Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In the tax year 2019/20, Laura worked for Sport plc until she was made redundant on 5 April 2020. Her salary for the year

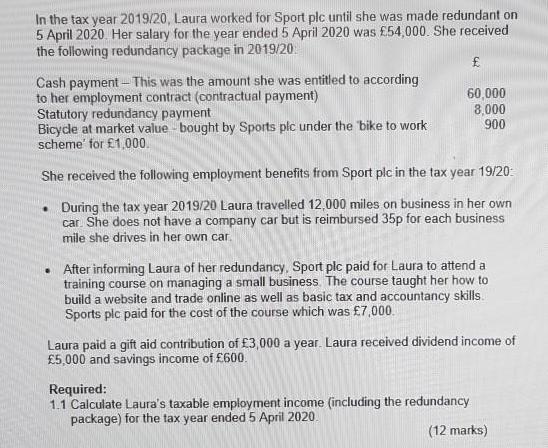

In the tax year 2019/20, Laura worked for Sport plc until she was made redundant on 5 April 2020. Her salary for the year ended 5 April 2020 was 54,000. She received the following redundancy package in 2019/20 Cash payment - This was the amount she was entitled to according to her employment contract (contractual payment) Statutory redundancy payment. Bicycle at market value bought by Sports plc under the bike to work scheme' for 1,000. 60,000 8,000 900 She received the following employment benefits from Sport plc in the tax year 19/20: . During the tax year 2019/20 Laura travelled 12,000 miles on business in her own car. She does not have a company car but is reimbursed 35p for each business mile she drives in her own car. After informing Laura of her redundancy, Sport plc paid for Laura to attend a training course on managing a small business. The course taught her how to build a website and trade online as well as basic tax and accountancy skills. Sports plc paid for the cost of the course which was 7,000. Laura paid a gift aid contribution of 3,000 a year. Laura received dividend income of 5,000 and savings income of 600. Required: 1.1 Calculate Laura's taxable employment income (including the redundancy package) for the tax year ended 5 April 2020. (12 marks)

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Computation of salary income of Miss Laura for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started