Question

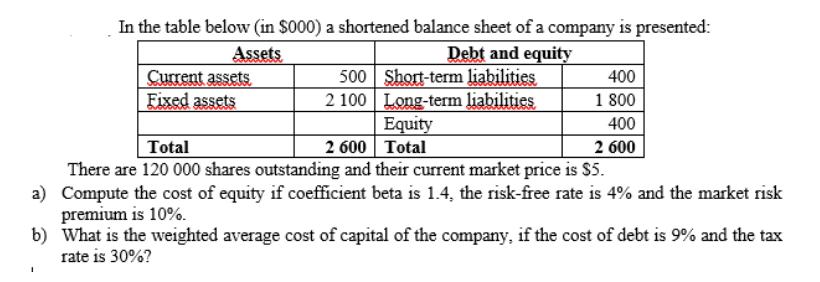

In the table below (in $000) a shortened balance sheet of a company is presented: Assets Debt and equity 400 1 800 400 Total

In the table below (in $000) a shortened balance sheet of a company is presented: Assets Debt and equity 400 1 800 400 Total 2 600 2 600 There are 120 000 shares outstanding and their current market price is $5. a) Compute the cost of equity if coefficient beta is 1.4, the risk-free rate is 4% and the market risk premium is 10%. b) What is the weighted average cost of capital of the company, if the cost of debt is 9% and the tax rate is 30%? Current assets Fixed assets 500 2 100 Short-term liabilities. Long-term liabilities Equity Total

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION a To compute the cost of equity we can use the Capital Asset Pricing Model CAPM formula Cost of Equity RiskFree Rate Beta Market Risk Premium ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Auditing The Art and Science of Assurance Engagements

Authors: Alvin A. Arens, Randal J. Elder, Mark S. Beasley, Joanne C. Jones

14th Canadian edition

134613112, 134835018, 9780134885254 , 978-0134613116

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App