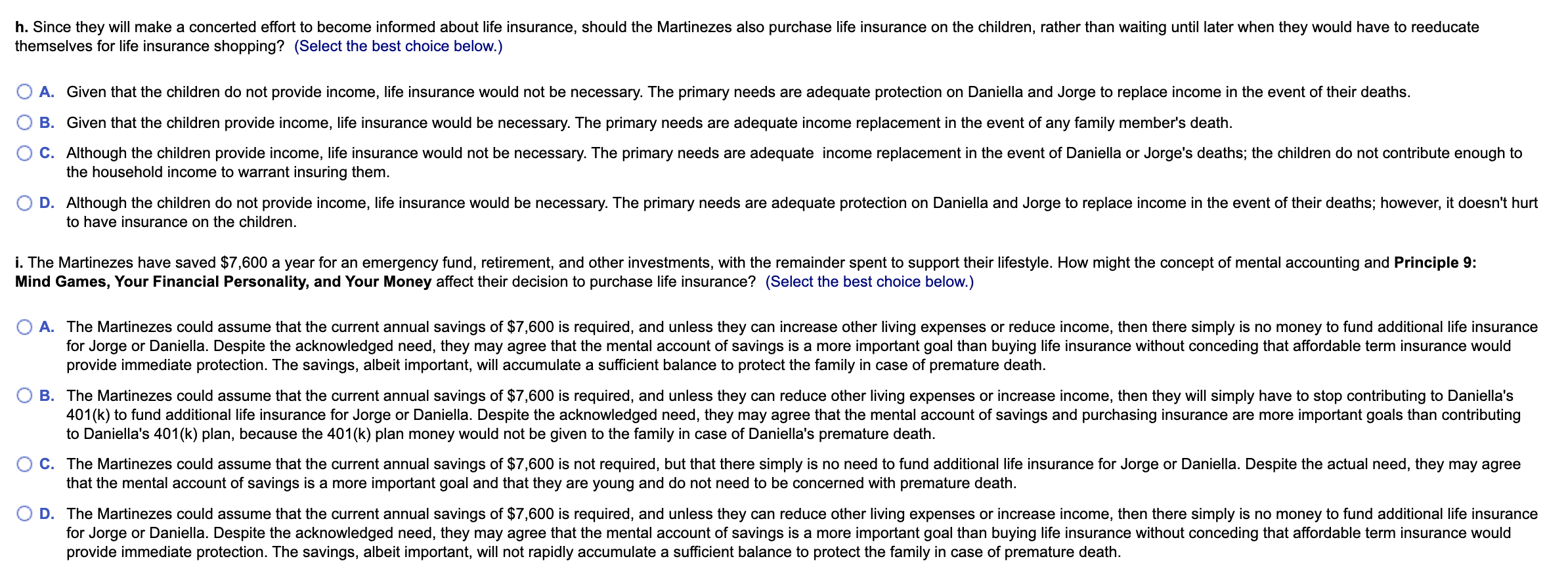

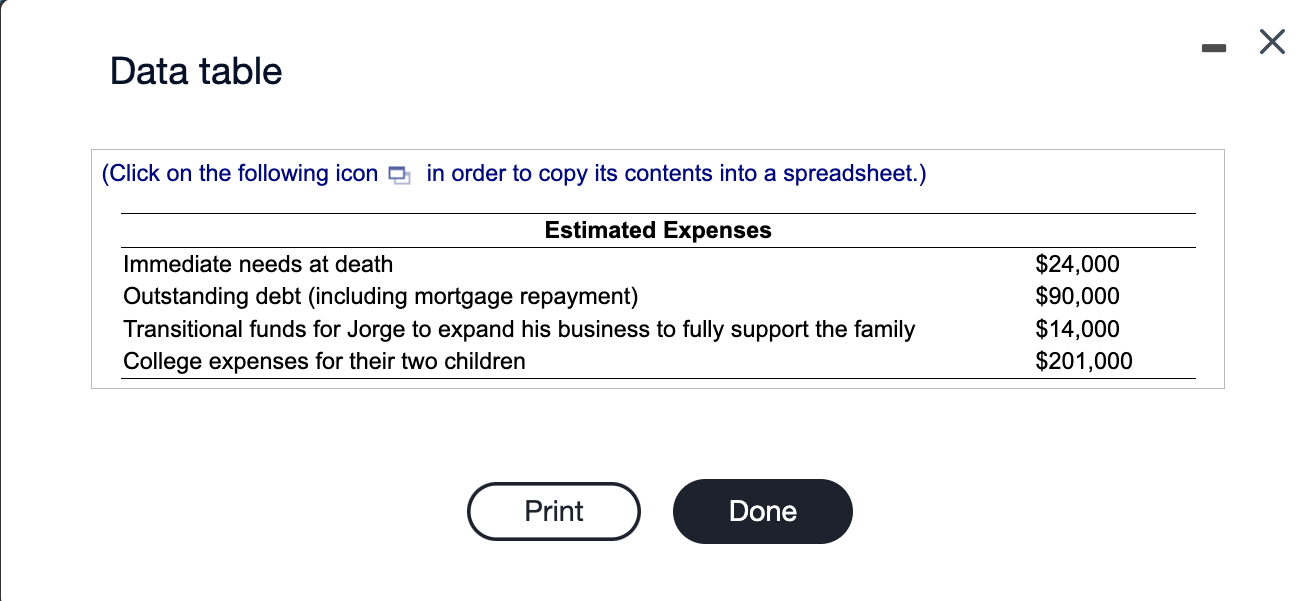

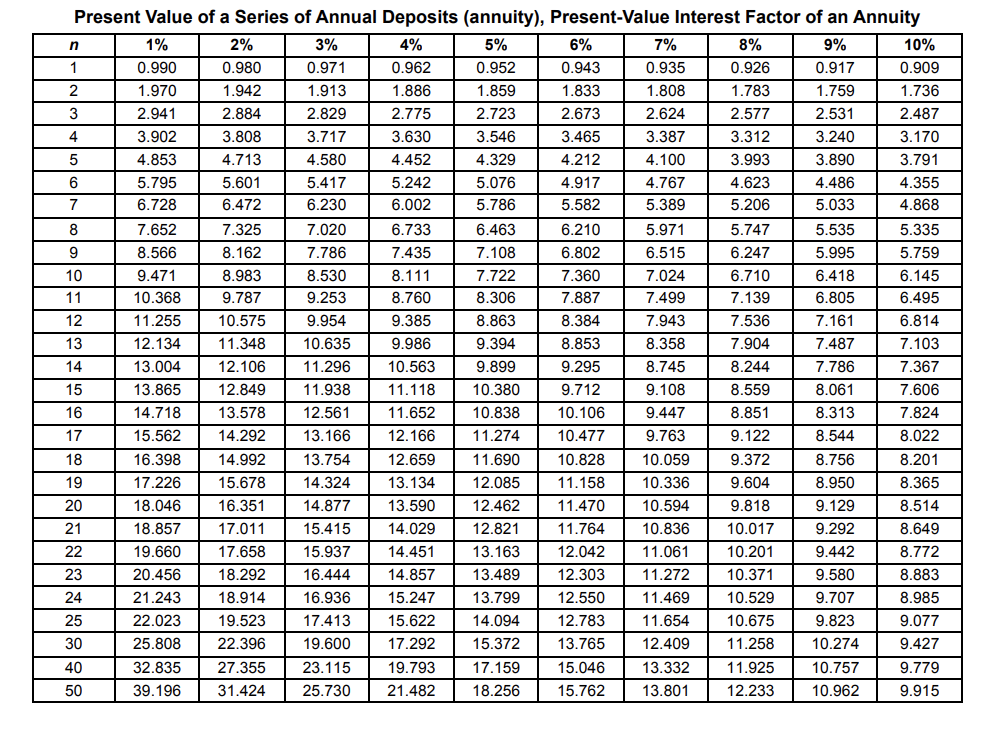

In step 9, the total cash from current policies is $ (Type a whole number.) The amount in retirement savings and investments is $ (Type a whole number.) The amount in other assets is $ (Type a whole number.) The total assets from step 9 is $ (Type a whole number.) In step 10, it is determined that the amount of additional life insurance that should be purchased is $. (Round to the nearest dollar.) b. Should Jorge purchase an insurance policy? Why or why not? If so, what type of policy would you recommend for Wendy? (Select the best choice below.) insurance would provide pure insurance protection for Jorge at a relatively low cost. protection for Jorge at a relatively low cost. potential expense. Term insurance would provide pure insurance protection for Jorge at a relatively low cost. Term insurance would provide pure insurance protection for Jorge at a relatively low cost. Present Value of a Series of Annual Deposits (annuity), Present-Value Interest Factor of an Annuity themselves for life insurance shopping? (Select the best choice below.) B. Given that the children provide income, life insurance would be necessary. The primary needs are adequate income replacement in the event of any family member's death. the household income to warrant insuring them. to have insurance on the children. Mind Games, Your Financial Personality, and Your Money affect their decision to purchase life insurance? (Select the best choice below.) provide immediate protection. The savings, albeit important, will accumulate a sufficient balance to protect the family in case of premature death. to Daniella's 401(k) plan, because the 401(k) plan money would not be given to the family in case of Daniella's premature death. that the mental account of savings is a more important goal and that they are young and do not need to be concerned with premature death. provide immediate protection. The savings, albeit important, will not rapidly accumulate a sufficient balance to protect the family in case of premature death. a. What method should the Martinezes use to determine how much insurance they need? In Step 1 of estimating their life insurance needs, the amount that the Martinezes estimate will be needed for immediate needs, should Daniella die, is $. (Type a whole number.) In Step 2, the amount that the Martinezes estimate will be needed to eliminate debt is $. (Type a whole number.) In Step 3, the amount that the Martinezes estimate will be needed for immediate transitional funds is $ (Type a whole number.) In step 4, dependency expenses, the current household expenses are $. (Round to the nearest dollar.) For the Martinezes, the deceased's expenses would be $ (Round to the nearest dollar.) The spousal income, or Jorge's projected income after his business expansion, is $. (Type a whole number.) The amount anticipated from Social Security Survivors' Benefits is $. (Type a whole number.) Hint: Assume the same amount will be received from Social Security until the youngest child turns 18 years old. The amount anticipated from pension benefits is $ (Type a whole number.) The income to be replaced until the children are self-supporting is $ (Round to the nearest dollar.) The total dependency expenses, or money in today's dollars needed for dependency expenses, is ! (Round to the nearest dollar.) In step 5, the desired amount for spousal income, after the children are self-supporting, is $. (Round to the nearest dollar.) The total spousal life income, or money in today's dollars needed to provide desired spousal income, is $. (Round to the nearest dollar.) In step 6, the total educational expenses for the children is : (Type a whole number.) In step 7, the additional desired annual income at retirement is $. (Round to the nearest dollar.) The total retirement income, or money in today's dollars needed to provide for desired retirement income, is \$ (Round to the nearest dollar.) In step 8, the total funds needed in today's dollars to cover needs is $. (Round to the nearest dollar.