Answered step by step

Verified Expert Solution

Question

1 Approved Answer

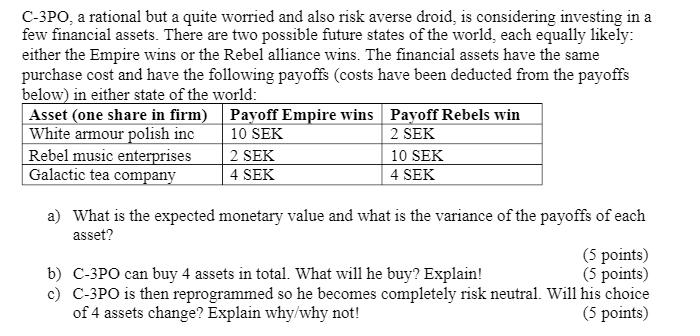

C-3PO, a rational but a quite worried and also risk averse droid, is considering investing in a few financial assets. There are two possible

C-3PO, a rational but a quite worried and also risk averse droid, is considering investing in a few financial assets. There are two possible future states of the world, each equally likely: either the Empire wins or the Rebel alliance wins. The financial assets have the same purchase cost and have the following payoffs (costs have been deducted from the payoffs below) in either state of the world: Asset (one share in firm) White armour polish inc Rebel music enterprises Galactic tea company Payoff Empire wins 10 SEK 2 SEK 4 SEK Payoff Rebels win 2 SEK 10 SEK 4 SEK a) What is the expected monetary value and what is the variance of the payoffs of each asset? (5 points) (5 points) b) C-3PO can buy 4 assets in total. What will he buy? Explain! c) C-3PO is then reprogrammed so he becomes completely risk neutral. Will his choice of 4 assets change? Explain why/why not! (5 points)

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Two different methods of analyzing work are 1 Job Observation This method involves directly observin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started