Answered step by step

Verified Expert Solution

Question

1 Approved Answer

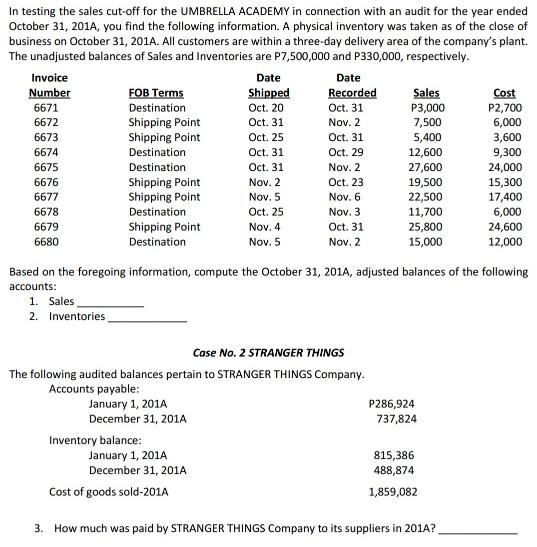

In testing the sales cut-off for the UMBRELLA ACADEMY in connection with an audit for the year ended October 31, 201A, you find the

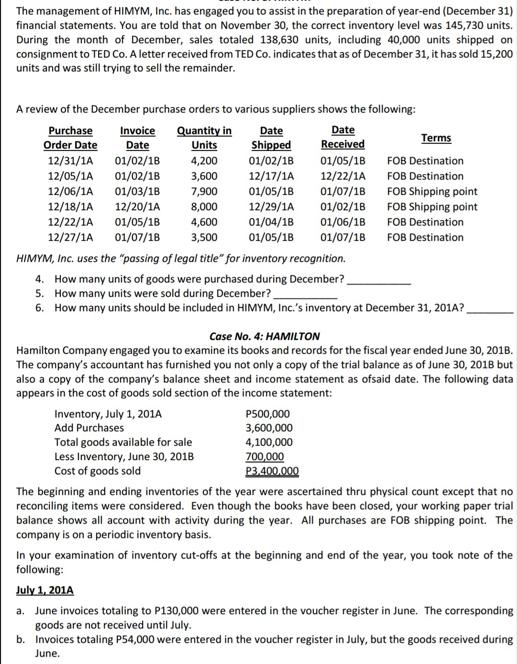

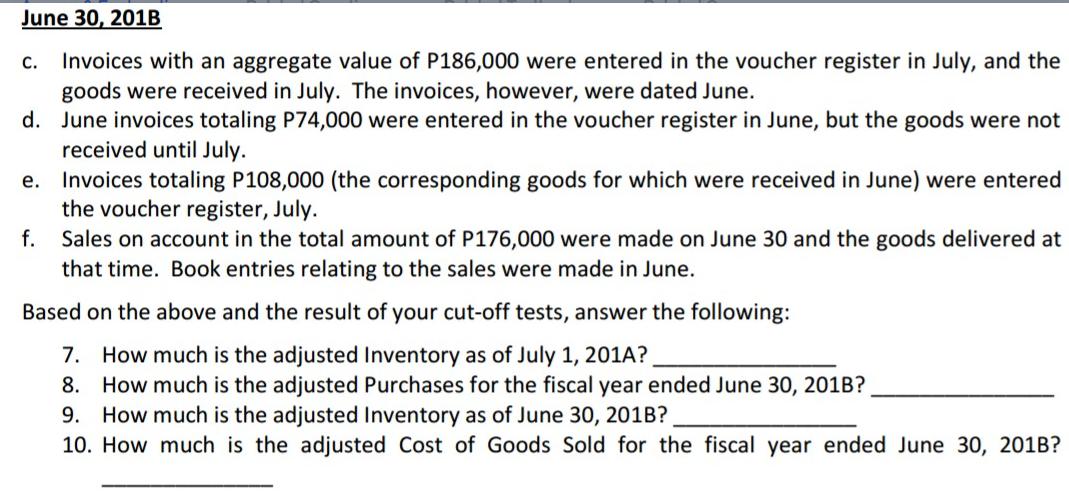

In testing the sales cut-off for the UMBRELLA ACADEMY in connection with an audit for the year ended October 31, 201A, you find the following information. A physical inventory was taken as of the close of business on October 31, 201A. All customers are within a three-day delivery area of the company's plant. The unadjusted balances of Sales and Inventories are P7,500,000 and P330,000, respectively. Invoice Number 6671 6672 6673 6674 6675 6676 6677 6678 6679 6680 FOB Terms Destination Shipping Point Shipping Point Destination Destination Shipping Point Shipping Point Destination Shipping Point Destination Accounts payable: January 1, 201A December 31, 201A Inventory balance: Date Shipped Oct. 20 Oct. 31 January 1, 201A December 31, 201A Oct. 25 Oct. 31 Oct. 31 Cost of goods sold-201A Nov. 2 Nov. 5 Oct. 25 Nov. 4 Nov. 5 Case No. 2 STRANGER THINGS The following audited balances pertain to STRANGER THINGS Company. Date Recorded Oct. 31 Nov. 2 Oct. 31 Oct. 29 Nov. 2 Oct. 23 Nov. 6 Nov. 3 Oct. 31 Nov. 2 Sales P3,000 7,500 5,400 12,600 27,600 Based on the foregoing information, compute the October 31, 201A, adjusted balances of the following accounts: 1. Sales. 2. Inventories, 19,500 22,500 11,700 25,800 15,000 P286,924 737,824 815,386 488,874 1,859,082 Cost P2,700 6,000 3. How much was paid by STRANGER THINGS Company to its suppliers in 201A? 3,600 9,300 24,000 15,300 17,400 6,000 24,600 12,000 The management of HIMYM, Inc. has engaged you to assist in the preparation of year-end (December 31) financial statements. You are told that on November 30, the correct inventory level was 145,730 units. During the month of December, sales totaled 138,630 units, including 40,000 units shipped on consignment to TED Co. A letter received from TED Co. indicates that as of December 31, it has sold 15,200 units and was still trying to sell the remainder. A review of the December purchase orders to various suppliers shows the following: Purchase Order Date Invoice Quantity in Date Units 01/02/18 4,200 12/31/1A 12/05/1A 01/02/18 3,600 12/06/1A 01/03/18 7,900 12/18/1A 12/20/1A 8,000 12/22/1A 01/05/18 4,600 01/07/18 3,500 12/27/1A HIMYM, Inc. uses the "passing of legal title" for inventory recognition. 4. How many units of goods were purchased during December? 5. How many units were sold during December?_ 6. How many units should be included in HIMYM, Inc.'s inventory at December 31, 201A? Date Date Shipped Received 01/02/18 01/05/18 12/17/1A 12/22/1A 01/05/18 01/07/18 12/29/1A 01/02/18 01/04/18 01/05/18 01/06/1B 01/07/18 P500,000 3,600,000 4,100,000 700,000 P3.400.000 Terms FOB Destination FOB Destination FOB Shipping point FOB Shipping point FOB Destination FOB Destination Case No. 4: HAMILTON Hamilton Company engaged you to examine its books and records for the fiscal year ended June 30, 2018. The company's accountant has furnished you not only a copy of the trial balance as of June 30, 2018 but also a copy of the company's balance sheet and income statement as ofsaid date. The following data appears in the cost of goods sold section of the income statement: Inventory, July 1, 201A Add Purchases Total goods