Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In the context of capital budgeting, what is the definition of independent projects? Select one: O a. Projects which can be run without any

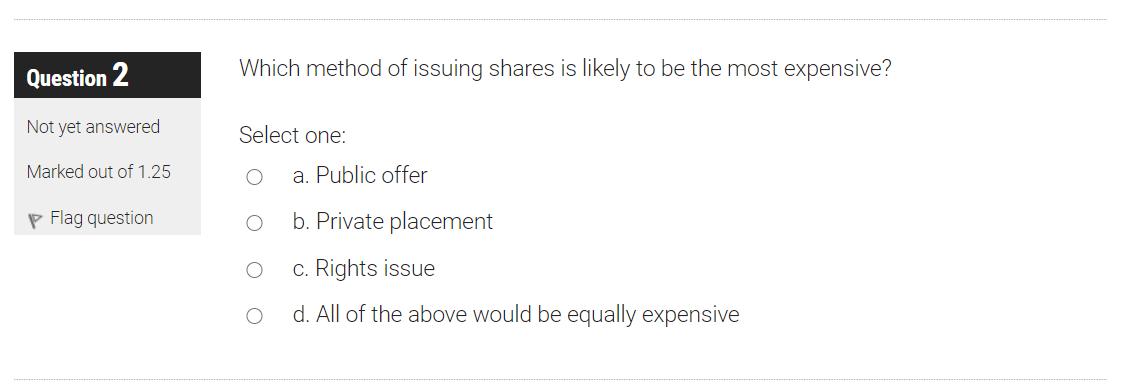

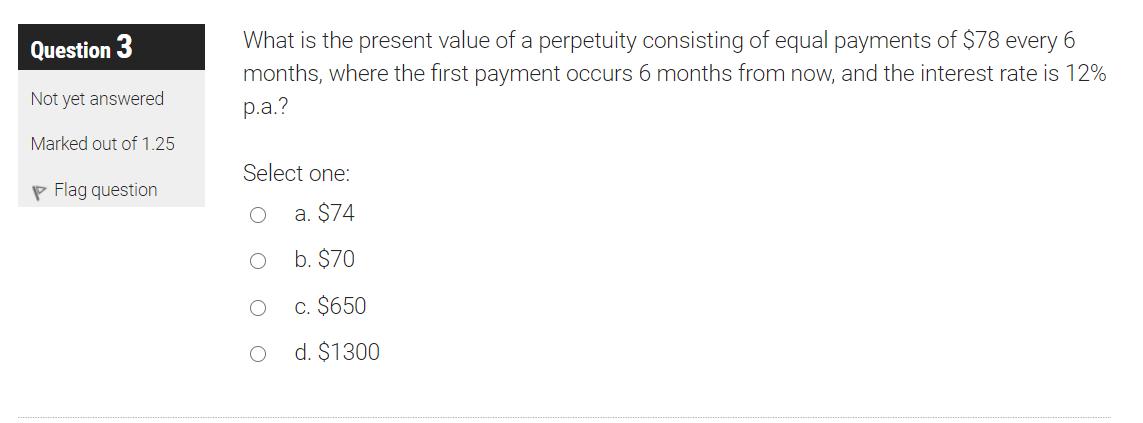

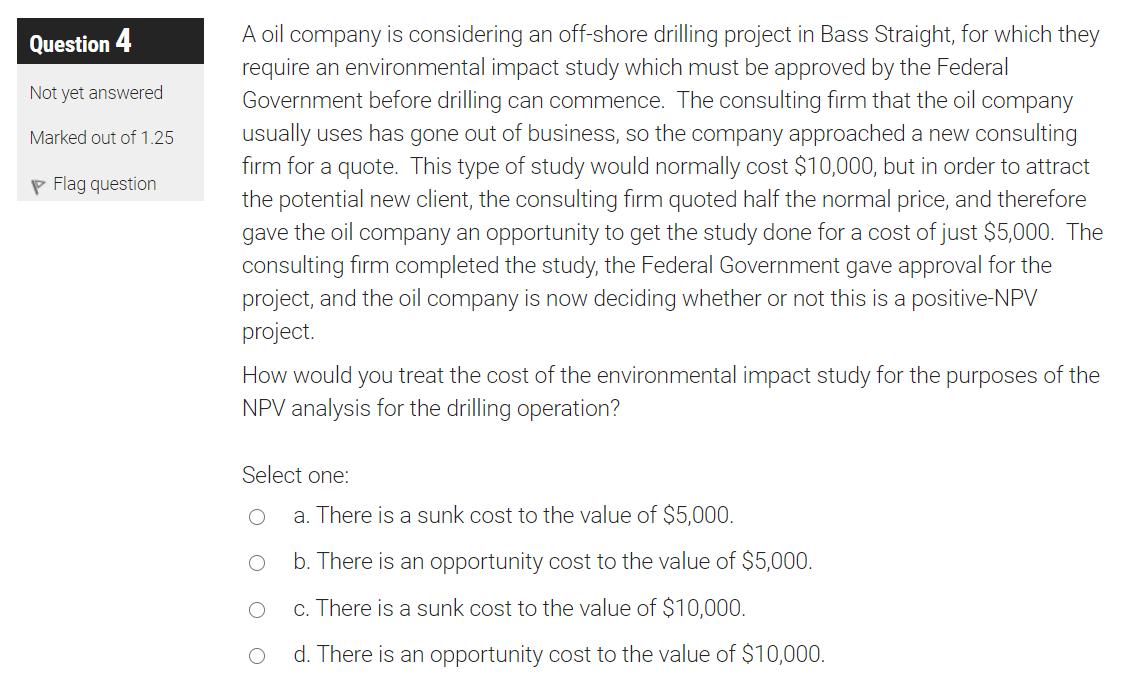

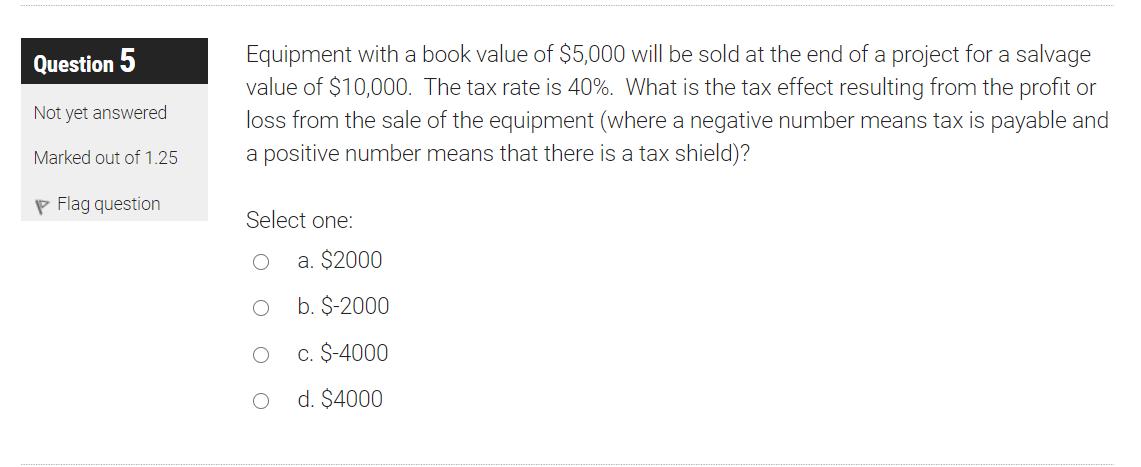

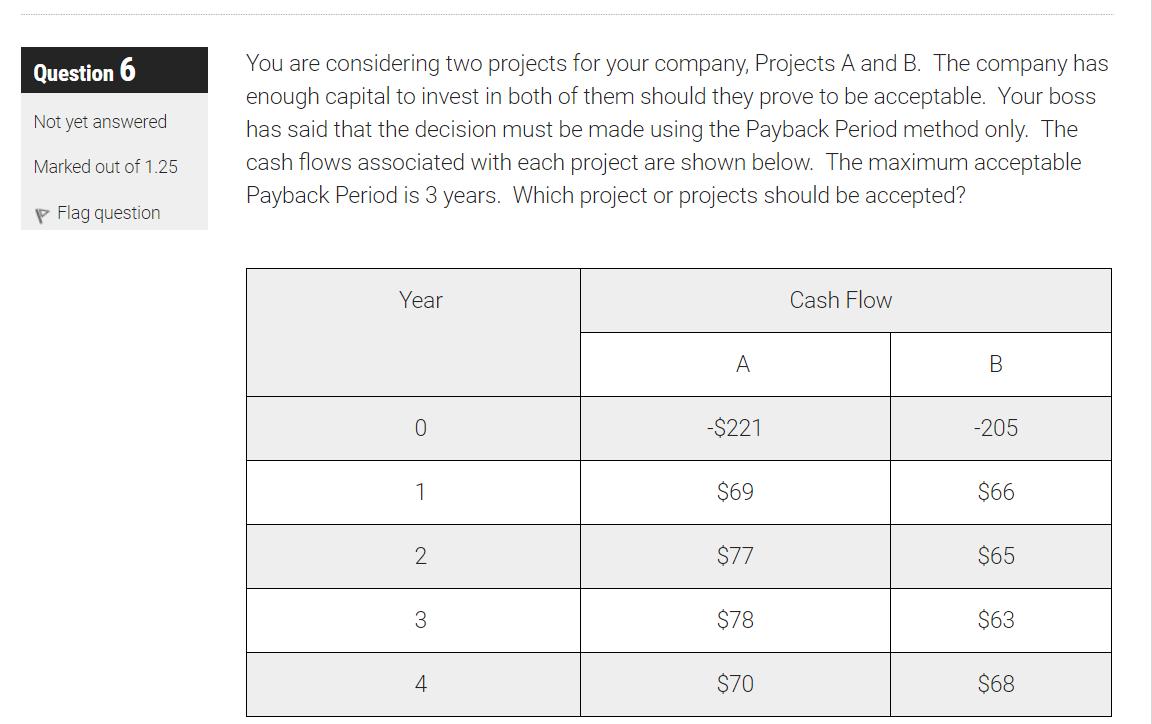

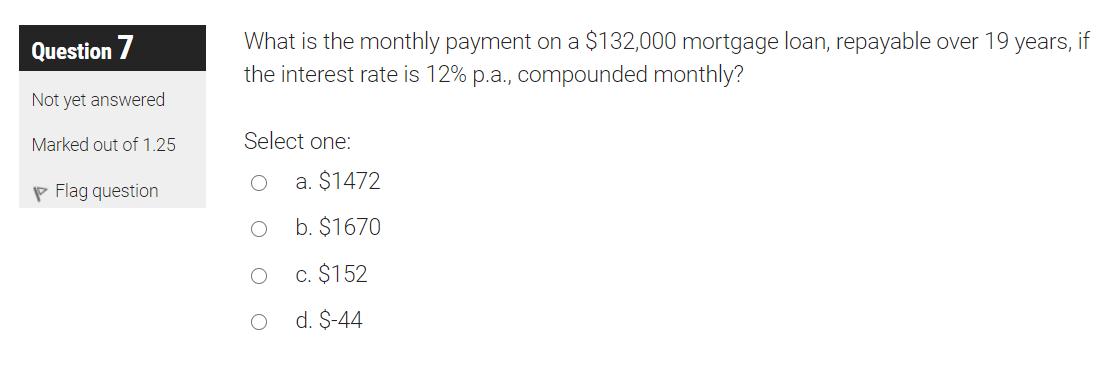

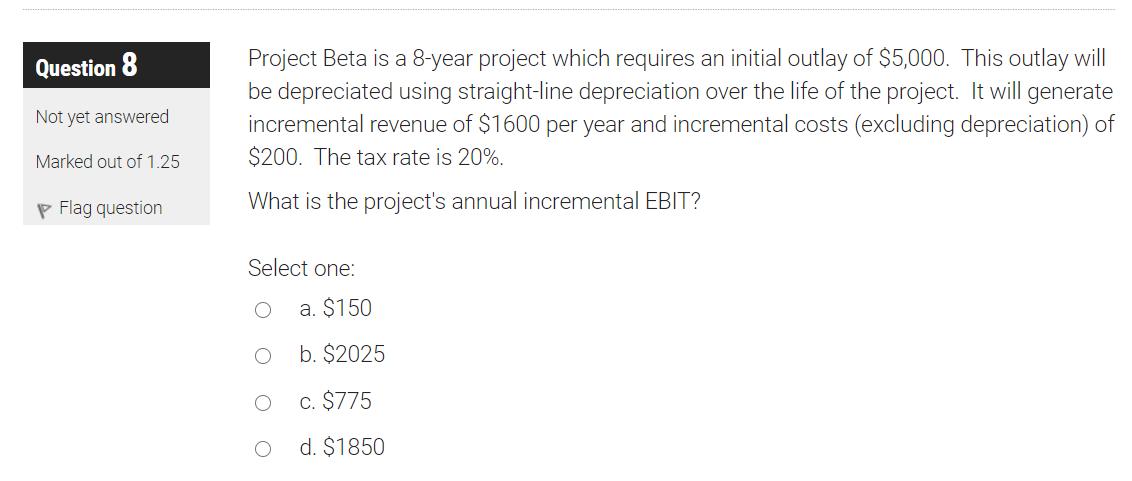

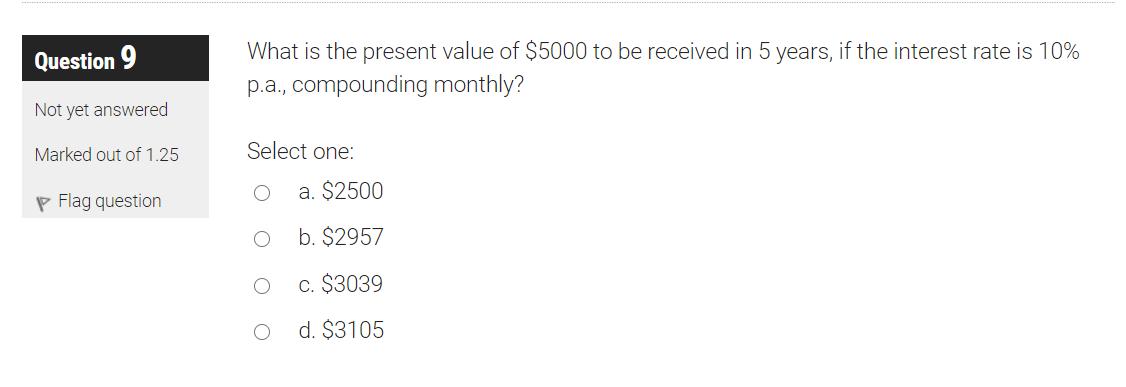

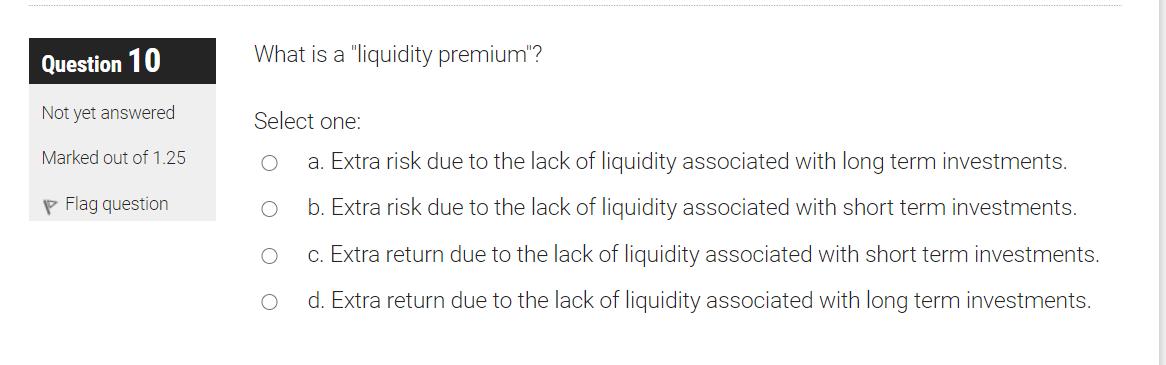

In the context of capital budgeting, what is the definition of independent projects? Select one: O a. Projects which can be run without any input from the management of the firm. O b. Projects which can be accepted or rejected without affecting the viability of other projects. c. Alternative projects where only one of them can be accepted. d. Alternative projects where the acceptance of one of them affects the viability of the others. Question 2 Not yet answered Marked out of 1.25 P Flag