Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In the conglomerate bank below the parent invests $100 million equity into 2 businesses, $40 million to the commercial bank and $60 million to

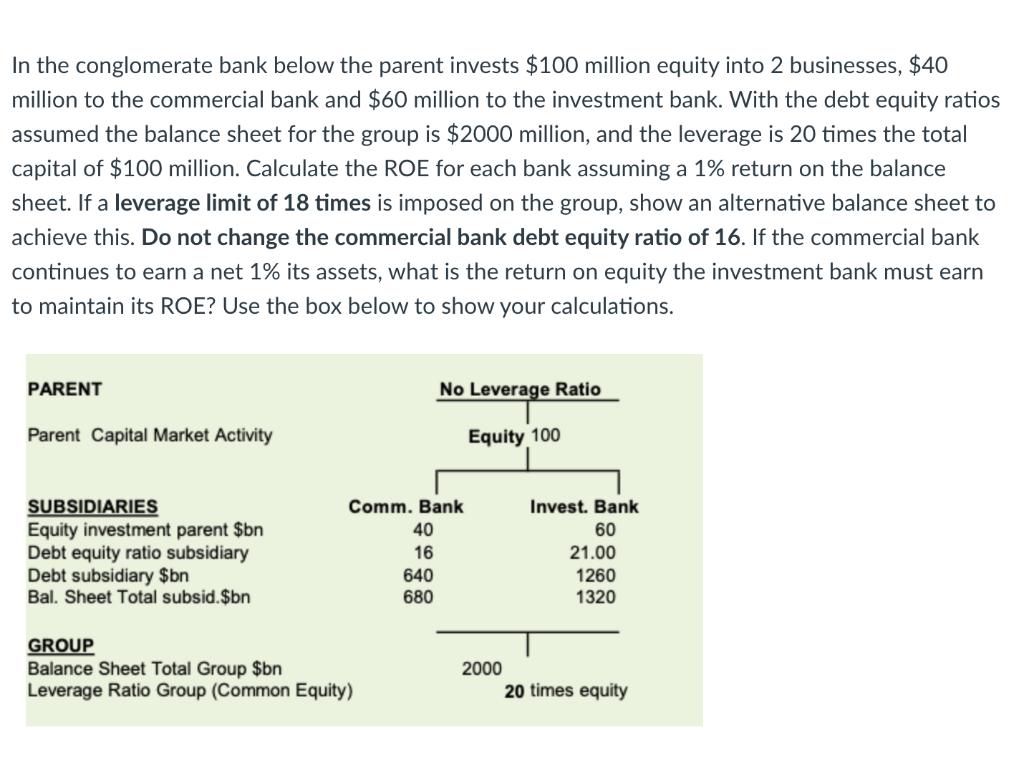

In the conglomerate bank below the parent invests $100 million equity into 2 businesses, $40 million to the commercial bank and $60 million to the investment bank. With the debt equity ratios assumed the balance sheet for the group is $2000 million, and the leverage is 20 times the total capital of $100 million. Calculate the ROE for each bank assuming a 1% return on the balance sheet. If a leverage limit of 18 times is imposed on the group, show an alternative balance sheet to achieve this. Do not change the commercial bank debt equity ratio of 16. If the commercial bank continues to earn a net 1% its assets, what is the return on equity the investment bank must earn to maintain its ROE? Use the box below to show your calculations. PARENT Parent Capital Market Activity SUBSIDIARIES Equity investment parent $bn Debt equity ratio subsidiary Debt subsidiary $bn Bal. Sheet Total subsid.$bn No Leverage Ratio Equity 100 Comm. Bank 40 16 640 680 GROUP Balance Sheet Total Group $bn Leverage Ratio Group (Common Equity) 2000 Invest. Bank 60 21.00 1260 1320 20 times equity

Step by Step Solution

★★★★★

3.47 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

ROE Commercial Bank 1 640 40 16 ROE Investment Bank ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started