Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In the city of King's Landing, Bronn lives and works as a sell - sword ( someone who is willing to fight with his sword

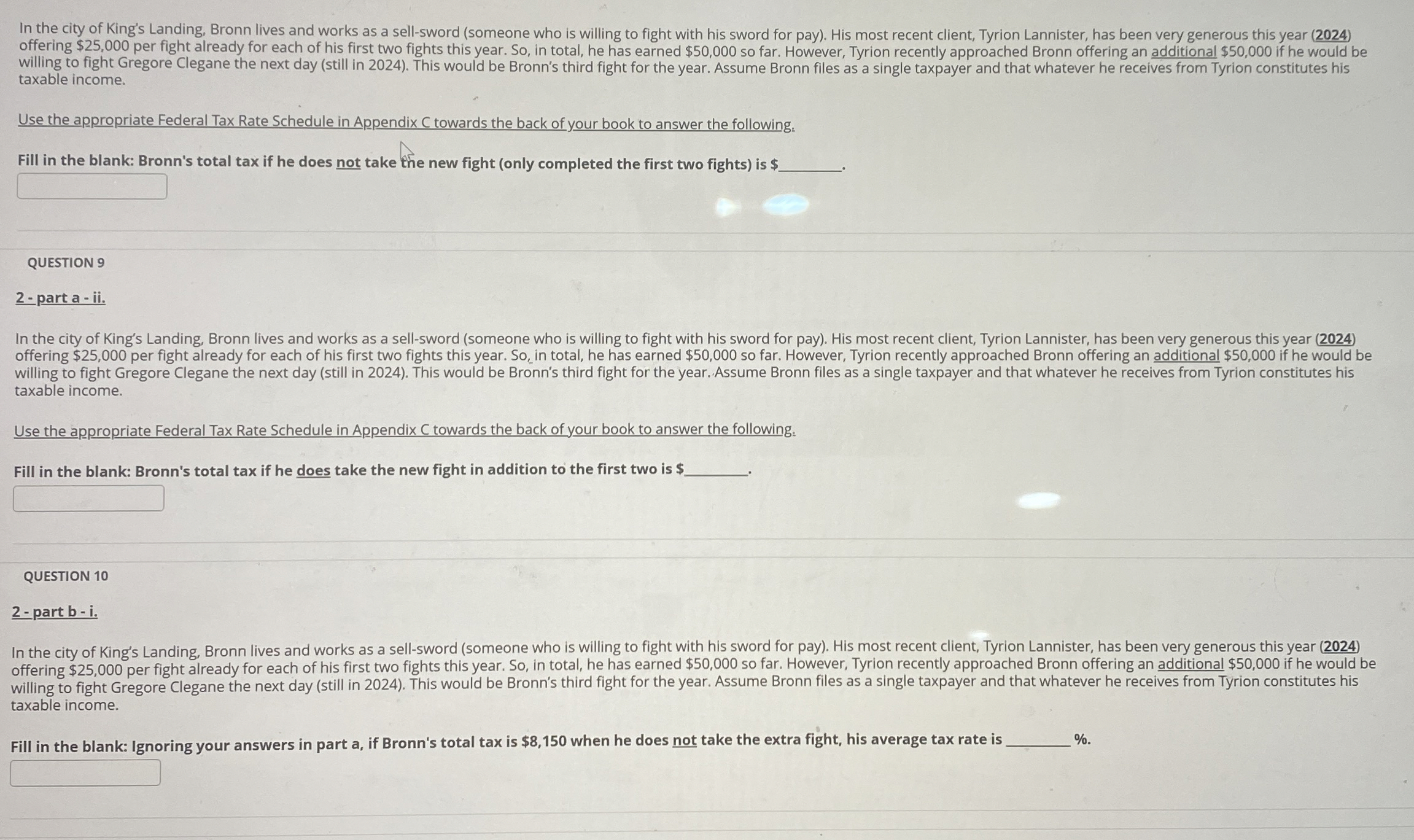

In the city of King's Landing, Bronn lives and works as a sellsword someone who is willing to fight with his sword for pay His most recent client, Tyrion Lannister, has been very generous this year offering $ per fight already for each of his first two fights this year. So in total, he has earned $ so far. However, Tyrion recently approached Bronn offering an additional $ if he would be willing to fight Gregore Clegane the next day still in This would be Bronn's third fight for the year. Assume Bronn files as a single taxpayer and that whatever he receives from Tyrion constitutes his taxable income.

Use the appropriate Federal Tax Rate Schedule in Appendix C towards the back of your book to answer the following:

Fill in the blank: Bronn's total tax if he does not take the new fight only completed the first two fights is $

QUESTION

part aii

In the city of King's Landing, Bronn lives and works as a sellsword someone who is willing to fight with his sword for pay His most recent client, Tyrion Lannister, has been very generous this year offering $ per fight already for each of his first two fights this year. So in total, he has earned $ so far. However, Tyrion recently approached Bronn offering an additional $ if he would be willing to fight Gregore Clegane the next day still in This would be Bronn's third fight for the year. Assume Bronn files as a single taxpayer and that whatever he receives from Tyrion constitutes his taxable income.

Use the appropriate Federal Tax Rate Schedule in Appendix C towards the back of your book to answer the following:

Fill in the blank: Bronn's total tax if he does take the new fight in addition to the first two is

QUESTION

part bi

In the city of King's Landing, Bronn lives and works as a sellsword someone who is willing to fight with his sword for pay His most recent client, Tyrion Lannister, has been very generous this year offering $ per fight already for each of his first two fights this year. So in total, he has earned $ so far. However, Tyrion recently approached Bronn offering an additional $ if he would be willing to fight Gregore Clegane the next day still in This would be Bronn's third fight for the year. Assume Bronn files as a single taxpayer and that whatever he receives from Tyrion constitutes his taxable income.

Fill in the blank: Ignoring your answers in part a if Bronn's total tax is $ when he does not take the extra fight, his average tax rate is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started