Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In the U.S., the consumer price index, which tracks a broad basket of goods and services, is over 8% during 2022. This is way

![]()

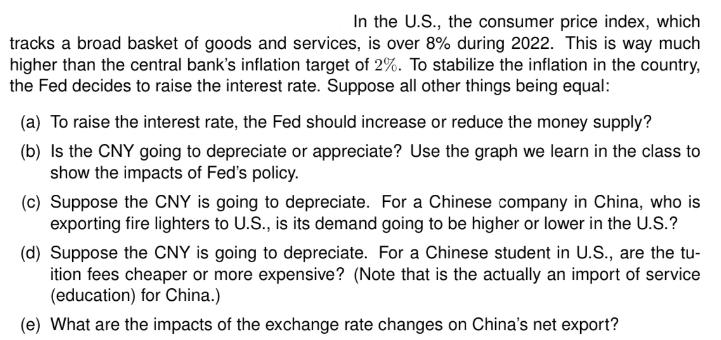

In the U.S., the consumer price index, which tracks a broad basket of goods and services, is over 8% during 2022. This is way much higher than the central bank's inflation target of 2%. To stabilize the inflation in the country, the Fed decides to raise the interest rate. Suppose all other things being equal: (a) To raise the interest rate, the Fed should increase or reduce the money supply? (b) Is the CNY going to depreciate or appreciate? Use the graph we learn in the class to show the impacts of Fed's policy. (c) Suppose the CNY is going to depreciate. For a Chinese company in China, who is exporting fire lighters to U.S., is its demand going to be higher or lower in the U.S.? (d) Suppose the CNY is going to depreciate. For a Chinese student in U.S., are the tu- ition fees cheaper or more expensive? (Note that is the actually an import of service (education) for China.) (e) What are the impacts of the exchange rate changes on China's net export? (f) All other things being equal, will the U.S. current account deficits be reduced? Why?

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a To raise the interest rate the Fed should reduce the money supply The Federal Reserve typically increases the federal funds rate the interest rate b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started