question Which method of issuing shares is likely to be the most expensive? Select one: O a. Public offer b. Private placement c. Rights issue d. All of the above would be equally expensive Question 3 Not yet answered Marked out of 1.25 Flag question What is the present value of a perpetuity consisting of equal payments of $78 every 6 months, where the first payment occurs 6 months from now, and the interest rate is 12% p.a.? Select one: a. $74 b. $70 c. $650 d. $1300 Question 4 Not yet answered Marked out of 1.25 Flag question A oil company is considering an off-shore drilling project in Bass Straight, for which they require an environmental impact study which must be approved by the Federal Government before drilling can commence. The consulting firm that the oil company usually uses has gone out of business, so the company approached a new consulting firm for a quote. This type of study would normally cost $10,000, but in order to attract the potential new client, the consulting firm quoted half the normal price, and therefore gave the oil company an opportunity to get the study done for a cost of just $5,000. The consulting firm completed the study, the Federal Government gave approval for the project, and the oil company is now deciding whether or not this is a positive-NPV project. How would you treat the cost of the environmental impact study for the purposes of the NPV analysis for the drilling operation? Select one: a. There is a sunk cost to the value of $5,000. b. There is an opportunity cost to the value of $5,000. c. There is a sunk cost to the value of $10,000. d. There is an opportunity cost to the value of $10,000. Question 5 Not yet answered Marked out of 1.25 Flag question Equipment with a book value of $5,000 will be sold at the end of a project for a salvage value of $10,000. The tax rate is 40%. What is the tax effect resulting from the profit or loss from the sale of the equipment (where a negative number means tax is payable and a positive number means that there is a tax shield)? Select one: a. $2000 b. $-2000 c. $-4000 d. $4000 Question Not yet answered Marked out of 