Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In the textbook Using Sage 50 Accounting 2018, please answer in Chapter 2, the questions on Binh's Bins. Thank you. I need help with journals.

In the textbook Using Sage 50 Accounting 2018, please answer in Chapter 2, the questions on Binh's Bins. Thank you. I need help with journals.

Complete all transactions (including transaction 28, dated June 30, 2020. for this company and submit the following reports in PDF format:

- Trial Balance dated June 30, 2020

- All Journal Entries Report with Additional Fields and Show Corrections selected.

Show transcribed data

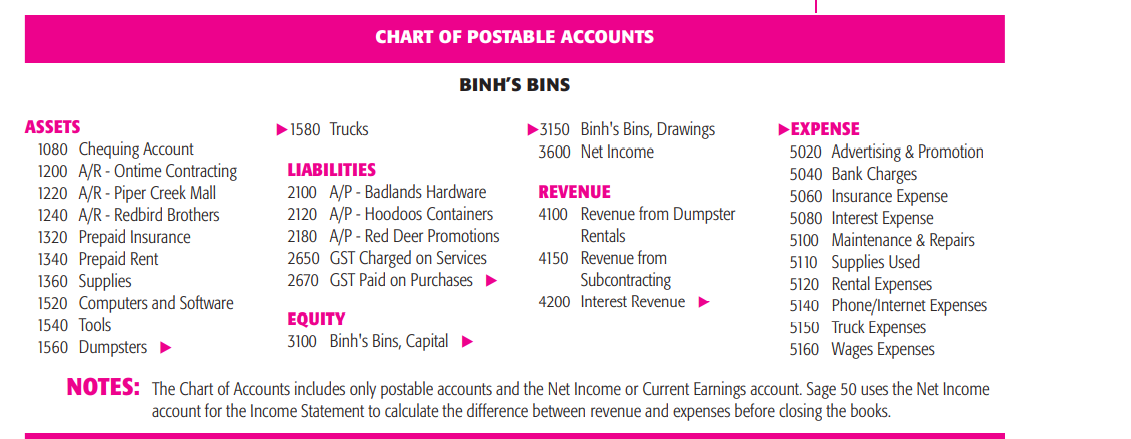

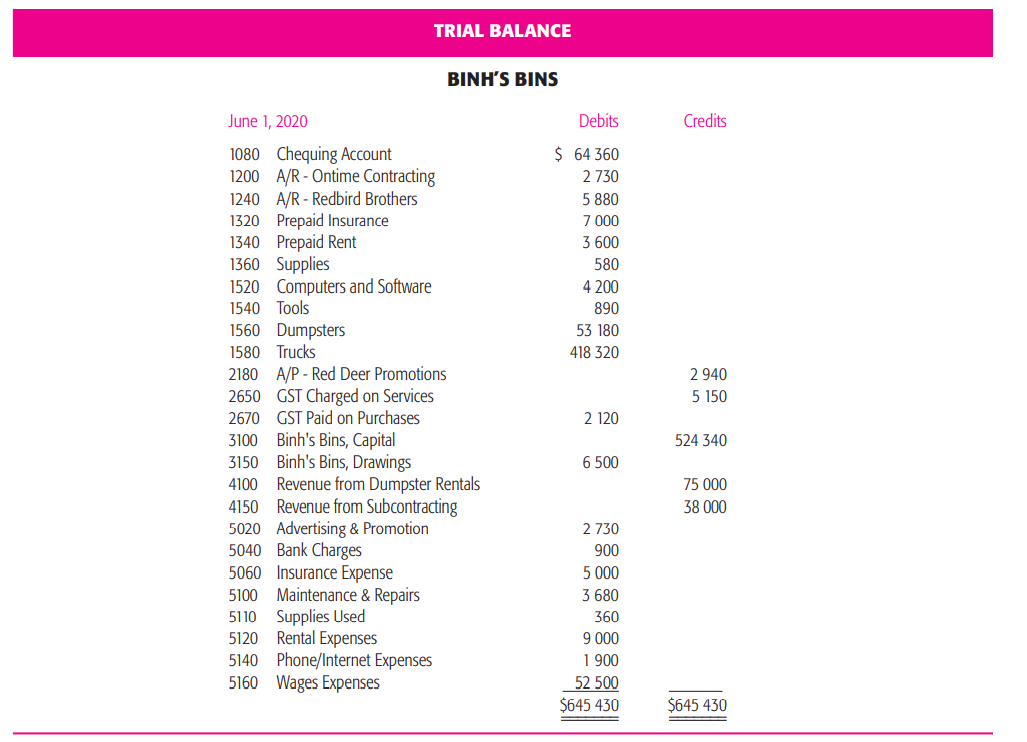

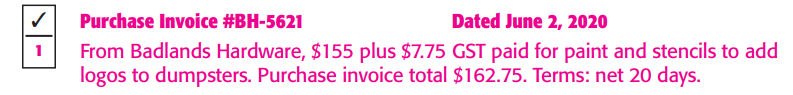

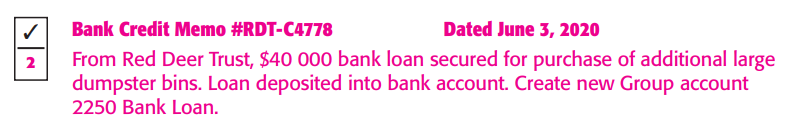

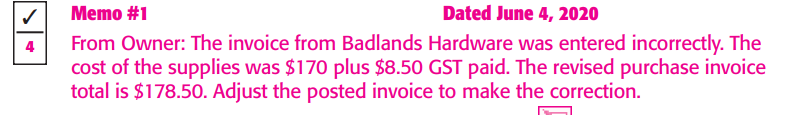

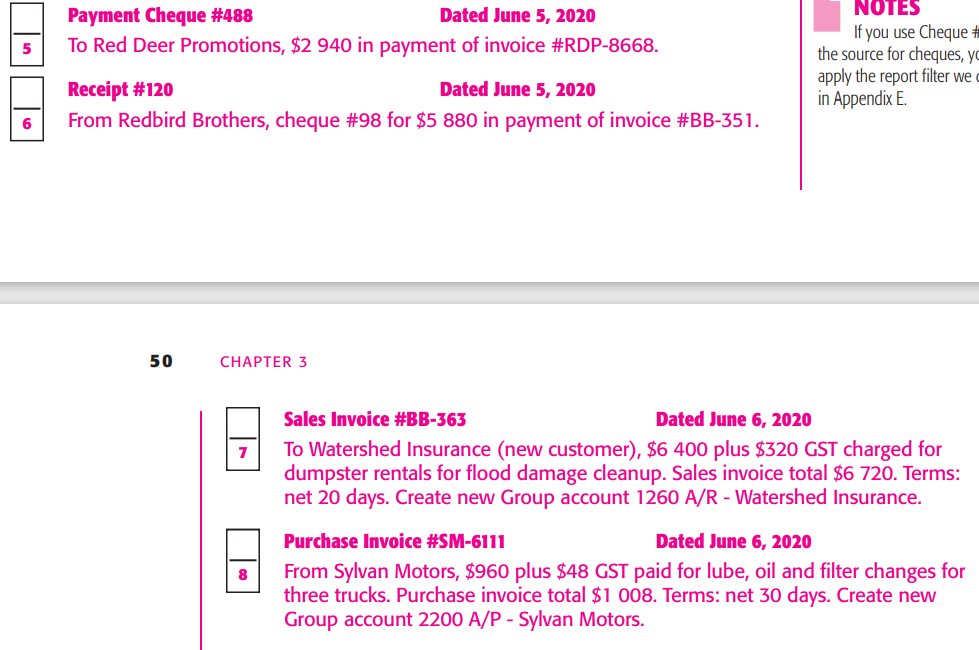

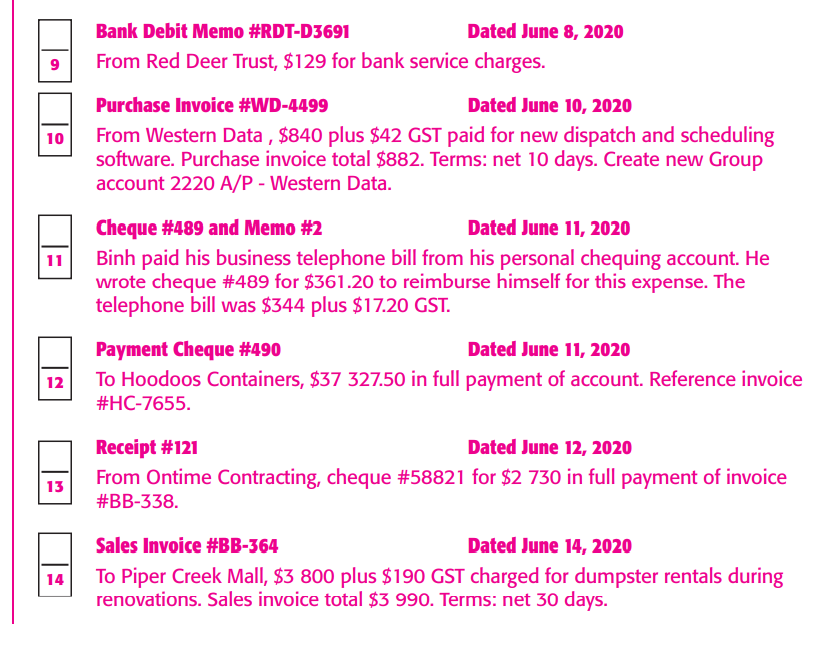

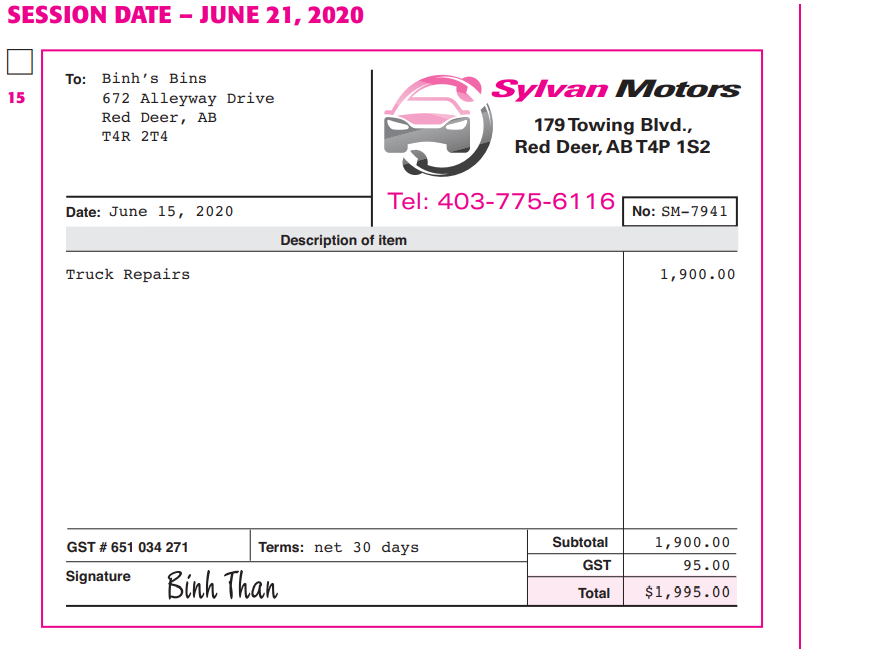

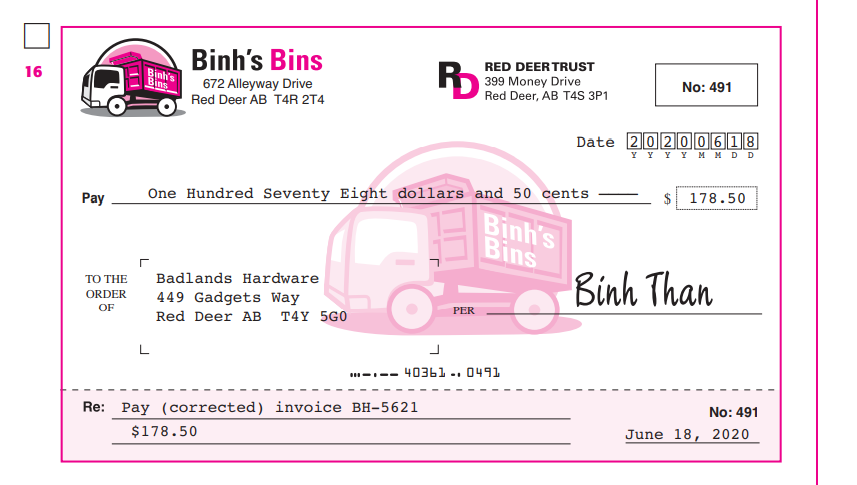

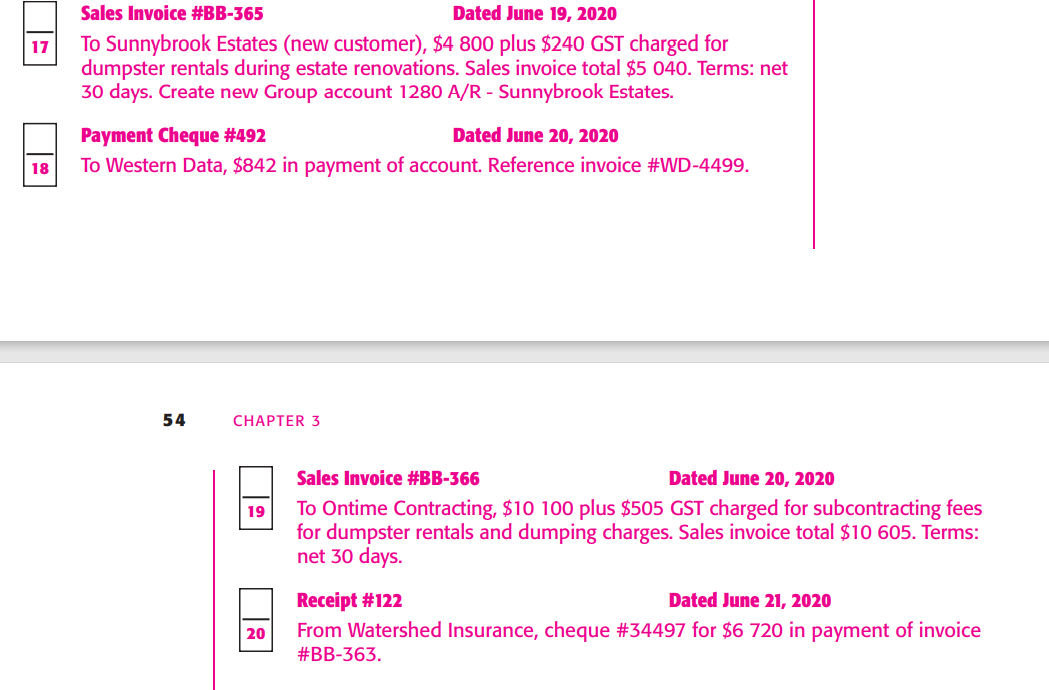

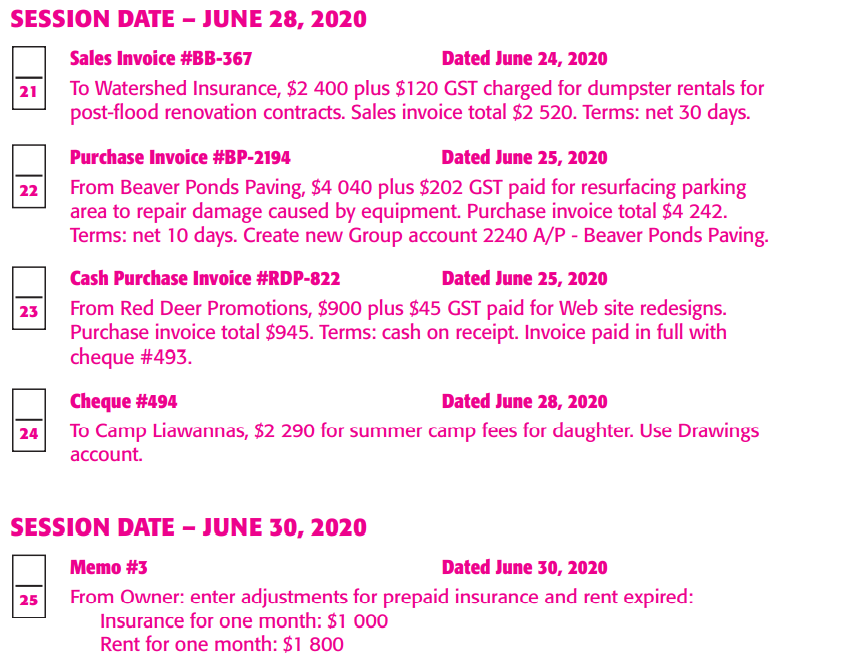

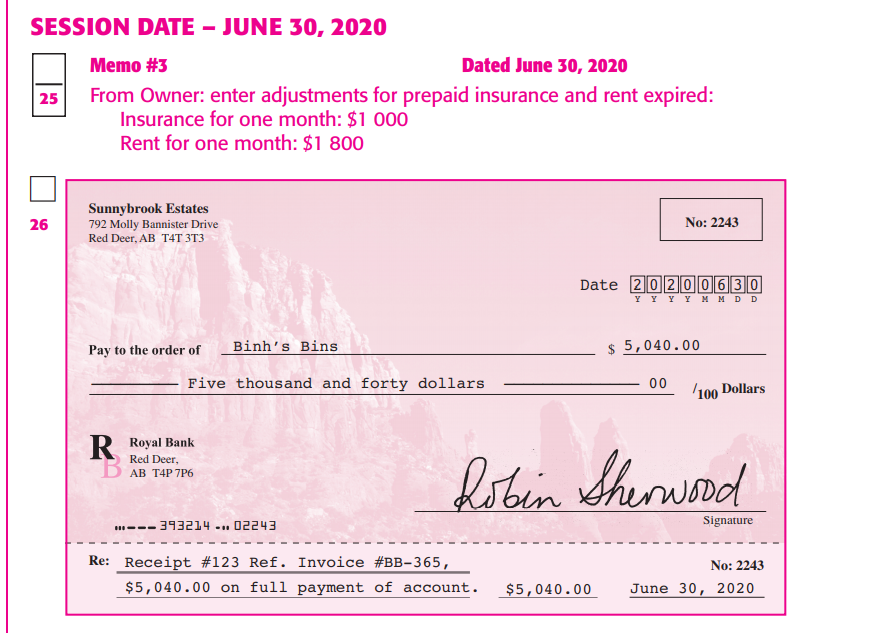

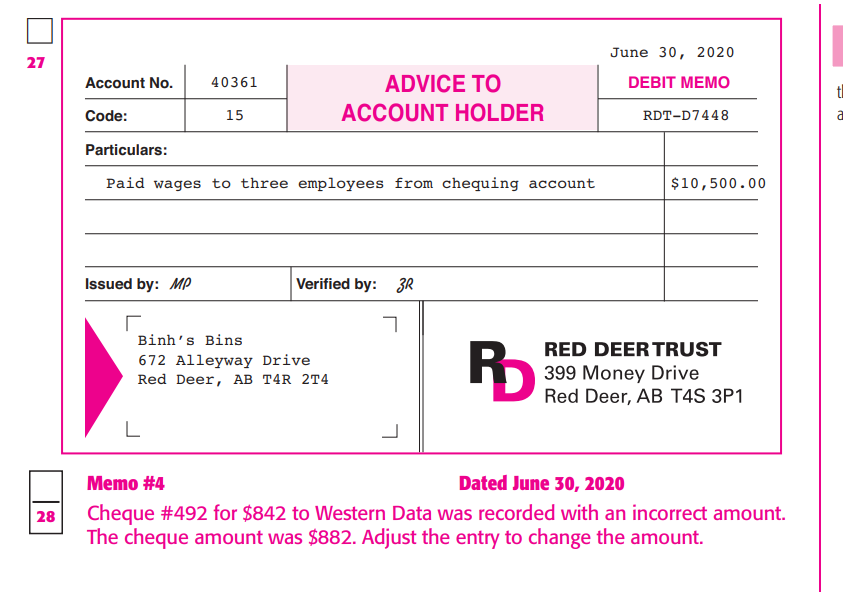

