Question

In the Capstone Simulation, as in the real world of business, it is always helpful to understand the level of industrial capacity and the related

In the Capstone Simulation, as in the real world of business, it is always helpful to understand the level of industrial capacity and the related concept of total industry supply.

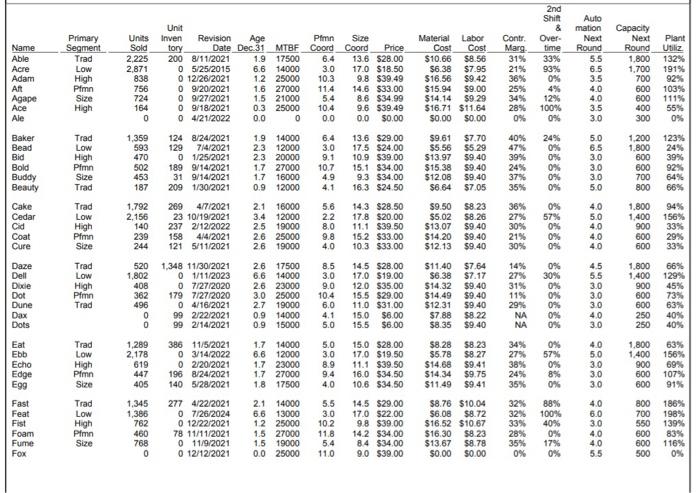

Given the data found in the Capstone Courier regarding company plant capacity, calculate the total plant capacity (all company's first shift capacity) in the Low-End segment. (5 points)

Follow-up question, assume you are product Bead. What portion (percentage) of the Low-End market does Bead have in total (segment) capacity? Explain your answer. (5 points)

To further clarify the question, we need to be aware of the comparison between our desired market share and our production capacity. For example, if our goal is to capture 30% of a given market, but we only have 10% of the market's production capacity, then it simply is not going to happen. Obviously, goals must be realistic, and companies must build capacity with their realistic market share goals in mind.

As decision-makers, we need to coordinate our strategic objectives (how much market we think we can capture) with our internal scale (size, plant capacity, distribution chain, etc.) in mind, and then build the right amount of plant capacity to make that happen at an efficient cost. It's just a simple reality check, but use it as it works.

Maximum Attainable Market Share = (Company maximum production level + Units in Inventory) / Total Segment Demand (x 100 to convert to %).

