Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. A financial institution with total asset size of $2.6 million and asset dollar duration of $18.4 million has total liabilities of $1.6 million

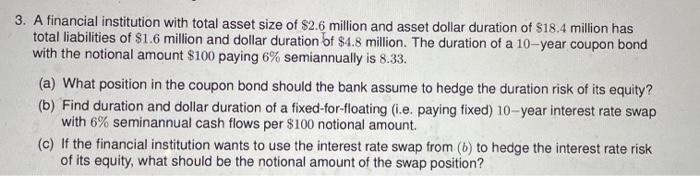

3. A financial institution with total asset size of $2.6 million and asset dollar duration of $18.4 million has total liabilities of $1.6 million and dollar duration of $4.8 million. The duration of a 10-year coupon bond with the notional amount $100 paying 6% semiannually is 8.33. (a) What position in the coupon bond should the bank assume to hedge the duration risk of its equity? (b) Find duration and dollar duration of a fixed-for-floating (i.e. paying fixed) 10-year interest rate swap with 6% seminannual cash flows per $100 notional amount. (c) If the financial institution wants to use the interest rate swap from (b) to hedge the interest rate risk of its equity, what should be the notional amount of the swap position?

Step by Step Solution

★★★★★

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a In order to hedge the duration risk of its equity the bank should assume a long position ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started