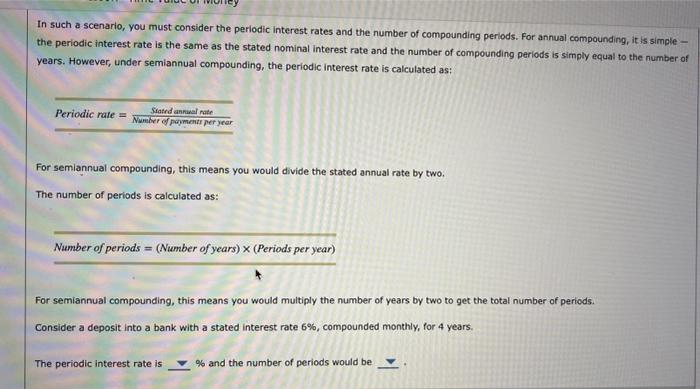

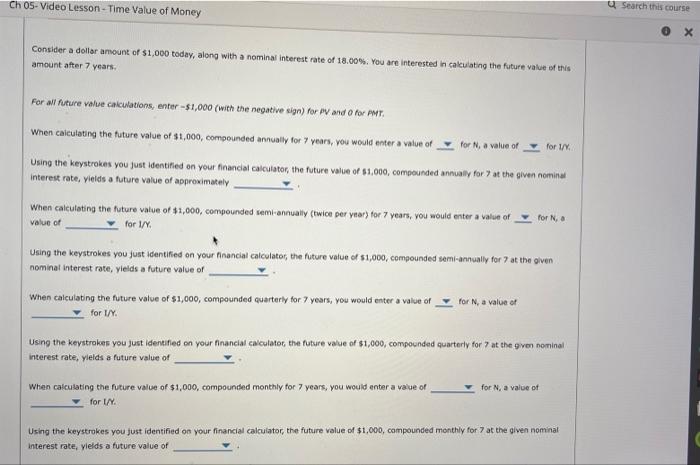

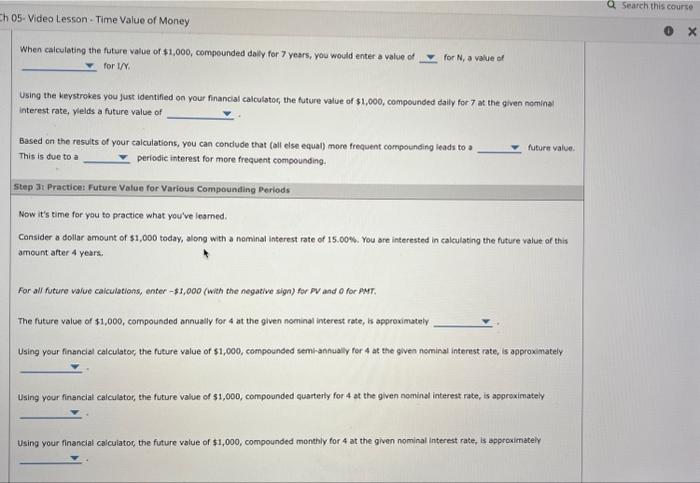

In such a scenario, you must consider the periodic interest rates and the number of compounding periods. For annual compounding, it is simple the periodic interest rate is the same as the stated nominal interest rate and the number of compounding periods is simply equal to the number of years. However, under semiannual compounding, the periodic interest rate is calculated as: Periodic rate =NumberofpaymettperyearSyatidannuelnate For semiannual compounding, this means you would divide the stated annual rate by two. The number of periods is calculated as: Number of periods =( Number of years )( Periods per year ) For semiannual compounding, this means you would multiply the number of years by two to get the total number of periods. Consider a deposit into a bank with a stated interest rate 6%, compounded monthly, for 4 years. The periodic interest rate is Consider a dollor anount of $1,000 today, along with a nominal interest rate of 18.00%, You are interested in calcuating the future value is this amount after 7 years, For alt future value calicilations, enter 51,000 (with the negative sign) for pV and o for AMT. When caiculating the future value of 31,000 , compounded annually for 7 years, you would enter a value of for N, a value of 1/2. interest rate, vields a future value of approximately When calculeting the future value of 31,000, compounded semi-ennually (twice per year) for 7 years, you would enter a value of value of for 1/Y1 Using the keystrokes you just identified on your financial calculator, the future value of 51,000 , compounded semi-annually for 7 at the oiven nominal interest rate, yields a future value of When calculating the future value of $1,000, compounded quarterly for 7 years, you would enter a value of for N,0 for 1/Y.. Using the kevstrokes you just identified on your financial cavculatot, the future value of $1,000, compounded quarteriy for 7 at the 9 vor nominal interest rate, ylelds a future value of When calculating the future value of $1,000, compounded monthly for 7 years, you would enter a wave of for N, a value of for LN. Using the keystrokes you just identified on your financial calculator, the future value of $1,000, compounded monthly for 7 at the given nominal interest rate, ylelds a future value of 05-Video Lesson-Time Value of Money When calculoting the future value of $1,000, compounded daily for 7 years, you would enter a value of for N, a value of for 1/%. Using the heystrokes you just identified on your financial calculatoc, the future value of $1,000, compounded dally for 7 at the given nominal interest rate, velds a future value of Based on the results of your calculations, you can condude that (oll else equal) more frequent compounding leads to a This is due to a periodic interest for more frequent compounding. Step 31 Practice: Future Value for Various Compounding Periods Now it's time for you to practice what you've leamed. Consider a dollar amount of $1,000 today, along with a nominal interest rate of 15.00%. You are interested in calculating the future value of this amount after 4 years. For all future value caiculations, enter $1,000 (with the negative sign) for PV and o for PMT. The future value of $1,000, compounded annually for 4 at the given nominal interest rote, is approximately Using your financial calculator, the future value of $1,000, compounded semi-annualy for 4 at the given neminal interest rate, is approximately Using your financial calculator, the future value of $1,000, compounded quarterly for 4 at the 9 iven nominal interest rate, is approximately Using your financial calculatoc, the future value of $1,000, compounded monthly for 4 at the given nominal interest rate, is approximately Hint: Assume that there are 365 days in a year. Using your financial calculator, the future value of $1,000, compounded daily for 4 at the given nominal interest rate, is approximately