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) c. What type of life insurance policy would you recommend that Daniella purchase? (Select the best choice below.) find an affordable policy. find an affordable policy. find an affordable policy. to find an affordable policy. d. What would happen to Daniella's group life insurance if she leaves her present job? (Select the best choice below.) greater risk of death occurring with no life insurance protection. protection. necessary. e. What could happen to the Martinezes' children if Daniella or Jorge should die without adequate life insurance coverage? (Select the best choice below.) college education). This would improve the children's standard of living. college education). This could cause a drop in the children's standard of living. through Social Security Survivors' Benefits. This could cause a drop in the children's standard of living, until they went to college. will be financially dependent, except for college costs, for about another 15 years. Once the children are in college, Jorge assumes their annual expenses will be $60,441. In preparation for a visit with their insurance agent, the Martinezes have estimated the following expenses if Daniella were to die: after-inflation return on their investments. other investments, and $52,000 in Daniella's 401(k) plan through her employer. a. What method should the Martinezes use to determine how much insurance they need? b. Should Jorge purchase an insurance policy? Why or why not? If so, what type of policy would you recommend for Jorge? c. What type of life insurance policy would you recommend that Daniella purchase? d. What will happen to Daniella's group life insurance if she leaves her present job? e. What could happen to the Martinezes' children if Daniella or Jorge should die without adequate life insurance coverage? f. Should the Martinezes name the children as life insurance beneficiaries? g. Which life insurance riders might the Martinezes select when purchasing a policy? themselves for life insurance shopping? Mind Games, Your Financial Personality, and Your Money affect their decision to purchase life insurance? Click on the table icon to view the PVIFA table: f. Should the Martinezes name the children as life insurance beneficiaries? (Select the best choice below.) A. Yes. Minor children generally can be paid life insurance proceeds directly. The policy should be set up to provide the same amount of income to each of the children. be set up to provide income to whoever will raise the children in the event of premature death, either the surviving spouse or guardian(s) for the children. set up to deposit equal amounts in each child's bank account, and send a letter to either the surviving spouse or guardian(s) stating it has been done. or guardian(s) for the children. g. Which life insurance riders might the Martinezes select when purchasing a policy? Life insurance riders the Martinezes might select when purchasing a policy are: (Select all the choices that apply.) A. a change of policy rider. B. a lump-sum settlement rider. C. a guaranteed insurability rider. D. a living benefits rider. E. a cost of living adjustment (COLA) rider. F. a waiver of premium