Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In the current year, Emil Gow won $5,000 in state lottery and spent $400 for the purchase of lottery tickets. Emil Elected the standard

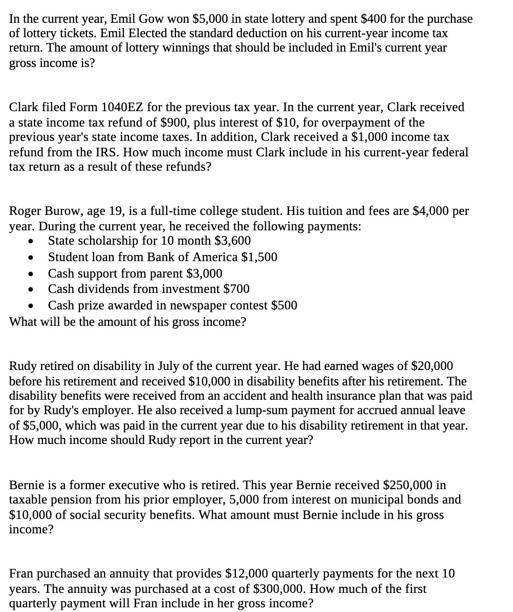

In the current year, Emil Gow won $5,000 in state lottery and spent $400 for the purchase of lottery tickets. Emil Elected the standard deduction on his current-year income tax return. The amount of lottery winnings that should be included in Emil's current year gross income is? Clark filed Form 1040EZ for the previous tax year. In the current year, Clark received a state income tax refund of $900, plus interest of $10, for overpayment of the previous year's state income taxes. In addition, Clark received a $1,000 income tax refund from the IRS. How much income must Clark include in his current-year federal tax return as a result of these refunds? Roger Burow, age 19, is a full-time college student. His tuition and fees are $4,000 per year. During the current year, he received the following payments: State scholarship for 10 month $3,600 Student loan from Bank of America $1,500 Cash support from parent $3,000 Cash dividends from investment $700 Cash prize awarded in newspaper contest $500 What will be the amount of his gross income? Rudy retired on disability in July of the current year. He had earned wages of $20,000 before his retirement and received $10,000 in disability benefits after his retirement. The disability benefits were received from an accident and health insurance plan that was paid for by Rudy's employer. He also received a lump-sum payment for accrued annual leave of $5,000, which was paid in the current year due to his disability retirement in that year. How much income should Rudy report in the current year? Bernie is a former executive who is retired. This year Bernie received $250,000 in taxable pension from his prior employer, 5,000 from interest on municipal bonds and $10,000 of social security benefits. What amount must Bernie include in his gross income? Fran purchased an annuity that provides $12,000 quarterly payments for the next 10 years. The annuity was purchased at a cost of $300,000. How much of the first quarterly payment will Fran include in her gross income?

Step by Step Solution

★★★★★

3.30 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Emil Gows gross income from lottery winnings is 4600 5000 winnings 400 spent on tickets Clark must ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started