Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In the past seven years, Sarah's uncle has been paying her monthly allowance of $1,000 in arrear, directly deposited into Sarah's bank account, with

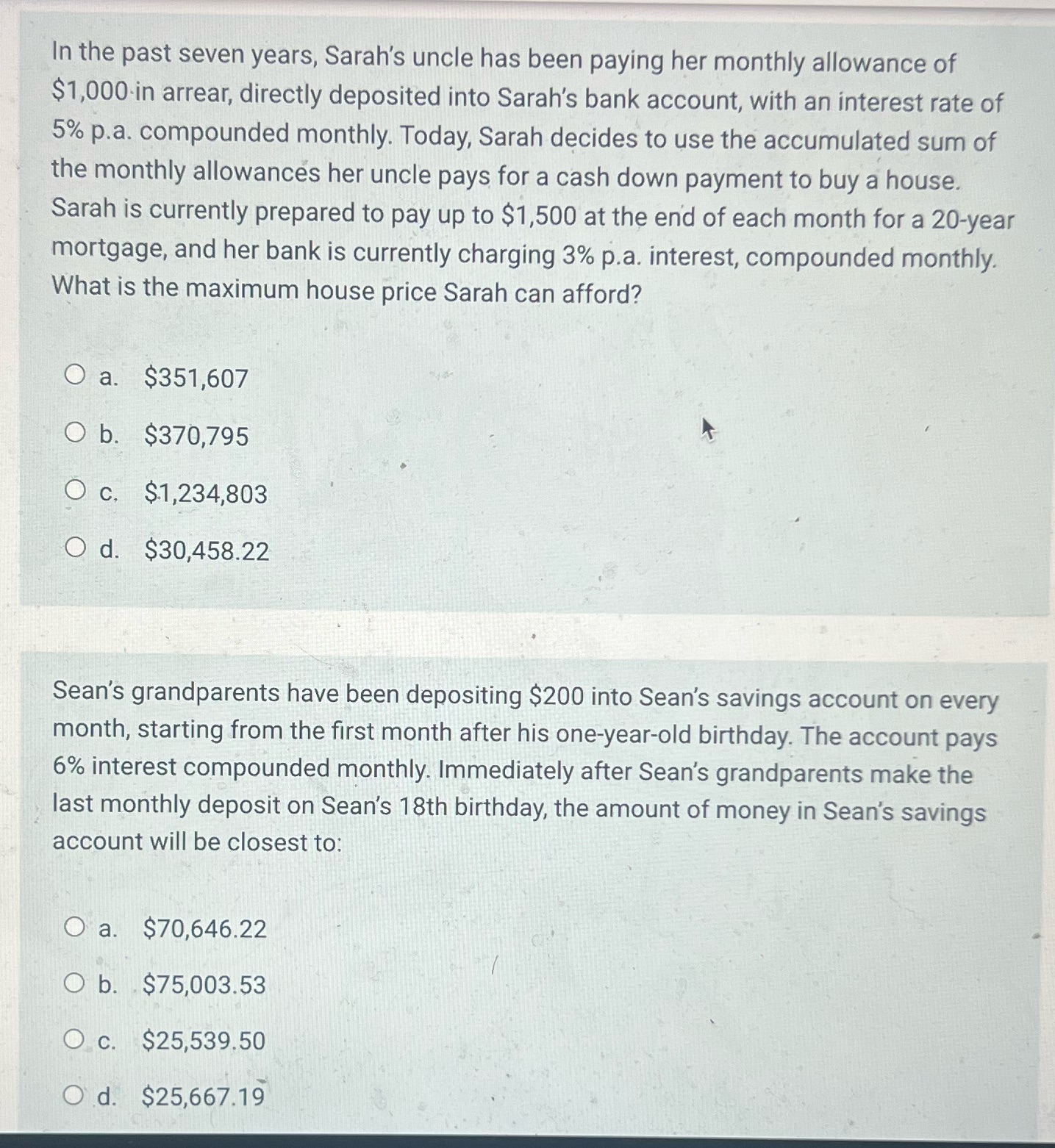

In the past seven years, Sarah's uncle has been paying her monthly allowance of $1,000 in arrear, directly deposited into Sarah's bank account, with an interest rate of 5% p.a. compounded monthly. Today, Sarah decides to use the accumulated sum of the monthly allowances her uncle pays for a cash down payment to buy a house. Sarah is currently prepared to pay up to $1,500 at the end of each month for a 20-year mortgage, and her bank is currently charging 3% p.a. interest, compounded monthly. What is the maximum house price Sarah can afford? O a. $351,607 O b. $370,795 O c. $1,234,803 O d. $30,458.22 Sean's grandparents have been depositing $200 into Sean's savings account on every month, starting from the first month after his one-year-old birthday. The account pays 6% interest compounded monthly. Immediately after Sean's grandparents make the last monthly deposit on Sean's 18th birthday, the amount of money in Sean's savings account will be closest to: O a. $70,646.22 O b. $75,003.53 O c. $25,539.50 Od. $25,667.19

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution Part 1 Sarahs Maximum Affordable House Price We can solve this problem by considering the p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started