for disability rider. In step 9, the total cash from current policies is $ (Type a whole number.) The amount in retirement savings and investments is $ (Type a whole number.) The amount in other assets is $ (Type a whole number.) The total assets from step 9 is $ (Type a whole number.) In step 10, it is determined that the amount of additional life insurance that should be purchased is $. (Round to the nearest dollar.) b. Should Jorge purchase an insurance policy? Why or why not? If so, what type of policy would you recommend for Wendy? (Select the best choice below.) insurance would provide pure insurance protection for Jorge at a relatively low cost. protection for Jorge at a relatively low cost. potential expense. Term insurance would provide pure insurance protection for Jorge at a relatively low cost. Term insurance would provide pure insurance protection for Jorge at a relatively low cost. Present Value of a Series of Annual Deposits (annuity), Present-Value Interest Factor of an Annuity themselves for life insurance shopping? (Select the best choice below.) B. Given that the children provide income, life insurance would be necessary. The primary needs are adequate income replacement in the event of any family member's death. the household income to warrant insuring them. to have insurance on the children. Mind Games, Your Financial Personality, and Your Money affect their decision to purchase life insurance? (Select the best choice below.) provide immediate protection. The savings, albeit important, will accumulate a sufficient balance to protect the family in case of premature death. to Daniella's 401(k) plan, because the 401(k) plan money would not be given to the family in case of Daniella's premature death. that the mental account of savings is a more important goal and that they are young and do not need to be concerned with premature death. provide immediate protection. The savings, albeit important, will not rapidly accumulate a sufficient balance to protect the family in case of premature death. a. What method should the Martinezes use to determine how much insurance they need? In Step 1 of estimating their life insurance needs, the amount that the Martinezes estimate will be needed for immediate needs, should Daniella die, is $. (Type a whole number.) In Step 2, the amount that the Martinezes estimate will be needed to eliminate debt is $. (Type a whole number.) In Step 3, the amount that the Martinezes estimate will be needed for immediate transitional funds is $ (Type a whole number.) In step 4, dependency expenses, the current household expenses are $. (Round to the nearest dollar.) For the Martinezes, the deceased's expenses would be $ (Round to the nearest dollar.) The spousal income, or Jorge's projected income after his business expansion, is $. (Type a whole number.) The amount anticipated from Social Security Survivors' Benefits is $. (Type a whole number.) Hint: Assume the same amount will be received from Social Security until the youngest child turns 18 years old. The amount anticipated from pension benefits is $ (Type a whole number.) The income to be replaced until the children are self-supporting is $ (Round to the nearest dollar.) The total dependency expenses, or money in today's dollars needed for dependency expenses, is ! (Round to the nearest dollar.) In step 5, the desired amount for spousal income, after the children are self-supporting, is $. (Round to the nearest dollar.) The total spousal life income, or money in today's dollars needed to provide desired spousal income, is $. (Round to the nearest dollar.) In step 6, the total educational expenses for the children is : (Type a whole number.) In step 7, the additional desired annual income at retirement is $. (Round to the nearest dollar.) The total retirement income, or money in today's dollars needed to provide for desired retirement income, is \$ (Round to the nearest dollar.) In step 8, the total funds needed in today's dollars to cover needs is $. (Round to the nearest dollar.