Answered step by step

Verified Expert Solution

Question

1 Approved Answer

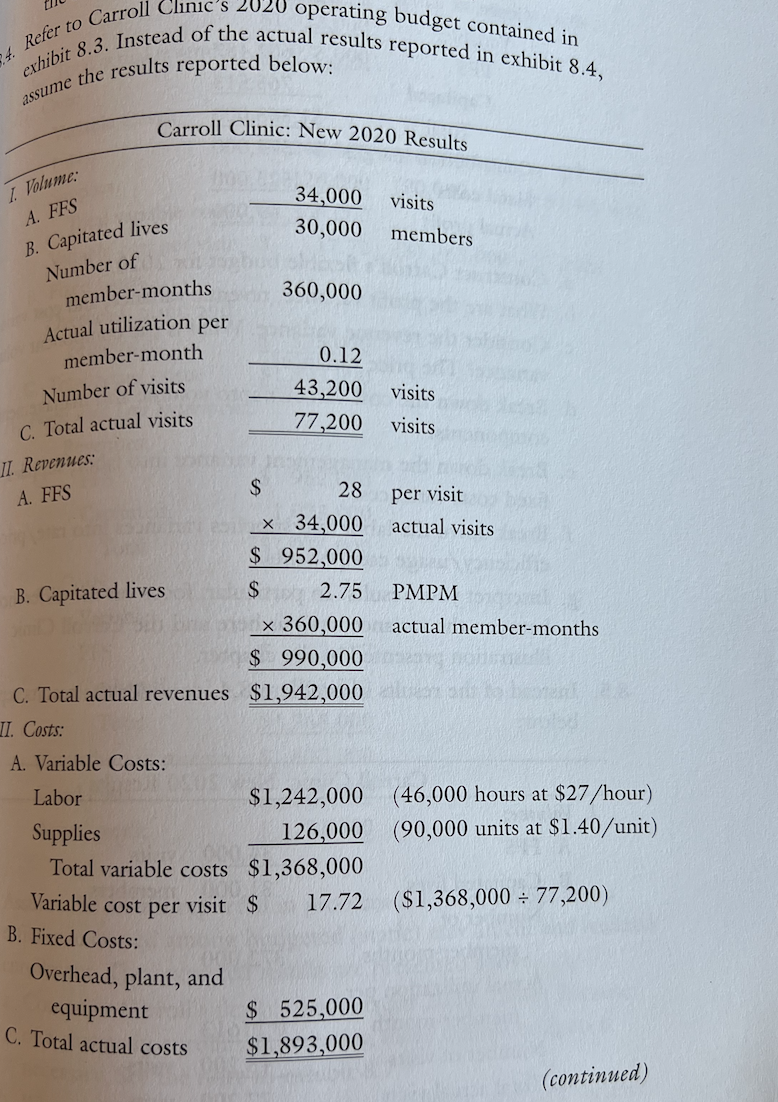

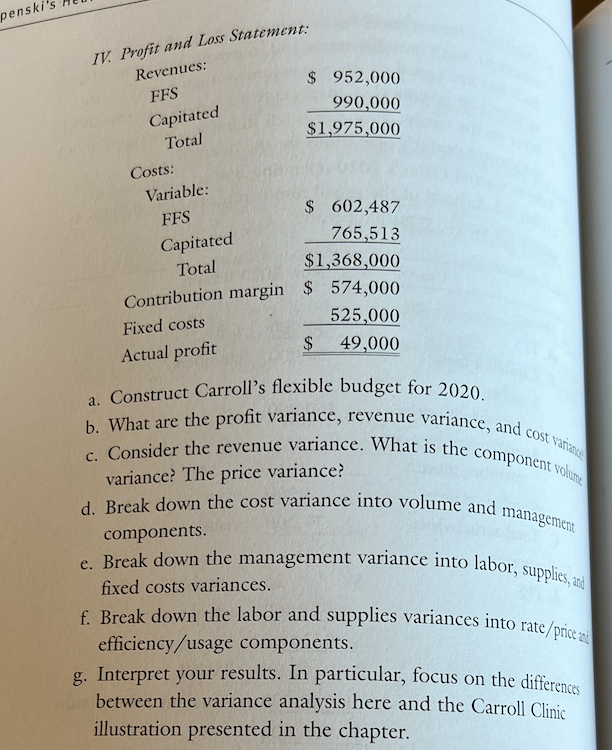

In the first picture is the question and in the second complete a-f. inic's 2020 operating budget contained in 4. Refer to Carroll exhibit 8.3.

