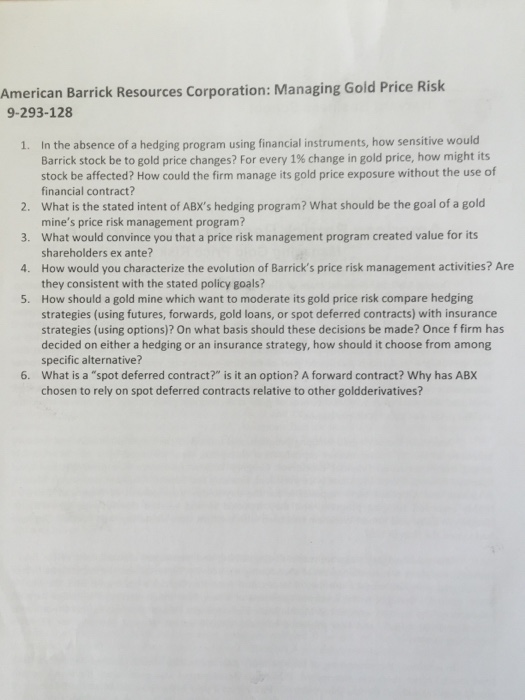

In the absence of a hedging program using financial instruments, how sensitive would Barrick stock be to gold price changes? For every 1% change in gold price, how might its stock be affected? How could the firm manage its gold price exposure without the use of financial contract? What is the stated intent of ABX's hedging program? What should be the goal of a gold mine's price risk management program? What would convince you that a price risk management program created value for its shareholders ex ante? How would you characterize the evolution of Barrick's price risk management activities? Are they consistent with the stated policy goals? How should a gold mine which want to moderate its gold price risk compare hedging strategies (using futures, forwards, gold loans, or spot deferred contracts) with insurance strategies (using options)? On what basis should these decisions be made? Once f firm has decided on either a hedging or an insurance strategy, how should it choose from among specific alternative? What is a "spot deferred contract?" is it an option? A forward contract? Why has ABX chosen to rely on spot deferred contracts relative to other goldderivatives? In the absence of a hedging program using financial instruments, how sensitive would Barrick stock be to gold price changes? For every 1% change in gold price, how might its stock be affected? How could the firm manage its gold price exposure without the use of financial contract? What is the stated intent of ABX's hedging program? What should be the goal of a gold mine's price risk management program? What would convince you that a price risk management program created value for its shareholders ex ante? How would you characterize the evolution of Barrick's price risk management activities? Are they consistent with the stated policy goals? How should a gold mine which want to moderate its gold price risk compare hedging strategies (using futures, forwards, gold loans, or spot deferred contracts) with insurance strategies (using options)? On what basis should these decisions be made? Once f firm has decided on either a hedging or an insurance strategy, how should it choose from among specific alternative? What is a "spot deferred contract?" is it an option? A forward contract? Why has ABX chosen to rely on spot deferred contracts relative to other goldderivatives