Answered step by step

Verified Expert Solution

Question

1 Approved Answer

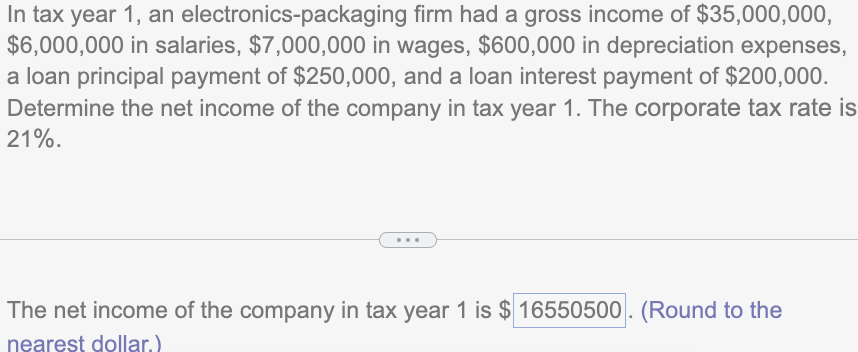

In tax year 1 , an electronics-packaging firm had a gross income of $35,000,000, $6,000,000 in salaries, $7,000,000 in wages, $600,000 in depreciation expenses, a

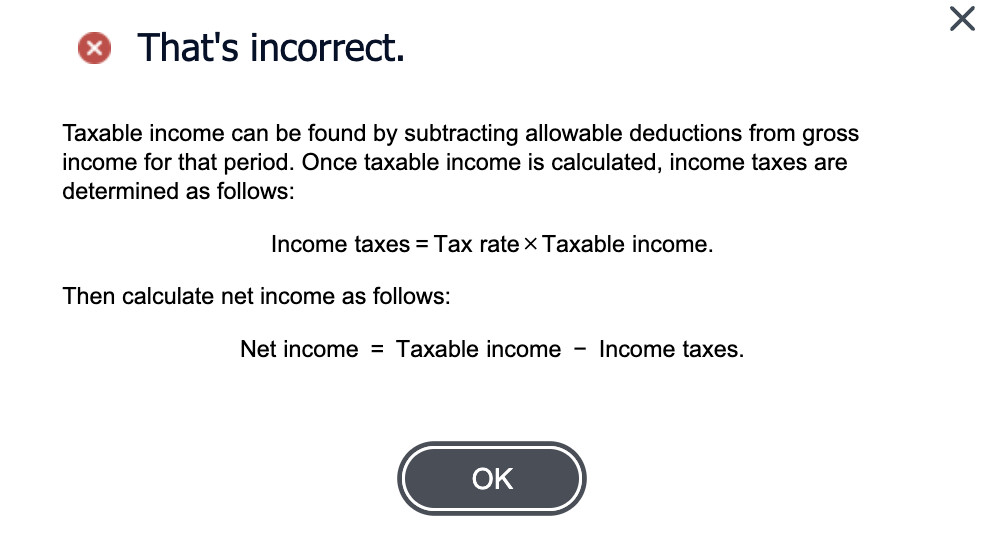

In tax year 1 , an electronics-packaging firm had a gross income of $35,000,000, $6,000,000 in salaries, $7,000,000 in wages, $600,000 in depreciation expenses, a loan principal payment of $250,000, and a loan interest payment of $200,000. Determine the net income of the company in tax year 1 . The corporate tax rate is 21%. The net income of the company in tax year 1 is $ (Round to the nearest dollar.) That's incorrect. Taxable income can be found by subtracting allowable deductions from gross income for that period. Once taxable income is calculated, income taxes are determined as follows: Income taxes = Tax rate Taxable income . Then calculate net income as follows: Net income = Taxable income - Income taxes

In tax year 1 , an electronics-packaging firm had a gross income of $35,000,000, $6,000,000 in salaries, $7,000,000 in wages, $600,000 in depreciation expenses, a loan principal payment of $250,000, and a loan interest payment of $200,000. Determine the net income of the company in tax year 1 . The corporate tax rate is 21%. The net income of the company in tax year 1 is $ (Round to the nearest dollar.) That's incorrect. Taxable income can be found by subtracting allowable deductions from gross income for that period. Once taxable income is calculated, income taxes are determined as follows: Income taxes = Tax rate Taxable income . Then calculate net income as follows: Net income = Taxable income - Income taxes Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started