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) c. What type of life insurance policy would you recommend that Daniella purchase? (Select the best choice below.) find an affordable policy. find an affordable policy. find an affordable policy. to find an affordable policy. d. What would happen to Daniella's group life insurance if she leaves her present job? (Select the best choice below.) greater risk of death occurring with no life insurance protection. protection. necessary. e. What could happen to the Martinezes' children if Daniella or Jorge should die without adequate life insurance coverage? (Select the best choice below.) college education). This would improve the children's standard of living. college education). This could cause a drop in the children's standard of living. through Social Security Survivors' Benefits. This could cause a drop in the children's standard of living, until they went to college. will be financially dependent, except for college costs, for about another 15 years. Once the children are in college, Jorge assumes their annual expenses will be $60,441. In preparation for a visit with their insurance agent, the Martinezes have estimated the following expenses if Daniella were to die: after-inflation return on their investments. other investments, and $52,000 in Daniella's 401(k) plan through her employer. a. What method should the Martinezes use to determine how much insurance they need? b. Should Jorge purchase an insurance policy? Why or why not? If so, what type of policy would you recommend for Jorge? c. What type of life insurance policy would you recommend that Daniella purchase? d. What will happen to Daniella's group life insurance if she leaves her present job? e. What could happen to the Martinezes' children if Daniella or Jorge should die without adequate life insurance coverage? f. Should the Martinezes name the children as life insurance beneficiaries? g. Which life insurance riders might the Martinezes select when purchasing a policy? themselves for life insurance shopping? Mind Games, Your Financial Personality, and Your Money affect their decision to purchase life insurance? Click on the table icon to view the PVIFA table: f. Should the Martinezes name the children as life insurance beneficiaries? (Select the best choice below.) A. Yes. Minor children generally can be paid life insurance proceeds directly. The policy should be set up to provide the same amount of income to each of the children. be set up to provide income to whoever will raise the children in the event of premature death, either the surviving spouse or guardian(s) for the children. set up to deposit equal amounts in each child's bank account, and send a letter to either the surviving spouse or guardian(s) stating it has been done. or guardian(s) for the children. g. Which life insurance riders might the Martinezes select when purchasing a policy? Life insurance riders the Martinezes might select when purchasing a policy are: (Select all the choices that apply.) A. a change of policy rider. B. a lump-sum settlement rider. C. a guaranteed insurability rider. D. a living benefits rider. E. a cost of living adjustment (COLA) rider. F. a waiver of premium for disability rider

