Answered step by step

Verified Expert Solution

Question

1 Approved Answer

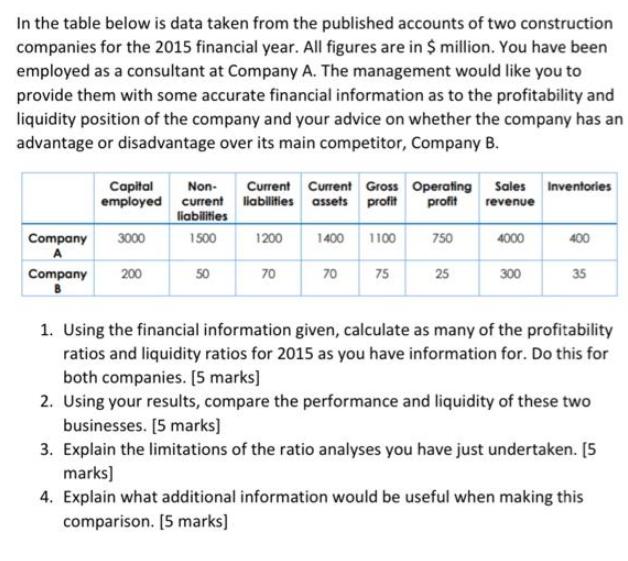

In the table below is data taken from the published accounts of two construction companies for the 2015 financial year. All figures are in

In the table below is data taken from the published accounts of two construction companies for the 2015 financial year. All figures are in $ million. You have been employed as a consultant at Company A. The management would like you to provide them with some accurate financial information as to the profitability and liquidity position of the company and your advice on whether the company has an advantage or disadvantage over its main competitor, Company B. Capital employed current liabilities assets profit Current Current Gross Operating Sales Inventories profit Non- revenue liabilities Company 3000 1500 1200 1400 1100 750 4000 400 Company 200 50 70 70 75 25 300 35 1. Using the financial information given, calculate as many of the profitability ratios and liquidity ratios for 2015 as you have information for. Do this for both companies. [5 marks] 2. Using your results, compare the performance and liquidity of these two businesses. [5 marks) 3. Explain the limitations of the ratio analyses you have just undertaken. [5 marks] 4. Explain what additional information would be useful when making this comparison. [5 marks]

Step by Step Solution

★★★★★

3.44 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Following are the calculation of Liquidity Ratios and Profitability Ratios Liquidity Ratio Formula C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started