Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In the final project we will work on a individual financial planning problem for Mr. Mar- cus Kim. His initial salary is $125,000, which

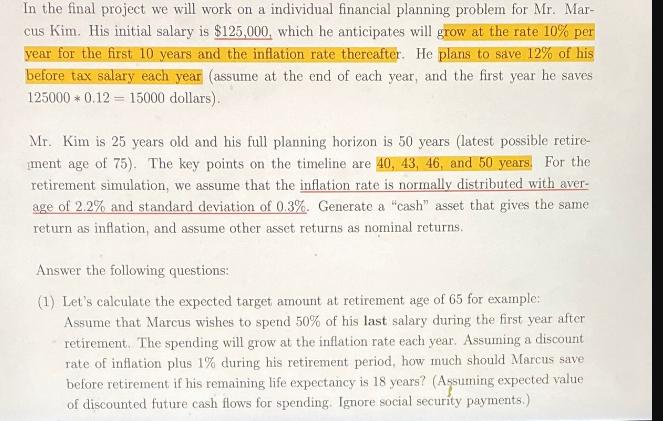

In the final project we will work on a individual financial planning problem for Mr. Mar- cus Kim. His initial salary is $125,000, which he anticipates will grow at the rate 10% per year for the first 10 years and the inflation rate thereafter. He plans to save 12% of his before tax salary each year (assume at the end of each year, and the first year he saves 1250000.12= 15000 dollars). Mr. Kim is 25 years old and his full planning horizon is 50 years (latest possible retire- ment age of 75). The key points on the timeline are 40, 43, 46, and 50 years. For the retirement simulation, we assume that the inflation rate is normally distributed with aver- age of 2.2% and standard deviation of 0.3%. Generate a "cash" asset that gives the same return as inflation, and assume other asset returns as nominal returns. Answer the following questions: (1) Let's calculate the expected target amount at retirement age of 65 for example: Assume that Marcus wishes to spend 50% of his last salary during the first year after retirement. The spending will grow at the inflation rate each year. Assuming a discount rate of inflation plus 1% during his retirement period, how much should Marcus save before retirement if his remaining life expectancy is 18 years? (Assuming expected value of discounted future cash flows for spending. Ignore social security payments.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Calculating Expected Target Amount at Retirement 1 InflationAdjusted Spending Year 1 Spending 125000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started