In step 9, the total cash from current policies is $ (Type a whole number.) The amount in retirement savings and investments is $ (Type a whole number.) The amount in other assets is $ (Type a whole number.) The total assets from step 9 is $ (Type a whole number.) In step 10, it is determined that the amount of additional life insurance that should be purchased is $. (Round to the nearest dollar.) b. Should Jorge purchase an insurance policy? Why or why not? If so, what type of policy would you recommend for Wendy? (Select the best choice below.) insurance would provide pure insurance protection for Jorge at a relatively low cost. protection for Jorge at a relatively low cost. potential expense. Term insurance would provide pure insurance protection for Jorge at a relatively low cost. Term insurance would provide pure insurance protection for Jorge at a relatively low cost. Present Value of a Series of Annual Deposits (annuity), Present-Value Interest Factor of an Annuity themselves for life insurance shopping? (Select the best choice below.) B. Given that the children provide income, life insurance would be necessary. The primary needs are adequate income replacement in the event of any family member's death. the household income to warrant insuring them. to have insurance on the children. Mind Games, Your Financial Personality, and Your Money affect their decision to purchase life insurance? (Select the best choice below.) provide immediate protection. The savings, albeit important, will accumulate a sufficient balance to protect the family in case of premature death. to Daniella's 401(k) plan, because the 401(k) plan money would not be given to the family in case of Daniella's premature death. that the mental account of savings is a more important goal and that they are young and do not need to be concerned with premature death. provide immediate protection. The savings, albeit important, will not rapidly accumulate a sufficient balance to protect the family in case of premature death. a. What method should the Martinezes use to determine how much insurance they need? In Step 1 of estimating their life insurance needs, the amount that the Martinezes estimate will be needed for immediate needs, should Daniella die, is $. (Type a whole number.) In Step 2, the amount that the Martinezes estimate will be needed to eliminate debt is $. (Type a whole number.) In Step 3, the amount that the Martinezes estimate will be needed for immediate transitional funds is $ (Type a whole number.) In step 4, dependency expenses, the current household expenses are $. (Round to the nearest dollar.) For the Martinezes, the deceased's expenses would be $ (Round to the nearest dollar.) The spousal income, or Jorge's projected income after his business expansion, is $. (Type a whole number.) The amount anticipated from Social Security Survivors' Benefits is $. (Type a whole number.) Hint: Assume the same amount will be received from Social Security until the youngest child turns 18 years old. The amount anticipated from pension benefits is $ (Type a whole number.) The income to be replaced until the children are self-supporting is $ (Round to the nearest dollar.) The total dependency expenses, or money in today's dollars needed for dependency expenses, is ! (Round to the nearest dollar.) In step 5, the desired amount for spousal income, after the children are self-supporting, is $. (Round to the nearest dollar.) The total spousal life income, or money in today's dollars needed to provide desired spousal income, is $. (Round to the nearest dollar.) In step 6, the total educational expenses for the children is : (Type a whole number.) In step 7, the additional desired annual income at retirement is $. (Round to the nearest dollar.) The total retirement income, or money in today's dollars needed to provide for desired retirement income, is \$ (Round to the nearest dollar.) In step 8, the total funds needed in today's dollars to cover needs is $. (Round to the nearest dollar.