In the first picture is the question and in the second complete a-f.

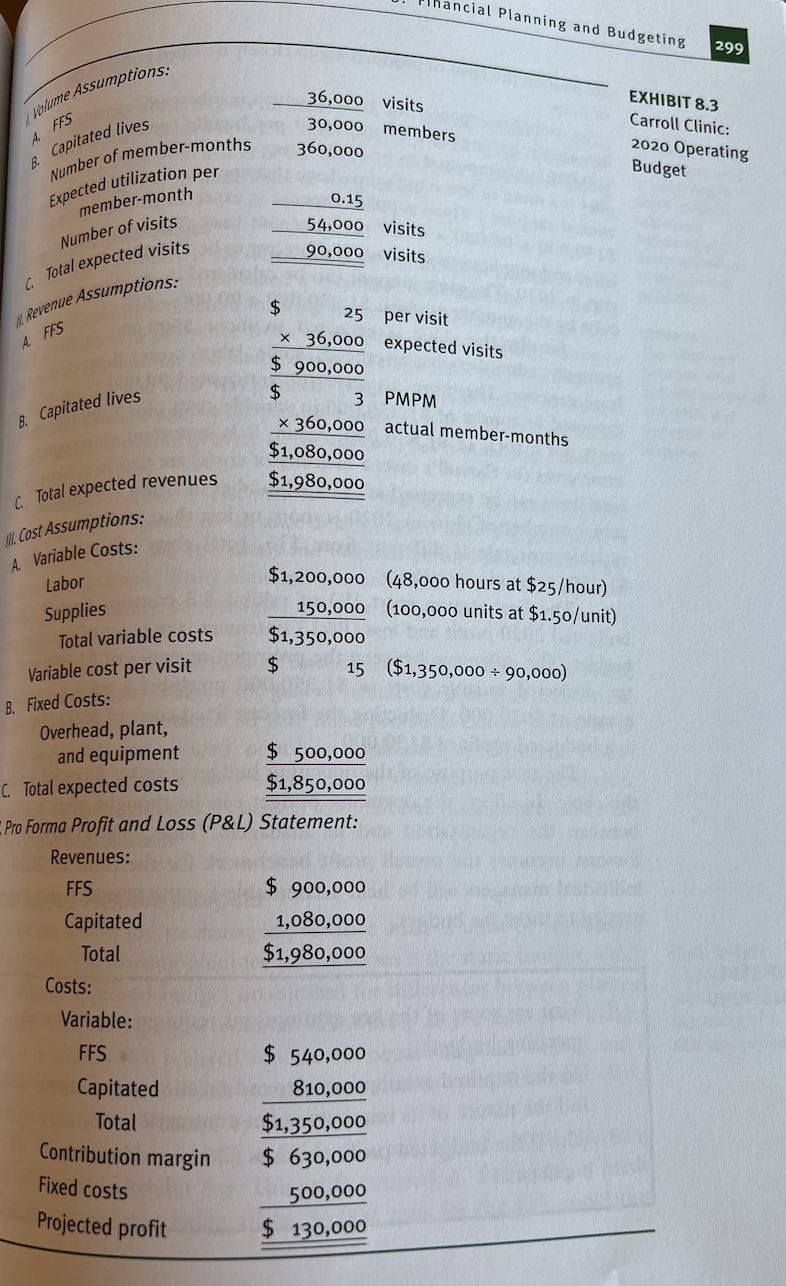

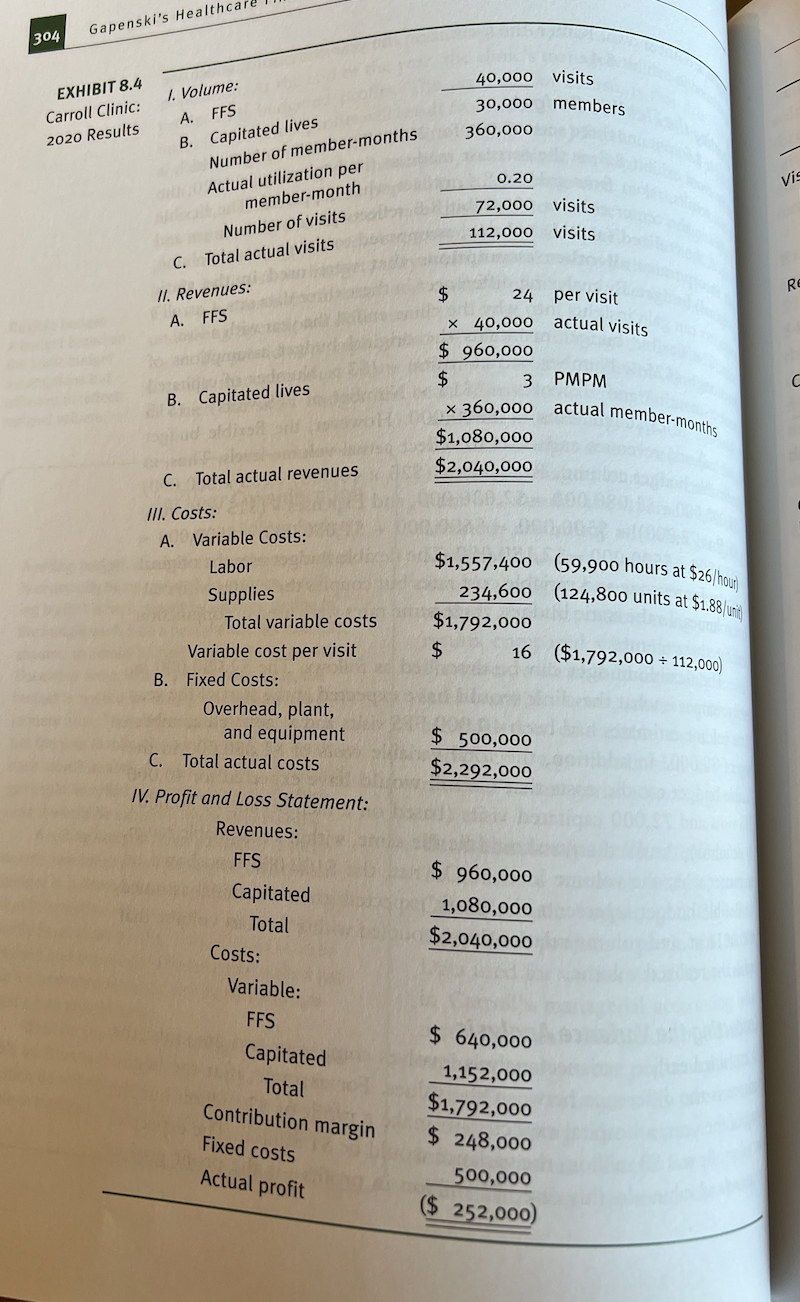

inic's 2020 operating budget contained in 4. Refer to Carroll exhibit 8.3. Instead of the actual results reported in exhibit 8.4, assume the results reported below: Carroll Clinic: New 2020 Results I Volume: A. FES 34,000 30,000 visits members B. Capitated lives Number of 360,000 member-months Actual utilization per member-month Number of visits C. Total actual visits II. Revenues: 0.12 43,200 77,200 visits visits A. FFS per visit B. Capitated lives $ 28 x 34,000 actual visits $ 952,000 $ 2.75 PMPM x 360,000 actual member-months $ 990,000 C. Total actual revenues $1,942,000 II. Costs: A. Variable Costs: Labor $1,242,000 (46,000 hours at $27/hour) Supplies 126,000 (90,000 units at $1.40/unit) Total variable costs $1,368,000 Variable cost per visit $ 17.72 ($1,368,000 = 77,200) B. Fixed Costs: Overhead, plant, and equipment $ 525,000 C. Total actual costs $1,893,000 (continued) penski $ 952,000 990,000 $1,975,000 IV. Profit and Loss Statement: Revenues: FFS Capitated Total Costs: Variable: FFS Capitated Total $ 602,487 765,513 $1,368,000 Contribution margin $ 574,000 525,000 Fixed costs $ 49,000 Actual profit a. Construct Carroll's flexible budget for 2020. b. What are the profit variance, revenue variance, and cost variante c. Consider the revenue variance. What is the component volume variance? The price variance? d. Break down the cost variance into volume and components. e. Break down the management variance into labor, supplies, and fixed costs variances. f. Break down the labor and supplies variances into rate/Price : efficiency/usage components. g. Interpret your results. In particular, focus on the differences between the variance analysis here and the Carroll Clinic illustration presented in the chapter. management incial Planning and Budgeting 