Answered step by step

Verified Expert Solution

Question

1 Approved Answer

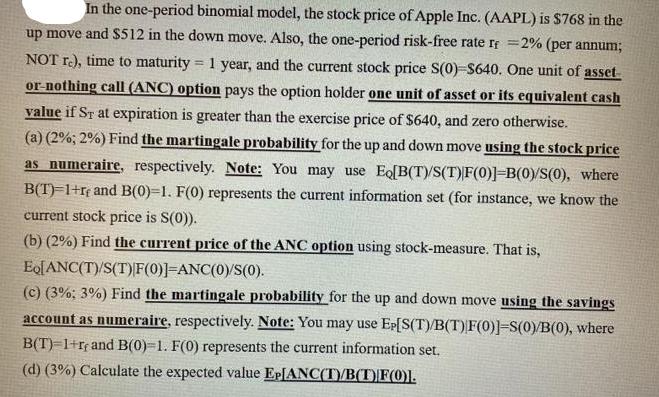

= In the one-period binomial model, the stock price of Apple Inc. (AAPL) is $768 in the up move and $512 in the down

= In the one-period binomial model, the stock price of Apple Inc. (AAPL) is $768 in the up move and $512 in the down move. Also, the one-period risk-free rate I =2% (per annum; NOT re), time to maturity 1 year, and the current stock price S(0)-$640. One unit of asset- or-nothing call (ANC) option pays the option holder one unit of asset or its equivalent cash value if ST at expiration is greater than the exercise price of $640, and zero otherwise. (a) (2%; 2%) Find the martingale probability for the up and down move using the stock price as numeraire, respectively. Note: You may use Eq[B(T)/S(T) F(0)]-B(0)/S(0), where B(T)=1+r and B(0)=1. F(0) represents the current information set (for instance, we know the current stock price is S(0)). (b) (2%) Find the current price of the ANC option using stock-measure. That is, EQ[ANC(T)/S(T)|F(0)]=ANC(0)/S(0). (c) (3%; 3%) Find the martingale probability for the up and down move using the savings account as numeraire, respectively. Note: You may use Ep[S(T)/B(T) F(0)]-S(0)/B(0), where B(T)=1+ and B(0) 1. F(0) represents the current information set. (d) (3%) Calculate the expected value Ep[ANC(T)/B(T) F(0)].

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution a Martingale Probability under Stock Numeraire We can use the given equat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started