NOTES: The Chart of Accounts includes only postable accounts and the Net Income or Current Earnings account. Sage 50 uses the Net Income account for the Income Statement to calculate the difference between revenue and expenses before closing the books. TRIAL BALANCE BINH'S BINS \begin{tabular}{llrl} June 1, 2020 & Debits & Credits \\ 1080 & Chequing Account & $64360 & \\ 1200 & A/R - Ontime Contracting & 2730 & \\ 1240 & A/R - Redbird Brothers & 5880 & \\ 1320 & Prepaid Insurance & 7000 & \\ 1340 & Prepaid Rent & 3600 & \\ 1360 & Supplies & 580 & \\ 1520 & Computers and Software & 4200 & \\ 1540 & Tools & 890 & \\ 1560 & Dumpsters & 53180 & \\ 1580 & Trucks & 418320 & \\ 2180 & A/P - Red Deer Promotions & & 2940 \\ 2650 & GST Charged on Services & & 5150 \\ 2670 & GST Paid on Purchases & 2120 & \\ 3100 & Binh's Bins, Capital & & 524340 \\ 3150 & Binh's Bins, Drawings & 6500 & \\ 4100 & Revenue from Dumpster Rentals & & 75000 \\ 4150 & Revenue from Subcontracting & & 38000 \\ 5020 & Advertising \& Promotion & 2730 & \\ 5040 & Bank Charges & 900 & \\ 5060 & Insurance Expense & 5000 & \\ 5100 & Maintenance \& Repairs & 3680 & \\ 5110 & Supplies Used & 360 & \\ 5120 & Rental Expenses & 9000 & \\ 5140 & Phone/Internet Expenses & 1900 & \\ 5160 & Wages Expenses & 52500 & \\ & & $645430 & $545430 \\ \hline \end{tabular} Purchase Invoice \#BH-5621 Dated June 2, 2020 From Badlands Hardware, $155 plus $7.75 GST paid for paint and stencils to add logos to dumpsters. Purchase invoice total $162.75. Terms: net 20 days. Bank Credit Memo \#RDT-C4778 Dated June 3, 2020 From Red Deer Trust, $40000 bank loan secured for purchase of additional large dumpster bins. Loan deposited into bank account. Create new Group account 2250 Bank Loan. Purchase Invoice \#HC-7655 Dated June 3, 2020 From Hoodoos Containers, $35550 plus $1777.50 GST to purchase additional dumpsters. Purchase invoice total $37327.50. Terms: net 30 days. Memo \#1 Dated June 4, 2020 From Owner: The invoice from Badlands Hardware was entered incorrectly. The cost of the supplies was $170 plus $8.50 GST paid. The revised purchase invoice total is $178.50. Adjust the posted invoice to make the correction. Payment Cheque \#488 Dated June 5, 2020 To Red Deer Promotions, \$2 940 in payment of invoice \#RDP-8668. If you use Cheque Receipt \#120 Dated June 5, 2020 From Redbird