Answered step by step

Verified Expert Solution

Question

1 Approved Answer

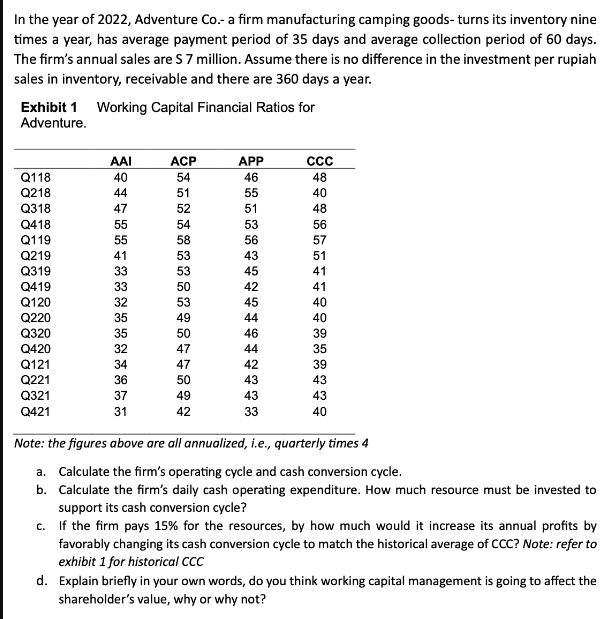

In the year of 2022, Adventure Co.- a firm manufacturing camping goods- turns its inventory nine times a year, has average payment period of

In the year of 2022, Adventure Co.- a firm manufacturing camping goods- turns its inventory nine times a year, has average payment period of 35 days and average collection period of 60 days. The firm's annual sales are S 7 million. Assume there is no difference in the investment per rupiah sales in inventory, receivable and there are 360 days a year. Exhibit 1 Working Capital Financial Ratios for Adventure. AAI ACP APP CCC Q118 40 54 46 48 Q218 44 51 55 40 Q318 47 52 51 48 Q418 55 54 53 56 Q119 55 58 56 57 Q219 41 53 43 51 Q319 33 53 45 41 Q419 Q120 Q220 Q320 Q420 32332 50 42 41 53 45 40 35 49 44 40 35 50 46 39 47 44 35 Q121 34 47 42 39 Q221 36 50 43 43 Q321 37 49 43 43 Q421 31 42 33 40 Note: the figures above are all annualized, i.e., quarterly times 4 a. Calculate the firm's operating cycle and cash conversion cycle. b. Calculate the firm's daily cash operating expenditure. How much resource must be invested to support its cash conversion cycle? c. If the firm pays 15% for the resources, by how much would it increase its annual profits by favorably changing its cash conversion cycle to match the historical average of CCC? Note: refer to exhibit 1 for historical CCC d. Explain briefly in your own words, do you think working capital management is going to affect the shareholder's value, why or why not?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer a To calculate the firms operating cycle and cash conversion cycle we can use the following formulas Operating Cycle Average Age of Inventory A...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started