Question

In the year 2020, in a project to develop a new product, Topeka Company incurred research and development costs totaling $7,000,000. Topeka management is able

In the year 2020, in a project to develop a new product, Topeka Company incurred research and development costs totaling $7,000,000. Topeka management is able to clearly distinguish the research phase from the development phase of the project. Research-phase costs are $4,000,000, and development-phase costs are $3,000,000. The IAS 38 criteria have been met for recognition of 50% of the development costs as an asset. The new product was brought to market at the beginning of 2021 and is expected to be marketable for 10 years. (Ignore income tax effects.)

1.Determine the impact the research and development costs have on Topeka Company's income statement for the years 2020, 2021 and 2022 for both U.S. GAAP and IFRS.

2.Summarize the difference in income, total assets and total stockholders’ equity using the two different sets of accounting rules for the years 2020, 2021 and 2022. (Keep in mind that assets and equity will have the same cumulative effect in order for the balance sheet to balance.)

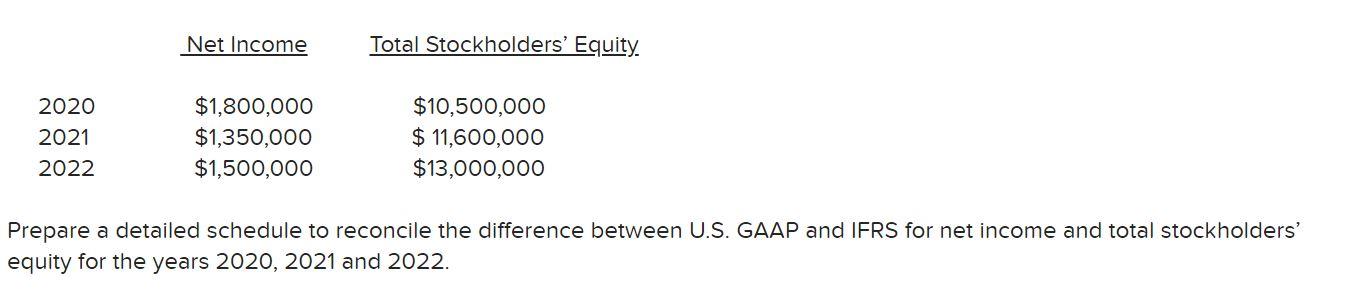

3.Assume that net income for each year and total stockholders’ equity at the end of year using U.S. GAAP was the following:

Net Income Total Stockholders' Equity $1,800,000 $1,350,000 $1,500,000 $10,500,000 $ 11,600,000 $13,000,000 2020 2021 2022 Prepare a detailed schedule to reconcile the difference between U.S. GAAP and IFRS for net income and total stockholders' equity for the years 2020, 2021 and 2022.

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Accounting requirements and rules for intangible assets ie non momentary with or without physical pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started