Brothers, cheque \#98 for \$5880 in payment of invoice \#BB-351. the source for cheques, y apply the report filter we in Appendix E. 50 CHAPTER 3 Sales Invoice \#BB-363 Dated June 6, 2020 To Watershed Insurance (new customer), $6400 plus $320 GST charged for dumpster rentals for flood damage cleanup. Sales invoice total $6720. Terms: net 20 days. Create new Group account 1260 A/R - Watershed Insurance. Purchase Invoice \#SM-6111 Dated June 6, 2020 From Sylvan Motors, $960 plus $48 GST paid for lube, oil and filter changes for three trucks. Purchase invoice total $1008. Terms: net 30 days. Create new Group account 2200 A/P - Sylvan Motors. Bank Debit Memo \#RDT-D3691 Dated June 8, 2020 From Red Deer Trust, $129 for bank service charges. Purchase Invoice \#WD-4499 Dated June 10, 2020 From Western Data , $840 plus $42 GST paid for new dispatch and scheduling software. Purchase invoice total $882. Terms: net 10 days. Create new Group account 2220 A/P - Western Data. Cheque \#489 and Memo \#2 Dated June 11, 2020 Binh paid his business telephone bill from his personal chequing account. He wrote cheque \#489 for $361.20 to reimburse himself for this expense. The telephone