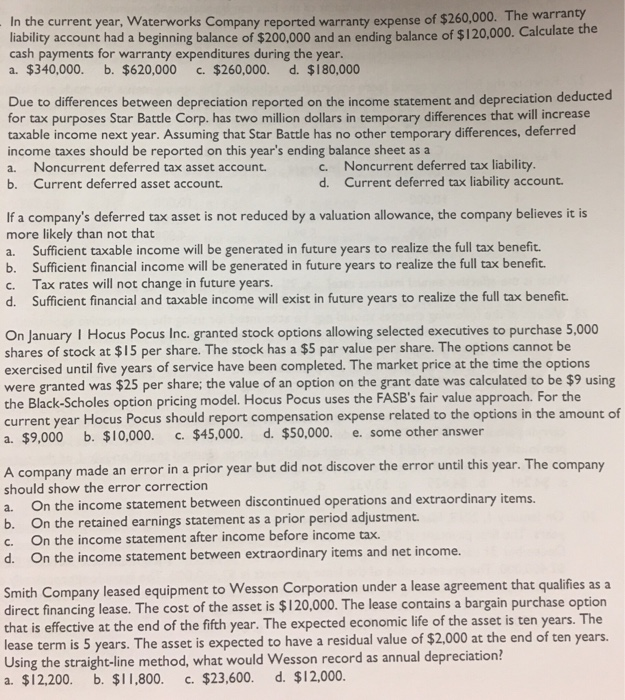

In the current year, Waterworks C ompany reported warranty expense of $260,000. The warranty liability account had a beginning balance of $200,000 and an ending balance of $120,000. Calculate the cash payments for warranty expenditures during the year a. $340,000. b. $620,000 c. $260,000. d. $180,000 Due to differences between depreciation reported on the income statement and depreciation deducted for tax purposes Star Battle Corp. has two million dollars in temporary differences that will increase taxable income next year. Assuming that Star Battle has no other temporary differences, deferred income taxes should be reported on this year's ending balance sheet as a a. Noncurrent deferred tax asset account. b. Current deferred asset account. c. Noncurrent deferred tax liability d. Current deferred tax liability account If a company's deferred tax asset is not reduced by a valuation allowance, the company believes it is more likely than not that a. Sufficient taxable income will be generated in future years to realize the full tax benefit. b. Sufficient financial income will be generated in future years to realize the full tax benefit. c. Tax rates will not change in future years. d. Sufficient financial and taxable income will exist in future years to realize the full tax benefit. On January I Hocus Pocus Inc. granted stock options allowing selected executives to purchase 5,000 shares of stock at $15 per share. The stock has a $5 par value per share. The exercised until five years of service have been completed. The market price at the time the options were granted was $25 per share:; the value of an option on the grant date was calculated to be $9 using the Black-Scholes option pricing model. Hocus Pocus uses the FASB's fair value approach. For the current year Hocus Pocus should report compensation expense related to the options in the amount o a. $9,000 b. $10,000. . $45,000. d. $50,000. e. some other answer A company made an error in a prior year but did not discover the error until this year. The company should show the error correction On the income statement between discontinued operations and extraordinary items. On the retained earnings statement as a prior period adjustment. b. On the income statement after income before income tax. c. On the income statement between extraordinary items and net income d. Smith Company leased equipment to Wesson Corporation under a lease agreement that qualifies as a direct financing lease. The cost of the asset is $120,000. The lease contains a bargain purchase option that is effective at the end of the fifth year. The expected economic life of the asset is ten years. The lease term is 5 years. The asset is expected to have a residual value of $2,000 at the end of ten years. Using the straight-line method, what would Wesson record as annual depreciation? $12,200. b. $11,800. c. $23,600. d. $12,000