Answered step by step

Verified Expert Solution

Question

1 Approved Answer

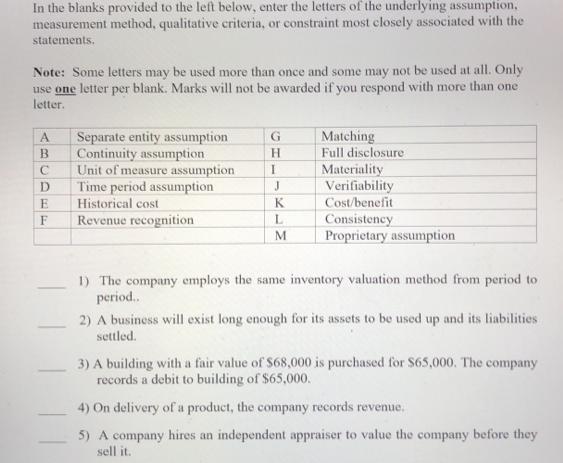

In the blanks provided to the left below, enter the letters of the underlying assumption, measurement method, qualitative criteria, or constraint most closely associated

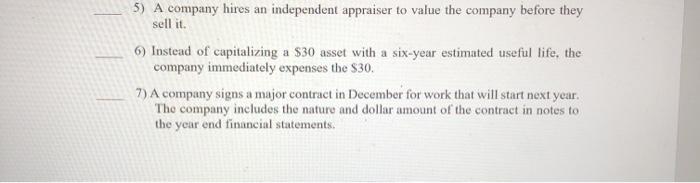

In the blanks provided to the left below, enter the letters of the underlying assumption, measurement method, qualitative criteria, or constraint most closely associated with the statements. Note: Some letters may be used more than once and some may not be used at all. Only use one letter per blank. Marks will not be awarded if you respond with more than one letter. Separate entity assumption Continuity assumption Unit of measure assumption Time period assumption Historical cost Matching Full disclosure A. H. Materiality Verifiability Cost/benefit Consistency Proprietary assumption Revenue recognition M. 1) The company employs the same inventory valuation method from period to period. 2) A business will exist long enough for its assets to be used up and its liabilities settled. 3) A building with a fair value of S68,000 is purchased for $65,000. The company records a debit to building of $65,000. 4) On delivery of a product, the company records revenue. 5) A company hires an independent appraiser to value the company before they sell it. 5) A company hires an independent appraiser to value the company before they sell it. 6) Instead of capitalizing a $30 asset with a six-year estimated useful life, the company immediately expenses the $30. 7) A company signs a major contract in December for work that will start next year. The company includes the nature and dollar amount of the contract in notes to the year end financial statements.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answers 1Any accounting method is acceptable for small items that will not change users decisions Re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started