Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In the process of researching new equipment, Sheffield settled on two seemingly viable alternatives: 1. 2 A one-time investment today of $38,000, which should

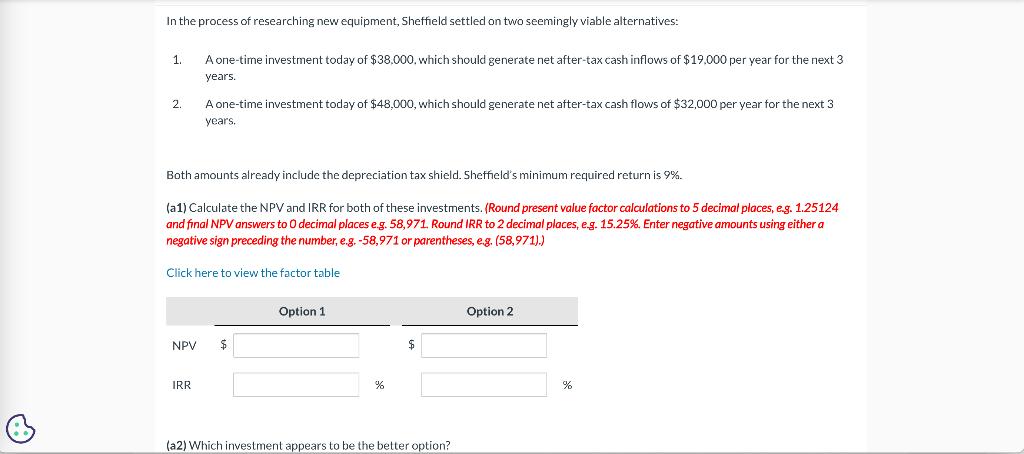

In the process of researching new equipment, Sheffield settled on two seemingly viable alternatives: 1. 2 A one-time investment today of $38,000, which should generate net after-tax cash inflows of $19.000 per year for the next 3 years. Both amounts already include the depreciation tax shield. Sheffield's minimum required return is 9%. (a1) Calculate the NPV and IRR for both of these investments. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and final NPV answers to 0 decimal places e.g. 58,971. Round IRR to 2 decimal places, e.g. 15.25%. Enter negative amounts using either a negative sign preceding the number, e.g. -58,971 or parentheses, e.g. (58,971).) NPV A one-time investment today of $48,000, which should generate net after-tax cash flows of $32,000 per year for the next 3 years. Click here to view the factor table IRR Option 1 % $ (a2) Which investment appears to be the better option? Option 2 %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started