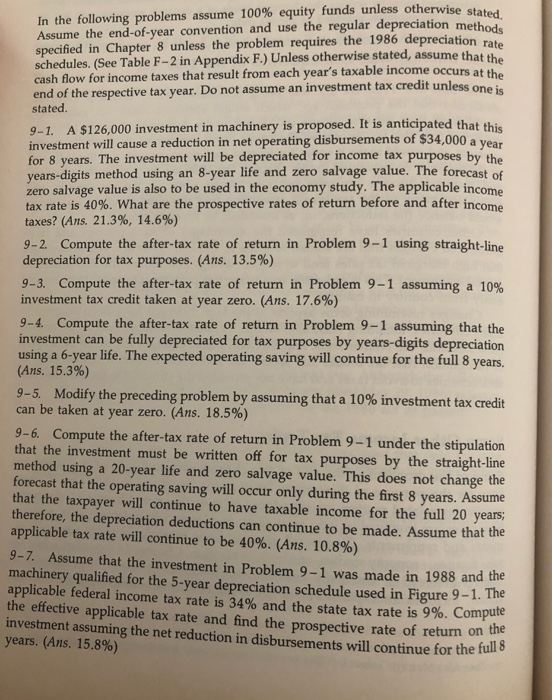

In the following problems assume 100% equity funds unless otherwise stated. Assume the end-of-year convention and use the regular depreciation methods specified in Chapter 8 unless the problem requires the 1986 depreciation rate schedules. (See Table F-2 in Appendix F.) Unless otherwise stated, assume that the cash flow for income taxes that result from each year's taxable income occurs at the end of the respective tax year. Do not assume an investment tax credit unless one is stated. 9-1. A $126,000 investment in machinery is proposed. It is anticipated that this investment will cause a reduction in net operating disbursements of $34,000 a year for 8 years. The investment will be depreciated for income tax purposes by the years-digits method using an 8-year life and zero salvage value. The forecast of zero salvage value is also to be used in the economy study. The applicable income tax rate is 40%. What are the prospective rates of return before and after income taxes? (Ans. 21.3%, 14.6%) 9-2 Compute the after-tax rate of return in Problem 9-1 using straight-line depreciation for tax purposes. (Ans. 13.5%) 9-3. Compute the after-tax rate of return in Problem 9-1 assuming a 10% investment tax credit taken at year zero. (Ans. 17.6%) 9-4. Compute the after-tax rate of return in Problem 9-1 assuming that the investment can be fully depreciated for tax purposes by years-digits depreciation using a 6-year life. The expected operating saving will continue for the full 8 years, (Ans. 15.3%) 9-5. Modify the preceding problem by assuming that a 10% investment tax credit can be taken at year zero. (Ans. 18.5%) 9-6. Compute the after-tax rate of return in Problem 9-1 under the stipulation that the investment must be written off for tax purposes by the straight-line method using a 20-year life and zero salvage value. This does not change the forecast that the operating saving will occur only during the first 8 years. Assume that the taxpayer will continue to have taxable income for the full 20 years, therefore, the depreciation deductions can continue to be made. Assume that the applicable tax rate will continue to be 40%. (Ans. 10.8%) 9-7. Assume that the investment in Problem 9-1 was made in 1988 and the machinery qualified for the 5-year depreciation schedule used in Figure 9-1. The applicable federal income tax rate is 34% and the state tax rate is 9%. Compute the effective applicable tax rate and find the prospective rate of return on the investment assuming the net reduction in disbursements will continue for the full 8 years. (Ans. 15.8%) In the following problems assume 100% equity funds unless otherwise stated. Assume the end-of-year convention and use the regular depreciation methods specified in Chapter 8 unless the problem requires the 1986 depreciation rate schedules. (See Table F-2 in Appendix F.) Unless otherwise stated, assume that the cash flow for income taxes that result from each year's taxable income occurs at the end of the respective tax year. Do not assume an investment tax credit unless one is stated. 9-1. A $126,000 investment in machinery is proposed. It is anticipated that this investment will cause a reduction in net operating disbursements of $34,000 a year for 8 years. The investment will be depreciated for income tax purposes by the years-digits method using an 8-year life and zero salvage value. The forecast of zero salvage value is also to be used in the economy study. The applicable income tax rate is 40%. What are the prospective rates of return before and after income taxes? (Ans. 21.3%, 14.6%) 9-2 Compute the after-tax rate of return in Problem 9-1 using straight-line depreciation for tax purposes. (Ans. 13.5%) 9-3. Compute the after-tax rate of return in Problem 9-1 assuming a 10% investment tax credit taken at year zero. (Ans. 17.6%) 9-4. Compute the after-tax rate of return in Problem 9-1 assuming that the investment can be fully depreciated for tax purposes by years-digits depreciation using a 6-year life. The expected operating saving will continue for the full 8 years, (Ans. 15.3%) 9-5. Modify the preceding problem by assuming that a 10% investment tax credit can be taken at year zero. (Ans. 18.5%) 9-6. Compute the after-tax rate of return in Problem 9-1 under the stipulation that the investment must be written off for tax purposes by the straight-line method using a 20-year life and zero salvage value. This does not change the forecast that the operating saving will occur only during the first 8 years. Assume that the taxpayer will continue to have taxable income for the full 20 years, therefore, the depreciation deductions can continue to be made. Assume that the applicable tax rate will continue to be 40%. (Ans. 10.8%) 9-7. Assume that the investment in Problem 9-1 was made in 1988 and the machinery qualified for the 5-year depreciation schedule used in Figure 9-1. The applicable federal income tax rate is 34% and the state tax rate is 9%. Compute the effective applicable tax rate and find the prospective rate of return on the investment assuming the net reduction in disbursements will continue for the full 8 years. (Ans. 15.8%)