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) c. What type of life insurance policy would you recommend that Daniella purchase? (Select the best choice below.) find an affordable policy. find an affordable policy. find an affordable policy. to find an affordable policy. d. What would happen to Daniella's group life insurance if she leaves her present job? (Select the best choice below.) greater risk of death occurring with no life insurance protection. protection. necessary. e. What could happen to the Martinezes' children if Daniella or Jorge should die without adequate life insurance coverage? (Select the best choice below.) college education). This would improve the children's standard of living. college education). This could cause a drop in the children's standard of living. through Social Security Survivors' Benefits. This could cause a drop in the children's standard of living, until they went to college. will be financially dependent, except for college costs, for about another 15 years. Once the children are in college, Jorge assumes their annual expenses will be $60,441. In preparation for a visit with their insurance agent, the Martinezes have estimated the following expenses if Daniella were to die: after-inflation return on their investments. other investments, and $52,000 in Daniella's 401(k) plan through her employer. a. What method should the Martinezes use to determine how much insurance they need? b. Should Jorge purchase an insurance policy? Why or why not? If so, what type of policy would you recommend for Jorge? c. What type of life insurance policy would you recommend that Daniella purchase? d. What will happen to Daniella's group life insurance if she leaves her present job? e. What could happen to the Martinezes' children if Daniella or Jorge should die without adequate life insurance coverage? f. Should the Martinezes name the children as life insurance beneficiaries? g. Which life insurance riders might the Martinezes select when purchasing a policy? themselves for life insurance shopping? Mind Games, Your Financial Personality, and Your Money affect their decision to purchase life insurance? Click on the table icon to view the PVIFA table: f. Should the Martinezes name the children as life insurance beneficiaries? (Select the best choice below.) A. Yes. Minor children generally can be paid life insurance proceeds directly. The policy should be set up to provide the same amount of income to each of the children. be set up to provide income to whoever will raise the children in the event of premature death, either the surviving spouse or guardian(s) for the children. set up to deposit equal amounts in each child's bank account, and send a letter to either the surviving spouse or guardian(s) stating it has been done. or guardian(s) for the children. g. Which life insurance riders might the Martinezes select when purchasing a policy? Life insurance riders the Martinezes might select when purchasing a policy are: (Select all the choices that apply.) A. a change of policy rider. B. a lump-sum settlement rider. C. a guaranteed insurability rider. D. a living benefits rider. E. a cost of living adjustment (COLA) rider. F. a waiver of premium for disability rider. In step 9, the total cash from current policies is $ (Type a whole number.) The amount in retirement savings and investments is $ (Type a whole number.) The amount in other assets