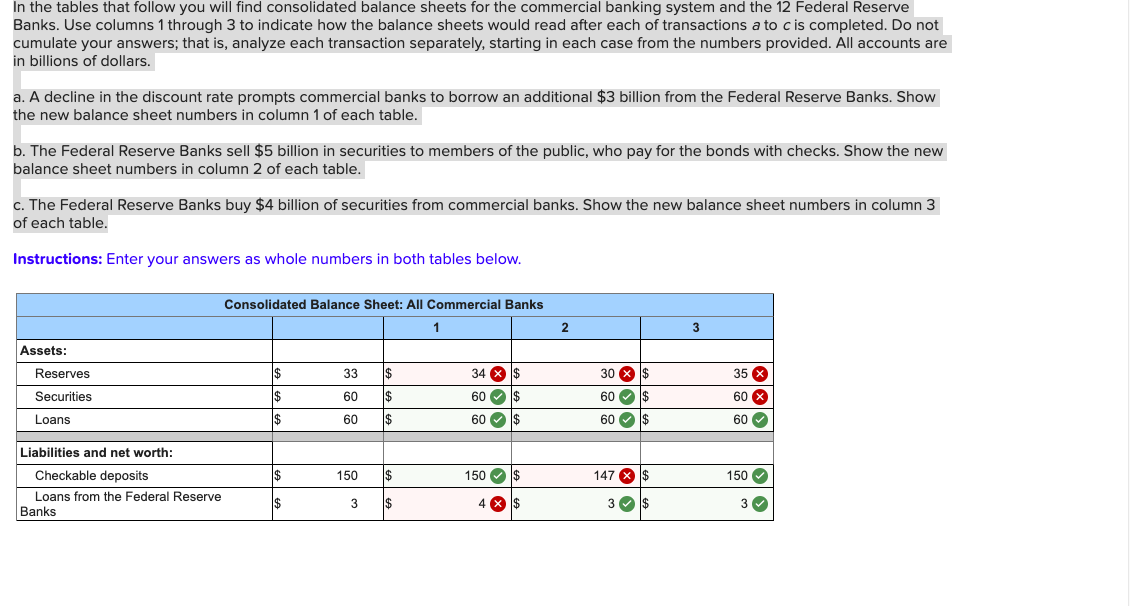

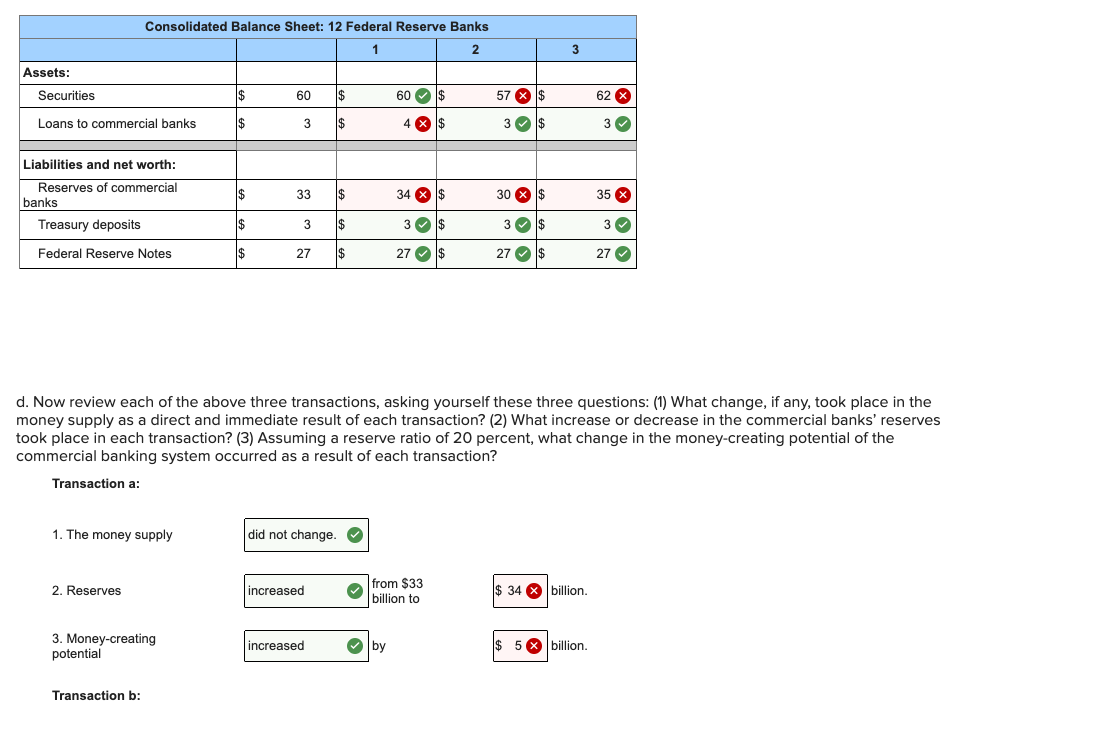

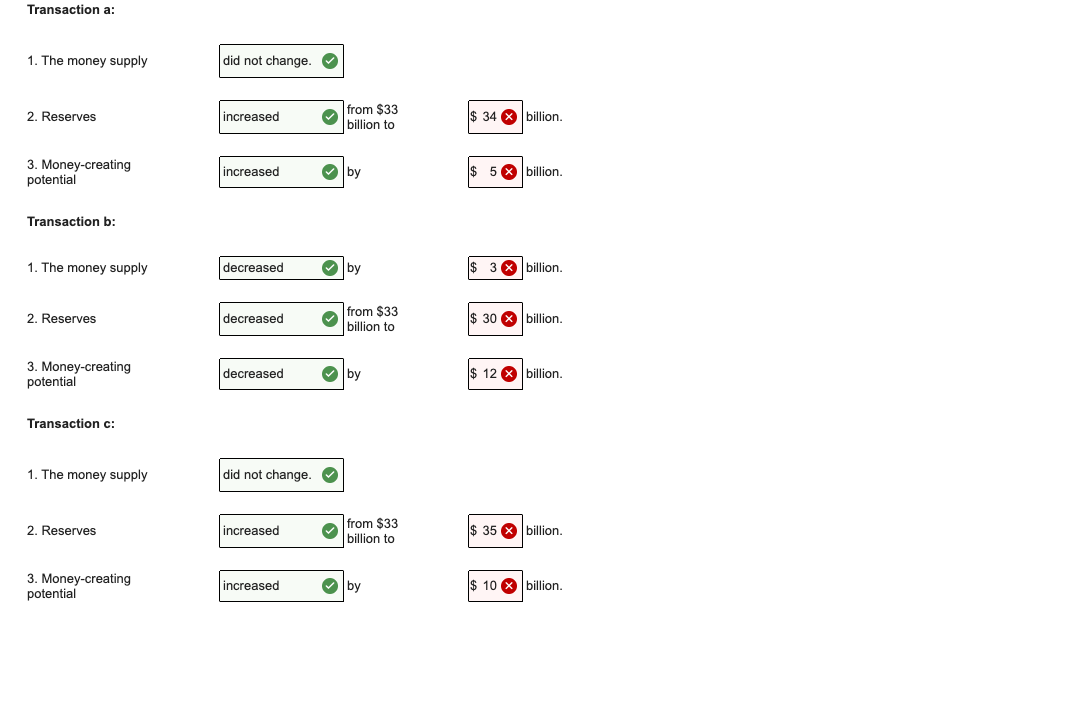

In the tables that follow you will find consolidated balance sheets for the commercial banking system and the 12 Federal Reserve Banks. Use columns 1 through 3 to indicate how the balance sheets would read after each of transactions a to c is completed. Do not cumulate your answers; that is, analyze each transaction separately, starting in each case from the numbers provided. All accounts are in billions of dollars. a. A decline in the discount rate prompts commercial banks to borrow an additional $3 billion from the Federal Reserve Banks. Show the new balance sheet numbers in column 1 of each table. b. The Federal Reserve Banks sell $5 billion in securities to members of the public, who pay for the bonds with checks. Show the new balance sheet numbers in column 2 of each table. c. The Federal Reserve Banks buy $4 billion of securities from commercial banks. Show the new balance sheet numbers in column 3 of each table. Instructions: Enter your answers as whole numbers in both tables below. Consolidated Balance Sheet: All Commercial Banks 2 3 Assets: Reserves 33 34 X 30 X 35 X Securities 60 60 $ 60 $ 60 X Loans 60 60 60 60 Liabilities and net worth: Checkable deposits 150 $ 150 147 X 150 Loans from the Federal Reserve Banks 3 4 X 3 $ 3 VConsolidated Balance