available for sale Less Inventory, June 30, 2018 Cost of goods sold The beginning and ending inventories of the year were ascertained thru physical count except that no reconciling items were considered. Even though the books have been closed, your working paper trial balance shows all account with activity during the year. All purchases are FOB shipping point. The company is on a periodic inventory basis. In your examination of inventory cut-offs at the beginning and end of the year, you took note of the following: July 1, 201A a. June invoices totaling to P130,000 were entered in the voucher register in June. The corresponding goods are not received until July. b. Invoices totaling P54,000 were entered in the voucher register in July, but the goods received during June. June 30, 201B C. Invoices with an aggregate value of P186,000 were entered in the voucher register in July, and the goods were received in July. The invoices, however, were dated June. d. June invoices totaling P74,000 were entered in the voucher register in June, but the goods were not received until July. e. Invoices totaling P108,000 (the corresponding goods for which were received in June) were entered the voucher register, July. f. Sales on account in the total amount of P176,000 were made on June 30 and the goods delivered at that time. Book entries relating to the sales were made in June. Based on the above and the result of your cut-off tests, answer the following: 7. How much is the adjusted Inventory as of July 1, 201A? 8. How much is the adjusted Purchases for the fiscal year ended June 30, 201B? 9. How much is the adjusted Inventory as of June 30, 201B? 10. How much is the adjusted Cost of Goods Sold for the fiscal year ended June 30, 201B? In testing the sales cut-off for the UMBRELLA ACADEMY in connection with an audit for the year ended October 31, 201A, you find the following information. A physical inventory was taken as of the close of business on October 31, 201A. All customers are within a three-day delivery area of the company's plant. The unadjusted balances of Sales and Inventories are P7,500,000 and P330,000, respectively. Invoice Number 6671 6672 6673 6674 6675 6676 6677 6678 6679 6680 FOB Terms Destination Shipping Point Shipping Point Destination Destination Shipping Point Shipping Point Destination Shipping Point Destination Accounts payable: January 1, 201A December 31, 201A Inventory balance: Date Shipped Oct. 20 Oct. 31 January 1, 201A December 31, 201A Oct. 25 Oct. 31 Oct. 31 Cost of goods sold-201A Nov. 2 Nov. 5 Oct. 25 Nov. 4 Nov. 5 Case No. 2 STRANGER THINGS The following audited balances pertain to STRANGER THINGS Company. Date Recorded Oct. 31 Nov. 2 Oct. 31 Oct. 29 Nov. 2 Oct. 23 Nov. 6 Nov. 3 Oct. 31 Nov. 2 Sales P3,000 7,500 5,400 12,600 27,600 Based on the foregoing information, compute the October 31, 201A, adjusted balances of the following accounts: 1. Sales. 2. Inventories, 19,500 22,500 11,700 25,800 15,000 P286,924 737,824 815,386 488,874 1,859,082 Cost P2,700 6,000 3. How much was paid by STRANGER THINGS Company to its suppliers in 201A? 3,600 9,300 24,000 15,300 17,400 6,000 24,600 12,000 The management of HIMYM, Inc. has engaged you to assist in the preparation of year-end (December 31) financial statements. You are told that on November 30, the correct inventory level was 145,730 units. During the month of December, sales totaled 138,630 units, including 40,000 units shipped on consignment to TED Co. A letter received from TED Co. indicates that as of December 31, it has sold 15,200 units and was still trying to sell the remainder. A review of the December purchase orders to various suppliers shows the following: Purchase Order Date Invoice Quantity in Date Units 01/02/18 4,200 12/31/1A 12/05/1A 01/02/18 3,600 12/06/1A 01/03/18 7,900 12/18/1A 12/20/1A 8,000 12/22/1A 01/05/18 4,600 01/07/18 3,500 12/27/1A HIMYM, Inc. uses the "passing of legal title" for inventory recognition. 