Question

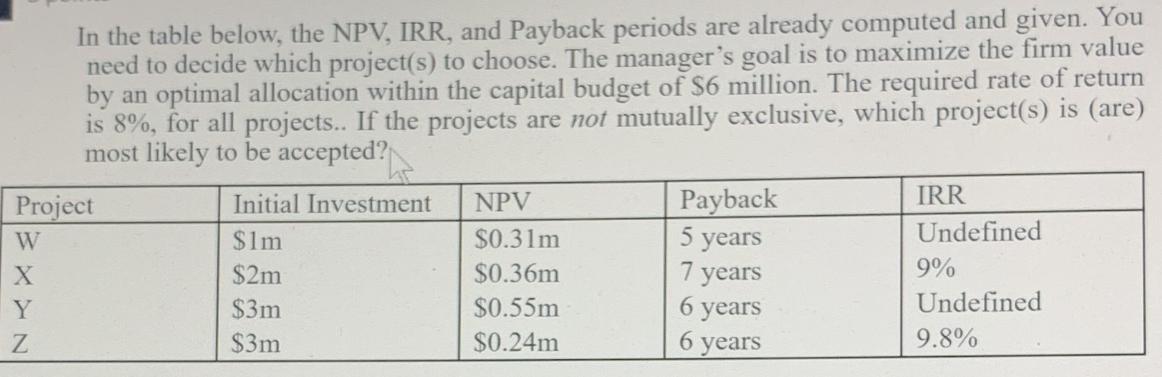

In the table below, the NPV, IRR, and Payback periods are already computed and given. You need to decide which project(s) to choose. The

In the table below, the NPV, IRR, and Payback periods are already computed and given. You need to decide which project(s) to choose. The manager's goal is to maximize the firm value by an optimal allocation within the capital budget of $6 million. The required rate of return is 8%, for all projects.. If the projects are not mutually exclusive, which project(s) is (are) most likely to be accepted? Project Initial Investment NPV W $1m $0.31m Payback 5 years IRR Undefined X $2m $0.36m 7 years 9% Y $3m $0.55m 6 years Undefined Z $3m $0.24m 6 years 9.8%

Step by Step Solution

3.35 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To determine which projects to choose we need to compare the NPV IRR and payback period of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Management and Cost Accounting

Authors: Colin Drury

8th edition

978-1408041802, 1408041804, 978-1408048566, 1408048566, 978-1408093887

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App