bill was $344 plus $17.20 GST. Payment Cheque \#490 Dated June 11, 2020 To Hoodoos Containers, $37327.50 in full payment of account. Reference invoice \#HC-7655. Receipt \#121 Dated June 12, 2020 From Ontime Contracting, cheque \#58821 for \$2 730 in full payment of invoice \#BB-338. Sales Invoice \#BB-364 Dated June 14, 2020 To Piper Creek Mall, $3800 plus $190 GST charged for dumpster rentals during renovations. Sales invoice total $3990. Terms: net 30 days. SESSION DATE - JUNE 21, 2020 Sales Invoice \#BB-365 Dated June 19, 2020 To Sunnybrook Estates (new customer), \$4 800 plus $240 GST charged for dumpster rentals during estate renovations. Sales invoice total \$5 040. Terms: net 30 days. Create new Group account 1280 A/R - Sunnybrook Estates. Payment Cheque \#492 Dated June 20, 2020 To Western Data, \$842 in payment of account. Reference invoice \#WD-4499. 54 CHAPTER 3 Sales Invoice \#BB-366 Dated June 20, 2020 To Ontime Contracting, \$10 100 plus $505 GST charged for subcontracting fees for dumpster rentals and dumping charges. Sales invoice total $10605. Terms: net 30 days. Receipt \#122 Dated June 21, 2020 From Watershed Insurance, cheque \#34497 