Question

In this analysis KCG is considering introducing a new product and you need to analyze the shareholder wealth impact of the product introduction. Use the

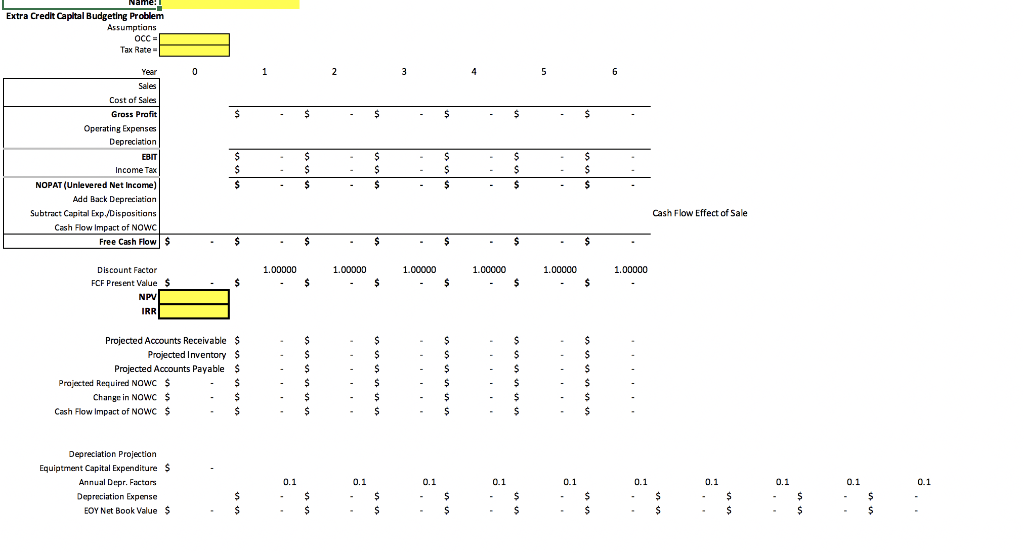

In this analysis KCG is considering introducing a new product and you need to analyze the shareholder wealth impact of the product introduction. Use the information below to calculate the NPV and IRR of the project. Over the past two years, KCG, Inc. has expended $500,000 for research, engineering and test market costs related to the possible manufacture and sale of improved portable generators that will run on propane fuel instead of gas. The time has come for a final decision about whether or not to add the new product to its existing product offerings of portable generators. The equipment necessary to produce the product will cost $4,000,000 installed, and will be depreciated on a straight line basis for 10 years. In six years, at the end of the project, they anticipate being able to sell the equipment for only $600,000. KCG, Inc. expects sales of the new generators to equal $4,800,000 annually over the next six years. Cost of Goods Sold are forecast to equal 70% of the new products sales. The accounting area has estimated that fixed operating expenses (exclusive of depreciation) of $190,000 annually should be allocated to production. This figure represents a reallocation of the firm's existing fixed annual operating expenses, yet this project is expected to only generate $40,000 in incremental operating expenses. The accounting department also estimates that at introduction in year zero the new product's required initial net operating working capital will be $450,000. In future years accounts receivable are expected to be 15% of the next year sales, inventory is expected to be 25% of the next years cost of goods sold and accounts payable are expected to be 15% of the next years cost of goods sold. You will first need to project Annual Sales and COGS to calculate NOWC. Here is additional information about the new venture:

(1) The income tax rate equals 21%.

(2) The appropriate cost of capital for the project is 12%.

(3) Assume that without the proposal KCG, Inc. has a positive taxable income so that if in any year the proposal generates a loss, it can be used to reduce the firms overall taxable income

and thereby save taxes.

*use template below*

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started