Answered step by step

Verified Expert Solution

Question

1 Approved Answer

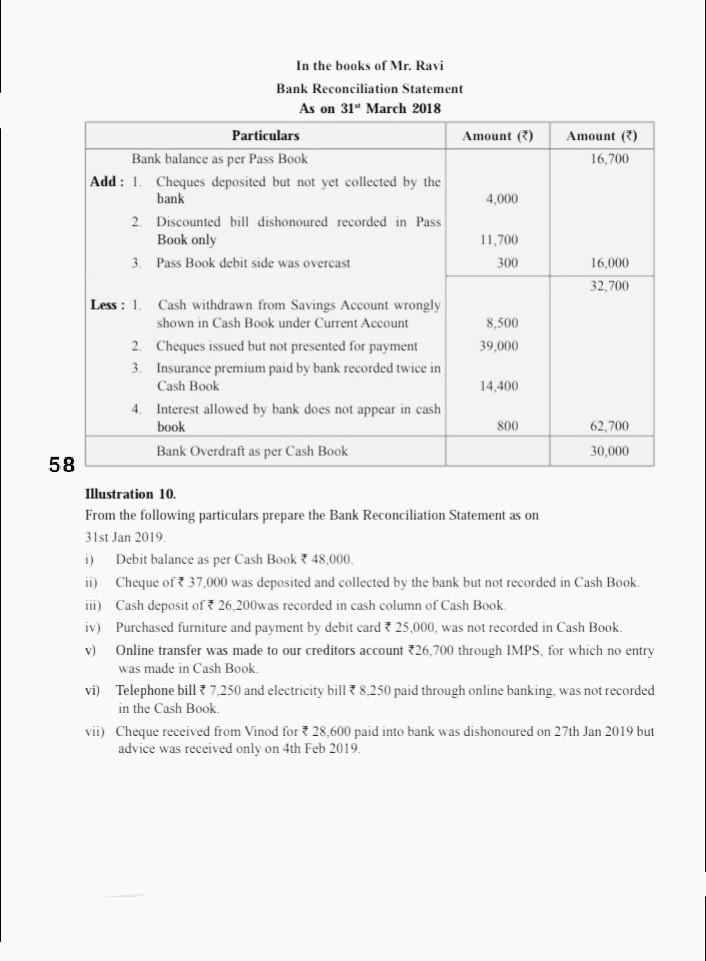

In the books of Mr. Ravi Bank Reconciliation Statement As on 31 March 2018 Amount () Amount ) 16,700 Particulars Bank balance as per Pass

In the books of Mr. Ravi Bank Reconciliation Statement As on 31" March 2018 Amount () Amount ) 16,700 Particulars Bank balance as per Pass Book Add: 1 Cheques deposited but not yet collected by the bank 2 Discounted bill dishonoured recorded in Pass Book only 3 Pass Book debit side was overcast 4,000 11.700 300 16,000 32,700 8,500 39.000 Less : 1 Cash withdrawn from Savings Account wrongly shown in Cash Book under Current Account 2. Cheques issued but not presented for payment 3. Insurance premium paid by bank recorded twice in Cash Book 4 Interest allowed by bank does not appear in cash book 14,400 800 62,700 Bank Overdraft as per Cash Book 30,000 58 Illustration 10. From the following particulars prepare the Bank Reconciliation Statement as on 31st Jan 2019 Debit balance as per Cash Book 48,000 11) Cheque of 37,000 was deposited and collected by the bank but not recorded in Cash Book. i Cash deposit of 3 26,200was recorded in cash column of Cash Book iv) Purchased furniture and payment by debit card 25,000, was not recorded in Cash Book. v) Online transfer was made to our creditors account 526,700 through IMPS, for which no entry was made in Cash Book vi) Telephone bill 37.250 and electricity bill 38.250 paid through online banking, was not recorded in the Cash Book vii) Cheque received from Vinod for 28,600 paid into bank was dishonoured on 27th Jan 2019 but advice was received only on 4th Feb 2019

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started