299 FFS Volume Assumptions: A. B. Capitated lives 36,000 visits 30,000 members 360,000 EXHIBIT 8.3 Carroll Clinic: 2020 Operating Budget Number of member-months Expected utilization per 0.15 54,000 visits 90,000 visits member-month Number of visits 6 Total expected visits Revenue Assumptions: 4. FFS $ 25 per visit X 36,000 expected visits $ 900,000 $ 3 PMPM * 360,000 actual member-months $1,080,000 $1,980,000 B. Capitated lives c. Total expected revenues M. Cost Assumptions: A. Variable Costs: Labor $1,200,000 (48,000 hours at $25/hour) Supplies 150,000 (100,000 units at $1.50/unit) Total variable costs $1,350,000 $ Variable cost per visit 15 ($1,350,000 = 90,000) B. Fixed Costs: Overhead, plant, and equipment $ 500,000 C. Total expected costs $1,850,000 Pro Forma Profit and Loss (P&L) Statement: Revenues: FFS $ 900,000 Capitated 1,080,000 Total $1,980,000 Costs: Variable: FFS $ 540,000 Capitated 810,000 Total $1,350,000 Contribution margin $ 630,000 500,000 $ 130,000 Fixed costs Projected profit inic's 2020 operating budget contained in 4. Refer to Carroll exhibit 8.3. Instead of the actual results reported in exhibit 8.4, assume the results reported below: Carroll Clinic: New 2020 Results I Volume: A. FES 34,000 30,000 visits members B. Capitated lives Number of 360,000 member-months Actual utilization per member-month Number of visits C. Total actual visits II. Revenues: 0.12 43,200 77,200 visits visits A. FFS per visit B. Capitated lives $ 28 x 34,000 actual visits $ 952,000 $ 2.75 PMPM x 360,000 actual member-months $ 990,000 C. Total actual revenues $1,942,000 II. Costs: A. Variable Costs: Labor $1,242,000 (46,000 hours at $27/hour) Supplies 126,000 (90,000 units at $1.40/unit) Total variable costs $1,368,000 Variable cost per visit $ 17.72 ($1,368,000 = 77,200) B. Fixed Costs: Overhead, plant, and equipment $ 525,000 C. Total actual costs $1,893,000 (continued) penski $ 952,000 990,000 $1,975,000 