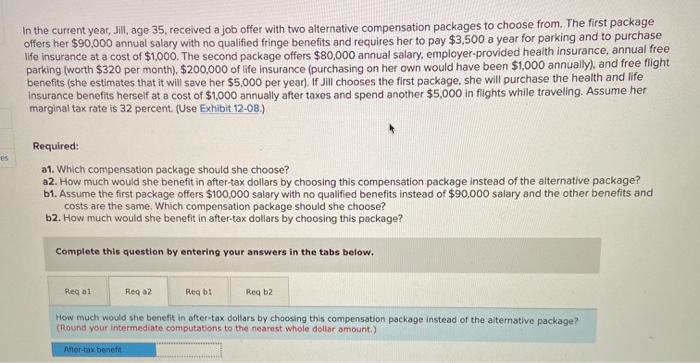

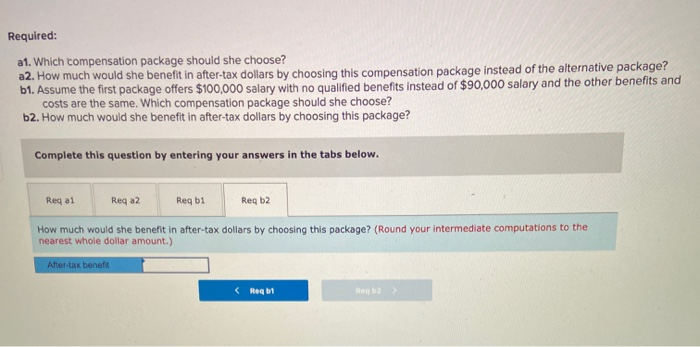

In the current year, Jill, age 35, received a job offer with two alternative compensation packages to choose from. The first package offers her $90,000 annual salary with no qualified fringe benefits and requires her to pay $3,500 a year for parking and to purchase life insurance at a cost of $1,000. The second package offers $80,000 annual salary, employer-provided health insurance, annual free parking (worth $320 per month) $200,000 of life insurance (purchasing on her own would have been $1,000 annually), and free flight benefits (she estimates that it will save her $5,000 per year). If Jill chooses the first package, she will purchase the health and life insurance benefits herself at a cost of $1,000 annually after taxes and spend another $5,000 in flights while traveling. Assume her marginal tax rate is 32 percent. (Use Exhibit 12-08.) es Required: a1. Which compensation package should she choose? a2. How much would she benefit in after-tax dollars by choosing this compensation package instead of the alternative package? 61. Assume the first package offers $100,000 salary with no qualified benefits instead of $90,000 salary and the other benefits and costs are the same. Which compensation package should she choose? b2. How much would she benefit in after-tax dollars by choosing this package? Complete this question by entering your answers in the tabs below. Regal Rega2 Reg b1 Reg 2 How much would she benefit in after-tax dollars by choosing this compensation package instead of the alternative package? (Round your intermediate computations to the nearest whole dollar amount.) After tax benefit Required: a1. Which compensation package should she choose? a2. How much would she benefit in after-tax dollars by choosing this compensation package instead of the alternative package? b1. Assume the first package offers $100,000 salary with no qualified benefits instead of $90,000 salary and the other benefits and costs are the same. Which compensation package should she choose? b2. How much would she benefit in after-tax dollars by choosing this package? Complete this question by entering your answers in the tabs below. Reg a1 Reg a2 Req b1 Reg b2 How much would she benefit in after-tax dollars by choosing this package? (Round your intermediate computations to the nearest whole dollar amount.) Ater-tax benett ( Reqb1