is $ (Type a whole number.) The total assets from step 9 is $ (Type a whole number.) In step 10, it is determined that the amount of additional life insurance that should be purchased is $. (Round to the nearest dollar.) b. Should Jorge purchase an insurance policy? Why or why not? If so, what type of policy would you recommend for Wendy? (Select the best choice below.) insurance would provide pure insurance protection for Jorge at a relatively low cost. protection for Jorge at a relatively low cost. potential expense. Term insurance would provide pure insurance protection for Jorge at a relatively low cost. Term insurance would provide pure insurance protection for Jorge at a relatively low cost. Present Value of a Series of Annual Deposits (annuity), Present-Value Interest Factor of an Annuity themselves for life insurance shopping? (Select the best choice below.) B. Given that the children provide income, life insurance would be necessary. The primary needs are adequate income replacement in the event of any family member's death. the household income to warrant insuring them. to have insurance on the children. Mind Games, Your Financial Personality, and Your Money affect their decision to purchase life insurance? (Select the best choice below.) provide immediate protection. The savings, albeit important, will accumulate a sufficient balance to protect the family in case of premature death. to Daniella's 401(k) plan, because the 401(k) plan money would not be given to the family in case of Daniella's premature death. that the mental account of savings is a more important goal and that they are young and do not need to be concerned with premature death. provide immediate protection. The savings, albeit important, will not rapidly accumulate a sufficient balance to protect the family in case of premature death. a. What method should the Martinezes use to determine how much insurance they need? In Step 1 of estimating their life insurance needs, the amount that the Martinezes estimate will be needed for immediate needs, should Daniella die, is $. (Type a whole number.) In Step 2, the amount that the Martinezes estimate will be needed to eliminate debt is $. (Type a whole number.) In Step 3, the amount that the Martinezes estimate will be needed for immediate transitional funds is $ (Type a whole number.) In step 4, dependency expenses, the current household expenses are $. (Round to the nearest dollar.) For the Martinezes, the deceased's expenses would be $ (Round to the nearest dollar.) The spousal income, or Jorge's projected income after his business expansion, is $. (Type a whole number.) The amount anticipated from Social Security Survivors' Benefits is $. (Type a whole number.) Hint: Assume the same amount will be received from Social Security until the youngest child turns 18 years old. The amount anticipated from pension benefits is $ (Type a whole number.) The income to be replaced until the children are self-supporting is $ (Round to the nearest dollar.) The total dependency expenses, or money in today's dollars needed for dependency expenses, is ! (Round to the nearest dollar.) In step 5, the desired amount for spousal income, after the children are self-supporting, is $. (Round to the nearest dollar.) The total spousal life income, or money in today's dollars needed to provide desired spousal income, is $. (Round to the nearest dollar.) In step 6, the total educational expenses for the children is : (Type a whole number.) In step 7, the additional desired annual income at retirement is $. (Round to the nearest dollar.) The total retirement income, or money in today's dollars needed to provide for desired retirement income, is \$ (Round to the nearest dollar.) In step 8, the total funds needed in today's dollars to cover needs is $. (Round to the nearest dollar.