Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In the past, Jayne has prepared her own tax returns. However, her financial affairs have become more complicated and she has engaged you to

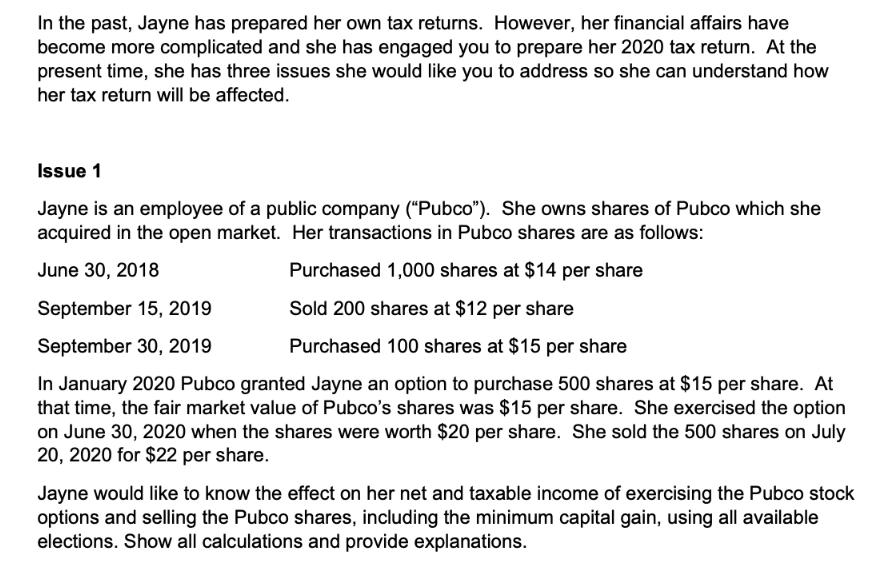

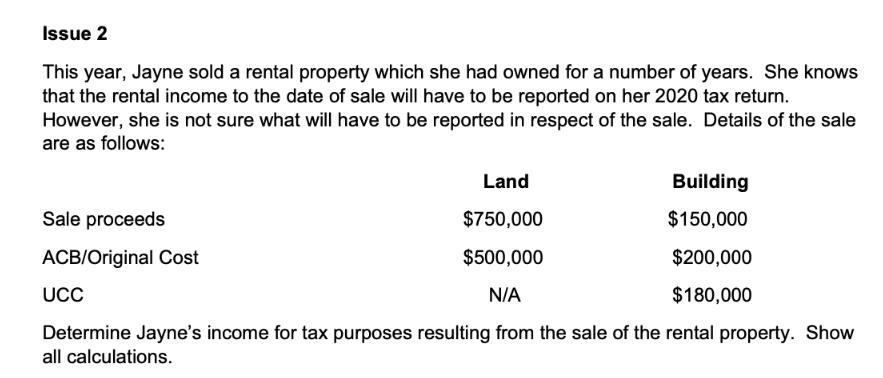

In the past, Jayne has prepared her own tax returns. However, her financial affairs have become more complicated and she has engaged you to prepare her 2020 tax return. At the present time, she has three issues she would like you to address so she can understand how her tax return will be affected. Issue 1 Jayne is an employee of a public company ("Pubco"). She owns shares of Pubco which she acquired in the open market. Her transactions in Pubco shares are as follows: June 30, 2018 Purchased 1,000 shares at $14 per share September 15, 2019 Sold 200 shares at $12 per share Purchased 100 shares at $15 per share September 30, 2019 In January 2020 Pubco granted Jayne an option to purchase 500 shares at $15 per share. At that time, the fair market value of Pubco's shares was $15 per share. She exercised the option on June 30, 2020 when the shares were worth $20 per share. She sold the 500 shares on July 20, 2020 for $22 per share. Jayne would like to know the effect on her net and taxable income of exercising the Pubco stock options and selling the Pubco shares, including the minimum capital gain, using all available elections. Show all calculations and provide explanations. Issue 2 This year, Jayne sold a rental property which she had owned for a number of years. She knows that the rental income to the date of sale will have to be reported on her 2020 tax return. However, she is not sure what will have to be reported in respect of the sale. Details of the sale are as follows: Sale proceeds ACB/Original Cost UCC Land $750,000 $500,000 N/A Building $150,000 $200,000 $180,000 Determine Jayne's income for tax purposes resulting from the sale of the rental property. Show all calculations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution Issue 1 To determine the effect on Jaynes net and taxable income of exercising the Pubco stock options and selling the Pubco shares we need t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started