Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In the Winter of 2023 you have purchased a Tuber Harvesting Machine from John Deere Ltd. in Chicago I In the agreement of purchase

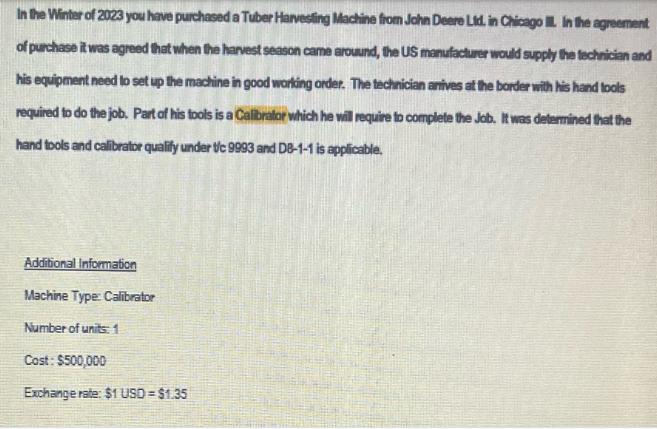

In the Winter of 2023 you have purchased a Tuber Harvesting Machine from John Deere Ltd. in Chicago I In the agreement of purchase it was agreed that when the harvest season came arouund, the US manufacturer would supply the technician and his equipment need to set up the machine in good working order. The technician anives at the border with his hand tools required to do the job. Part of his tools is a Calibrator which he will require to complete the Job. It was determined that the hand tools and calibrator qualify under t/c 9993 and DB-1-1 is applicable. Additional Information Machine Type: Calibrator Number of units: 1 Cost: $500,000 Exchange rate: $1 USD = $1.35 Calculate VFCC, VFD, CD, VFT, GST, TDTP

Step by Step Solution

★★★★★

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the Value for Customs Calculation VFCC Value for Duty VFD Customs Duties CD Value for Tax Calculation VFT Goods and Services Tax GST and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started