Sheet: 12 Federal Reserve Banks 1 2 3 Assets: Securities 60 60 $ 57 X 62 X Loans to commercial banks 3 4 X 3 3 Liabilities and net worth: Reserves of commercial banks 33 69 34 X $ 30 X 35 X Treasury deposits 3 3 3 3 V Federal Reserve Notes 27 27 $ 27 $ 27 d. Now review each of the above three transactions, asking yourself these three questions: (1) What change, if any, took place in the money supply as a direct and immediate result of each transaction? (2) What increase or decrease in the commercial banks' reserves took place in each transaction? (3) Assuming a reserve ratio of 20 percent, what change in the money-creating potential of the commercial banking system occurred as a result of each transaction? Transaction a: 1. The money supply did not change. 2. Reserves increased from $33 billion to $ 34 X billion. 3. Money-creating potential increased by 5 X billion. Transaction b:Transaction a: 1. The money supply did not change. V 2. Reserves increased from $33 billion to $ 34 X billion. 3. Money-creating potential increased V by $ 5 x billion. Transaction b: 1. The money supply decreased by $ 3 x billion. 2. Reserves decreased V from $33 billion to $ 30 X billion. 3. Money-creating potential decreased V by $ 12 X billion. Transaction c: 1. The money supply did not change. 2. Reserves increased rom $33 billion to $ 35 x billion. 3. Money-creating potential increased by 6 10 x billion