Answered step by step

Verified Expert Solution

Question

1 Approved Answer

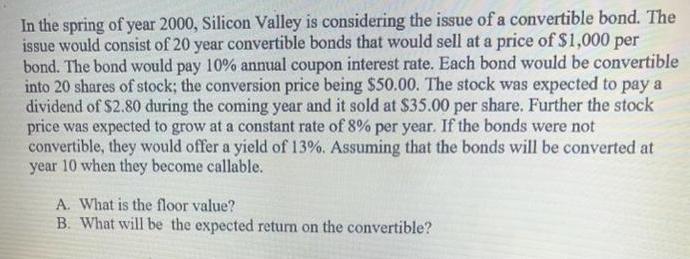

In the spring of year 2000, Silicon Valley is considering the issue of a convertible bond. The issue would consist of 20 year convertible

In the spring of year 2000, Silicon Valley is considering the issue of a convertible bond. The issue would consist of 20 year convertible bonds that would sell at a price of $1,000 per bond. The bond would pay 10% annual coupon interest rate. Each bond would be convertible into 20 shares of stock; the conversion price being $50.00. The stock was expected to pay a dividend of $2.80 during the coming year and it sold at $35.00 per share. Further the stock price was expected to grow at a constant rate of 8% per year. If the bonds were not convertible, they would offer a yield of 13%. Assuming that the bonds will be converted at year 10 when they become callable. A. What is the floor value? B. What will be the expected return on the convertible?

Step by Step Solution

★★★★★

3.40 Rating (141 Votes )

There are 3 Steps involved in it

Step: 1

A To calculate the floor value of the convertible bond we need to compare the value of the convertible bond when converted into stock at the conversio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started