Name Able Acre Adam Aft Agape Ace Ale Baker Bead Bid Bold Buddy Beauty Cake Cedar Cid Coat Cure Daze Dell Dixie Dot Dune Dax Dots Eat Ebb Echo Edge Egg Fast Feat Fist Foam Fume Fox Primary Segment Trad Low High Pfmn Size High Trad Low High Pfmn Size Trad Trad Low High Pfmn Size Trad Low High Pfmn Trad Trad Low High Pimn Size Trad Low High Pfmn Size 2,225 Unit Units Inven Revision Sold tory 200 8/11/2021 05/25/2015 0 12/26/2021 0 9/20/2021 0 9/27/2021 0 9/18/2021 04/21/2022 2,871 838 756 724 164 0 1,359 593 470 502 453 187 140 239 244 520 1,802 1,792 269 4/7/2021 23 10/19/2021 237 2/12/2022 2,156 158 4/4/2021 121 5/11/2021 408 362 496 0 0 1,289 2,178 619 447 405 Age Pimn Size Date Dec.31 MTBF Coord_Coord 1.9 17500 6.6 14000 1.2 25000 1.6 27000 1.5 21000 0.3 25000 0.0 0 124 8/24/2021 129 7/4/2021 460 768 0 01/25/2021 189 9/14/2021 31 9/14/2021 209 1/30/2021 1,348 11/30/2021 01/11/2023 07/27/2020 179 7/27/2020 04/16/2021 99 2/22/2021 99 2/14/2021 1,345 277 4/22/2021 1,386 762 07/26/2024 0 12/22/2021 78 11/11/2021 0 11/9/2021 0 12/12/2021 1.9 14000 2.3 12000 2.3 20000 1.7 27000 10.7 1.7 16000 0.9 12000 2.1 16000 3.4 12000 2.5 19000 2.6 25000 2.6 19000 386 11/5/2021 1.7 14000 0 3/14/2022 6.6 12000 02/20/2021 196 8/24/2021 1.7 23000 1.7 27000 1.8 17500 140 5/28/2021 0.9 14000 0.9 15000 6.4 3.0 10.3 11.4 5.4 10.4 0.0 6.4 3.0 2.1 14000 6.6 13000 1.2 25000 1.5 27000 1.5 19000 0.0 25000 39044 FOT791 9.1 4.9 4.1 10 NO34 5.6 2.2 8.0 62039 2.6 17500 8.5 6.6 14000 3.0 2.6 23000 9.0 3.0 25000 10.4 2.7 19000 6.0 4.1 5.0 9.8 4.0 5.0 3.0 8.9 9.4 4.0 07000 5.5 3.0 10.2 11.8 5.4 11.0 Price 13.6 $28.00 17.0 $18.50 9.8 $39.49 14.6 $33.00 8.6 $34.99 9.6 $39.49 0.0 $0.00 13.6 $29.00 17.5 $24.00 10.9 $39.00 15.1 $34.00 9.3 $34.00 16.3 $24.50 14.3 $28.50 17.8 $20.00 11.1 $39.50 15.2 $33.00 10.3 $33.00 14.5 $28.00 17.0 $19.00 12.0 $35.00 15.5 $29.00 11.0 $31.00 15.0 $6.00 15.5 $6.00 15.0 $28.00 17.0 $19.50 11.1 $39.50 16.0 $34.50 10.6 $34.50 14.5 $29.00 17.0 $22.00 9.8 $39.00 14.2 $34.00 8.4 $34.00 9.0 $39.00 Material Labor Cost Cost $10.66 $8.56 $6.38 $7.95 $16.56 $9.42 $15.94 $9.00 $14.14 $9.29 $16.71 $11.64 $0.00 $0.00 Contr. Over- time Marg 31% 33% 21% 93% 36% 0% 4% 25% 34% 12% 28% 100% 0% 0% 0% 0% 0% 0% 0% $9.61 $7.70 40% 24% $5.56 $5.29 47% $13.97 $9.40 39% $15.38 $9.40 24% $12.08 $9.40 37% $6.64 $7.05 35% $9.50 $8.23 $5.02 $8.26 $13.07 $9.40 $14.20 $9.40 21% $12.13 $9.40 30% 36% 0% 27% 57% 30% 0% 0% 0% $11.40 $7.64 $6.38 $7.17 $14.32 $9.40 $14.49 $9.40 11% $12.31 $9.40 29% $7.88 $8.22 $8.35 $9.40 NA NA $8.28 $8.23 $5.78 $8.27 $14.68 $9.41 $14.34 $9.75 $11.49 $9.41 2nd Shift & 14% 0% 27% 30% 31% 0% 0% 0% 0% 0% 34% 0% 27% 57% 38% 0% 8% 0% 24% 35% 88% $8.76 $10.04 32% $6.08 $8.72 32% 100% $16.52 $10.67 33% 40% $16.30 $8.23 28% $13.67 $8.78 35% $0.00 $0.00 0% 0% 17% 0% Auto mation Capacity Next Round 5.5 6.5 3.5 56344053 SUSSGE 4.0 4.0 3.5 3.0 5.0 6.5 3.0 55 333 10 050000 3.0 3.0 5.0 45444 20000 4.0 5.0 4.0 4.0 4.0 formimi43 4.5 5500000 5.5 3.0 3.0 3.0 4.0 3.0 00000 4.0 45330 5.0 3.0 3.0 3.0 4.0 6.0 3.0 4.0 4.0 5.5 Next Plant Round Utiliz 1,800 132% 1,700 191% 700 92% 600 103% 600 111% 400 55% 300 0% 1,200 1,800 600 600 92% 700 64% 800 66% 1,800 1,400 900 600 600 123% 24% 39% 900 600 600 94% 156% 33% 29% 33% 1,800 66% 1,400 129% 45% 73% 63% 250 40% 250 40% 1,800 63% 1,400 156% 900 69% 600 107% 600 91% 800 186% 198% 700 550 139% 600 83% 600 116% 500 0%

Step by Step Solution

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the total plant capacity all companys ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started