Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In the audit of Maxref Corporation (Maxref) for the financial year ended 30 June 2020, you are assigned to check the sale account totalling

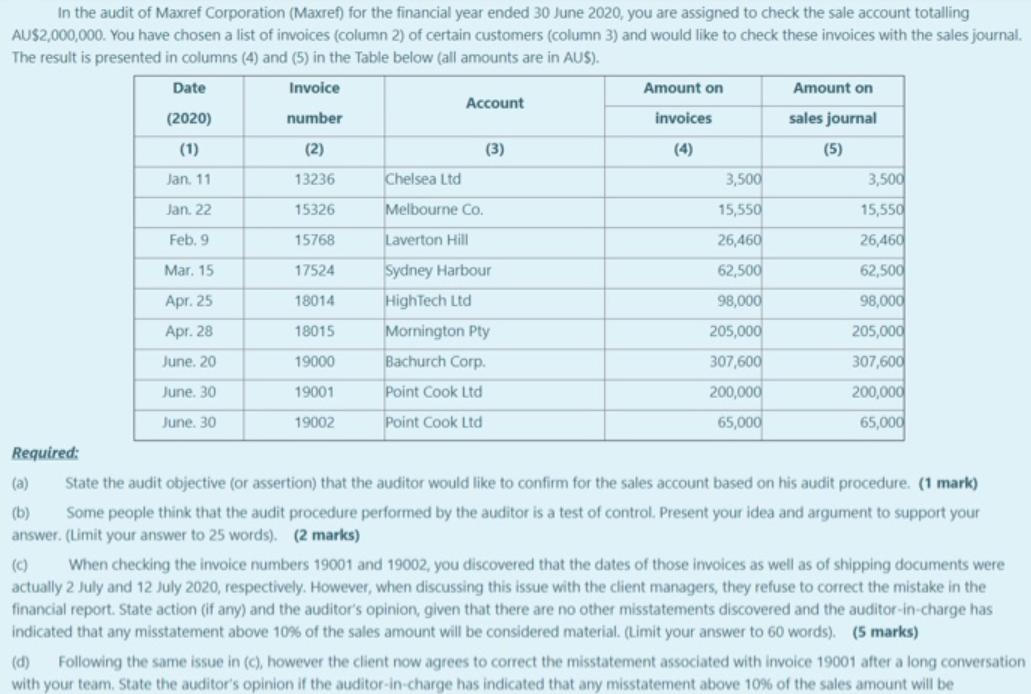

In the audit of Maxref Corporation (Maxref) for the financial year ended 30 June 2020, you are assigned to check the sale account totalling AU$2,000,000. You have chosen a list of invoices (column 2) of certain customers (column 3) and would like to check these invoices with the sales journal. The result is presented in columns (4) and (5) in the Table below (all amounts are in AUS). Date Invoice Amount on Amount on Account (2020) number invoices sales journal (1) (2) (3) (4) (5) Jan. 11 13236 Chelsea Ltd 3,500 3,500 Jan. 22 15326 Melbourne Co. 15,550 15,550 Feb. 9 15768 Laverton Hill 26,460 26,460 Mar. 15 17524 Sydney Harbour 62,500 62,500 Apr. 25 18014 HighTech Ltd 98,000 98,000 Apr. 28 18015 Mornington Pty 205,000 205,000 June. 20 19000 Bachurch Corp. 307,600 307,600 June. 30 19001 Point Cook Ltd 200,000 200,000 June. 30 19002 Point Cook Ltd 65,000 65,000 Required: (a) State the audit objective (or assertion) that the auditor would like to confirm for the sales account based on his audit procedure. (1 mark) (b) Some people think that the audit procedure performed by the auditor is a test of control. Present your idea and argument to support your answer. (Limit your answer to 25 words). (2 marks) When checking the invoice numbers 19001 and 19002, you discovered that the dates of those invoices as well as of shipping documents were actually 2 July and 12 July 2020, respectively. However, when discussing this issue with the client managers, they refuse to correct the mistake in the financial report. State action (if any) and the auditor's opinion, given that there are no other misstatements discovered and the auditor-in-charge has indicated that any misstatement above 10% of the sales amount will be considered material. (Limit your answer to 60 words). (5 marks) (c) (d) Following the same issue in (c), however the client now agrees to correct the misstatement associated with invoice 19001 after a long conversation with your team. State the auditor's opinion if the auditor-in-charge has indicated that any misstatement above 10% of the sales amount will be

Step by Step Solution

★★★★★

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a The audit assertion being confirmed by the auditor by way of this proc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started