Answered step by step

Verified Expert Solution

Question

1 Approved Answer

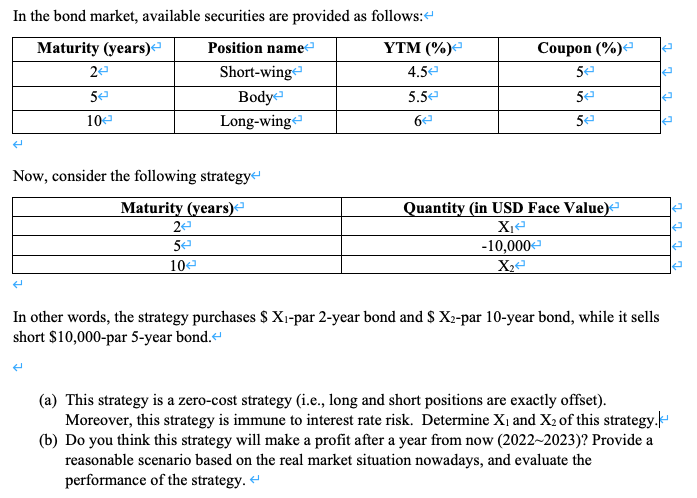

In the bond market, available securities are provided as follows: < Maturity (years) < 2 < 50 10 < Position name Short-wing YTM (%)

In the bond market, available securities are provided as follows: < Maturity (years) < 2 < 50 10 < Position name Short-wing YTM (%) < 4.5 Coupon (%) Body 5.5 5 50 Long-wing 6 50 Now, consider the following strategy Maturity (years) < 2 < 5 10 < Quantity (in USD Face Value) < X < -10,000 X2 < In other words, the strategy purchases $ Xi-par 2-year bond and $ X2-par 10-year bond, while it sells short $10,000-par 5-year bond. < (a) This strategy is a zero-cost strategy (i.e., long and short positions are exactly offset). Moreover, this strategy is immune to interest rate risk. Determine X1 and X2 of this strategy. (b) Do you think this strategy will make a profit after a year from now (2022-2023)? Provide a reasonable scenario based on the real market situation nowadays, and evaluate the performance of the strategy. < 2 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started