for \$6 720 in payment of invoice \#BB-363. ESSION DATE - JUNE 28, 2020 Sales Invoice \#BB-367 Dated June 24, 2020 To Watershed Insurance, $2400 plus $120 GST charged for dumpster rentals for post-flood renovation contracts. Sales invoice total $2520. Terms: net 30 days. Purchase Invoice \#BP-2194 Dated June 25, 2020 From Beaver Ponds Paving, $4040 plus $202 GST paid for resurfacing parking area to repair damage caused by equipment. Purchase invoice total \$4 242. Terms: net 10 days. Create new Group account 2240 A/P - Beaver Ponds Paving. Cash Purchase Invoice \#RDP-822 Dated June 25, 2020 From Red Deer Promotions, $900 plus $45 GST paid for Web site redesigns. Purchase invoice total $945. Terms: cash on receipt. Invoice paid in full with cheque \#493. Cheque \#494 Dated June 28, 2020 To Camp Liavannas, \$2 290 for summer camp fees for daughter. Use Dravvings account. ESSION DATE - JUNE 30, 2020 Memo \#3 Dated June 30, 2020 From Owner: enter adjustments for prepaid insurance and rent expired: Insurance for one month: $1000 Rent for one month: $1800 Memo \#3 Dated June 30, 2020 From Owner: enter adjustments for prepaid insurance and rent expired: Insurance for one month: $1000 Rent for one month: $1800 Cheque \#492 for $842 to Western Data was recorded with an incorrect amount. The cheque amount was $882. Adjust the entry to change the amount. A key advantage to using Sage 50 rather than a manual system is the ability to produce financial reports quickly for any date or time period. Sage 50 allows you to enter accounting data accurately so you can prepare the reports you need for reporting to government and investors and for business analysis. Reports that are provided for a specific date, such as the Balance Sheet, can be produced for any date from the time the accounting records were converted to the computerized system up to the latest journal entry. Reports that summarize a financial period, such as the Income Statement, can be produced for any period between the beginning of the fiscal period and the latest journal entry. Reports are available from multiple locations: the Accounts window, the Home window Reports menu, the Select A Report tool in the Classic view, and from the Reports list and the Report Centre in the Reports pane of the Home windowStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started