1.25 Flag question You are considering two projects for your company, Projects A and B. The has company enough capital to invest in both of them should they prove to be acceptable. Your boss has said that the decision must be made using the Payback Period method only. The cash flows associated with each project are shown below. The maximum acceptable Payback Period is 3 years. Which project or projects should be accepted? Year 0 1 2 3 4 A -$221 $69 $77 $78 $70 Cash Flow B -205 $66 $65 $63 $68 Question 7 Not yet answered Marked out of 1.25 Flag question What is the monthly payment on a $132,000 mortgage loan, repayable over 19 if years, the interest rate is 12% p.a., compounded monthly? Select one: a. $1472 b. $1670 c. $152 d. $-44 Question 8 Not yet answered Marked out of 1.25 P Flag question Project Beta is a 8-year project which requires an initial outlay of $5,000. This outlay will be depreciated using straight-line depreciation over the life of the project. It will generate incremental revenue of $1600 per year and incremental costs (excluding depreciation) of $200. The tax rate is 20%. What is the project's annual incremental EBIT? Select one: C O a. $150 b. $2025 c. $775 d. $1850 Question 9 Not yet answered Marked out of 1.25 P Flag question What is the present value of $5000 to be received in 5 years, if the interest rate is 10% p.a., compounding monthly? Select one: O O O a. $2500 b. $2957 c. $3039 d. $3105 Question 10 Not yet answered Marked out of 1.25 Flag question What is a "liquidity premium"? Select one: a. Extra risk due to the lack of liquidity associated with long term investments. b. Extra risk due to the lack of liquidity associated with short term investments. c. Extra return due to the lack of liquidity associated with short term investments. d. Extra return due to the lack of liquidity associated with long term investments. O

Step by Step Solution

★★★★★

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

1 In the context of capital budgeting independent projects are Select b Projects which can be accept...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started