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) c. What type of life insurance policy would you recommend that Daniella purchase? (Select the best choice below.) find an affordable policy. find an affordable policy. find an affordable policy. to find an affordable policy. d. What would happen to Daniella's group life insurance if she leaves her present job? (Select the best choice below.) greater risk of death occurring with no life insurance protection. protection. necessary. e. What could happen to the Martinezes' children if Daniella or Jorge should die without adequate life insurance coverage? (Select the best choice below.) college education). This would improve the children's standard of living. college education). This could cause a drop in the children's standard of living. through Social Security Survivors' Benefits. This could cause a drop in the children's standard of living, until they went to college. will be financially dependent, except for college costs, for about another 15 years. Once the children are in college, Jorge assumes their annual expenses will be $60,441. In preparation for a visit with their insurance agent, the Martinezes have estimated the following expenses if Daniella were to die: after-inflation return on their investments. other investments, and $52,000 in Daniella's 401(k) plan through her employer. a. What method should the Martinezes use to determine how much insurance they need? b. Should Jorge purchase an insurance policy? Why or why not? If so, what type of policy would you recommend for Jorge? c. What type of life insurance policy would you recommend that Daniella purchase? d. What will happen to Daniella's group life insurance if she leaves her present job? e. What could happen to the Martinezes' children if Daniella or Jorge should die without adequate life insurance coverage? f. Should the Martinezes name the children as life insurance beneficiaries? g. Which life insurance riders might the Martinezes select when purchasing a policy? themselves for life insurance shopping? Mind Games, Your Financial Personality, and Your Money affect their decision to purchase life insurance? Click on the table icon to view the PVIFA table: f. Should the Martinezes name the children as life insurance beneficiaries? (Select the best choice below.) A. Yes. Minor children generally can be paid life insurance proceeds directly. The policy should be set up to provide the same amount of income to each of the children. be set up to provide income to whoever will raise the children in the event of premature death, either the surviving spouse or guardian(s) for the children. set up to deposit equal amounts in each child's bank account, and send a letter to either the surviving spouse or guardian(s) stating it has been done. or guardian(s) for the children. g. Which life insurance riders might the Martinezes select when purchasing a policy? Life insurance riders the Martinezes might select when purchasing a policy are: (Select all the choices that apply.) A. a change of policy rider. B. a lump-sum settlement rider. C. a guaranteed insurability rider. D. a living benefits rider. E. a cost of living adjustment (COLA) rider. F. a waiver of premium for disability rider Step by Step Solution

There are 3 Steps involved in it

Step: 1

To analyze the life insurance needs of the Martinezes and answer the questions based on provided data lets go through each part step by step a What me...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started