Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In the sheet 3 Financing Implications with initial values, which one of following is true a . Data Analytics strategy has highest NPV and

In the sheet Financing Implications" with initial values, which one of following is true

a Data Analytics strategy has highest NPV and lowest financial need.

b Traditional strategy has earlier payback time than Razor and Blades strategy.

c Only Traditional strategy has positive annual cash flows within years.

d Traditional strategy and Razor and Razor Blades Strategy have about similar NPVs so investors would be ambivalent between them.

Umulative Free Cash Flow Curves and NPV

he wumary data and charts below reflect the model on the prevlous tab, induding the effects of aty changes you have made to the aspomptions. Plowie use this informuclon to anpwer the questions brloes. Trediligul strulery

Tradnional Strateger

Rmorand Razor Elades Strategr:

Duta Analyics Strategr:

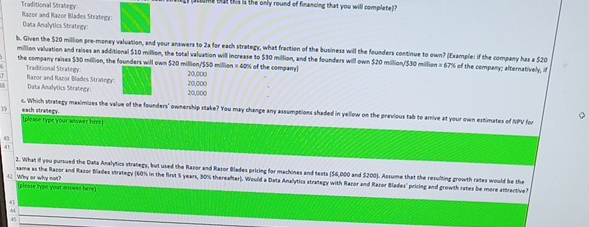

b Given the $ millon premaney valuation, and your anawers to a for each stratecy, what fraction of the builheis will the founders coethue to ewn? Erample: if the company has a $ millos valuation and raises an additienal $ millon, the tatal valasion will increwese to $ million, and the foundern will own $ millon $ millisn a of the compary: alternatively, if

Tradivonal Strategy.

flanor and Pamor Blades Stratror

Data AnalVics Stratecr:

Which urategr makimaes the vise of the founderi' owrenhlp stake? You may change amy assumptions ahaded in yellow on the previous tab to amive at your ewen ertimetes of NoV for ench straveg.

please type your mower here

Why er why non? I taie type your dend eres heret

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started