Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In the scenario, you sell Netflix subscriptions. In January, you sell 5,000 subscriptions. In February, you sell an additional 5,000 subscriptions and in March, you

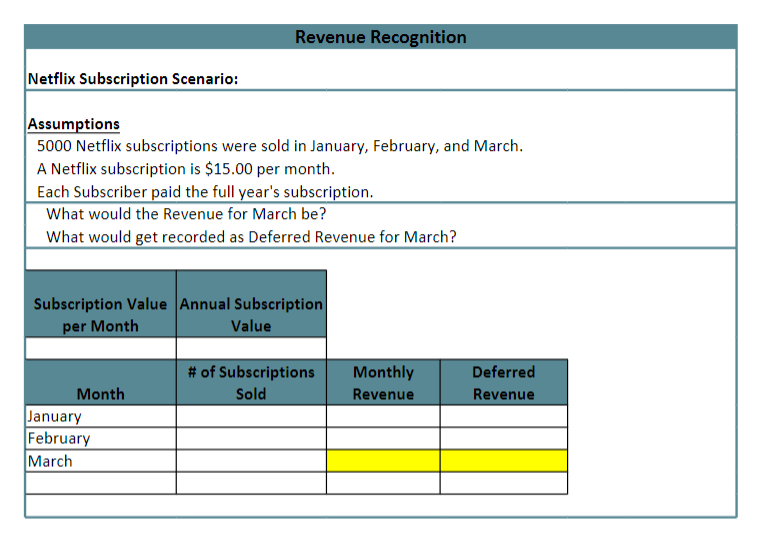

In the scenario, you sell Netflix subscriptions. In January, you sell 5,000 subscriptions. In February, you sell an additional 5,000 subscriptions and in March, you sell another 5,000 subscriptions. Therefore, when working with revenue recognition, you must make sure to account for the new customers each month plus the recognition of revenue from the previous months.

- Calculate what the revenue would be on the Income Statement for January, February and March.

- Calculate what the deferred revenue would be on the Balance Sheet for January, February and March.

After working on the worksheet,

- Introduce to the concept of revenue recognition.

- Provide the results of the work you did and describe how you obtained those results?

- Explain what happens to revenue and deferred revenue as the months' progress?

- Explain when revenue can be recognized and why?

Revenue Recognition Netflix Subscription Scenario: Assumptions 5000 Netflix subscriptions were sold in January, February, and March. A Netflix subscription is $15.00 per month. Each Subscriber paid the full year's subscription. What would the Revenue for March be? What would get recorded as Deferred Revenue for March? Subscription Value Annual Subscription per Month Value Month # of Subscriptions Sold Monthly Deferred Revenue Revenue January February March

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started