IV. Profit and Loss Statement: Revenues: FFS Capitated Total Costs: Variable: FFS Capitated Total $ 602,487 765,513 $1,368,000 Contribution margin $ 574,000 525,000 Fixed costs $ 49,000 Actual profit a. Construct Carroll's flexible budget for 2020. b. What are the profit variance, revenue variance, and cost variante c. Consider the revenue variance. What is the component volume variance? The price variance? d. Break down the cost variance into volume and components. e. Break down the management variance into labor, supplies, and fixed costs variances. f. Break down the labor and supplies variances into rate/Price : efficiency/usage components. g. Interpret your results. In particular, focus on the differences between the variance analysis here and the Carroll Clinic illustration presented in the chapter. management incial Planning and Budgeting 299 FFS Volume Assumptions: A. B. Capitated lives 36,000 visits 30,000 members 360,000 EXHIBIT 8.3 Carroll Clinic: 2020 Operating Budget Number of member-months Expected utilization per 0.15 54,000 visits 90,000 visits member-month Number of visits 6 Total expected visits Revenue Assumptions: 4. FFS $ 25 per visit X 36,000 expected visits $ 900,000 $ 3 PMPM * 360,000 actual member-months $1,080,000 $1,980,000 B. Capitated lives c. Total expected revenues M. Cost Assumptions: A. Variable Costs: Labor $1,200,000 (48,000 hours at $25/hour) Supplies 150,000 (100,000 units at $1.50/unit) Total variable costs $1,350,000 $ Variable cost per visit 15 ($1,350,000 = 90,000) B. Fixed Costs: Overhead, plant, and equipment $ 500,000 C. Total expected costs $1,850,000 Pro Forma Profit and Loss (P&L) Statement: Revenues: FFS $ 900,000 Capitated 1,080,000 Total $1,980,000 Costs: Variable: FFS $ 540,000 Capitated 810,000 Total $1,350,000 Contribution margin $ 630,000 500,000 $ 130,000 Fixed costs Projected profitStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started