4. How many units of goods were purchased during December? 5. How many units were sold during December?_ 6. How many units should be included in HIMYM, Inc.'s inventory at December 31, 201A? Date Date Shipped Received 01/02/18 01/05/18 12/17/1A 12/22/1A 01/05/18 01/07/18 12/29/1A 01/02/18 01/04/18 01/05/18 01/06/1B 01/07/18 P500,000 3,600,000 4,100,000 700,000 P3.400.000 Terms FOB Destination FOB Destination FOB Shipping point FOB Shipping point FOB Destination FOB Destination Case No. 4: HAMILTON Hamilton Company engaged you to examine its books and records for the fiscal year ended June 30, 2018. The company's accountant has furnished you not only a copy of the trial balance as of June 30, 2018 but also a copy of the company's balance sheet and income statement as ofsaid date. The following data appears in the cost of goods sold section of the income statement: Inventory, July 1, 201A Add Purchases Total goods available for sale Less Inventory, June 30, 2018 Cost of goods sold The beginning and ending inventories of the year were ascertained thru physical count except that no reconciling items were considered. Even though the books have been closed, your working paper trial balance shows all account with activity during the year. All purchases are FOB shipping point. The company is on a periodic inventory basis. In your examination of inventory cut-offs at the beginning and end of the year, you took note of the following: July 1, 201A a. June invoices totaling to P130,000 were entered in the voucher register in June. The corresponding goods are not received until July. b. Invoices totaling P54,000 were entered in the voucher register in July, but the goods received during June. June 30, 201B C. Invoices with an aggregate value of P186,000 were entered in the voucher register in July, and the goods were received in July. The invoices, however, were dated June. d. June invoices totaling P74,000 were entered in the voucher register in June, but the goods were not received until July. e. Invoices totaling P108,000 (the corresponding goods for which were received in June) were entered the voucher register, July. f. Sales on account in the total amount of P176,000 were made on June 30 and the goods delivered at that time. Book entries relating to the sales were made in June. Based on the above and the result of your cut-off tests, answer the following: 7. How much is the adjusted Inventory as of July 1, 201A? 8. How much is the adjusted Purchases for the fiscal year ended June 30, 201B? 9. How much is the adjusted Inventory as of June 30, 201B? 10. How much is the adjusted Cost of Goods Sold for the fiscal year ended June 30, 201B?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION 1 Sales P7500000 Invoices 6672 6673 6674 6675 6676 6679 6680 should be included in Oct 2014 sales since they were shipped before Oct 31 Sales P7500000 P27600 6675 P12600 6674 P19500 6676 P258...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started