Question

In this analysis, you are asked to advise Boeing (whose currency of operation is the US dollar) on how to hedge its foreign exchange risk

In this analysis, you are asked to advise Boeing (whose currency of operation is the US dollar) on how to hedge its foreign exchange risk exposure to a 310M NZD receivable. You will consider several possible hedging strategies and provide advice as to which would be best. You have the information in Exhibit 1.

Exhibit 1

FX Market

Bid Ask Current spot rate (USD per NZD) Bid =0.6450 Ask=0.6550

12-month forward swap points 65 75 12-month forward rate (USD per NZD)

Over-the-Counter Options Available Option Strike (USD per NZD) 0.6500

Maturity 12 Months

Bid Ask Call Option premium (USD per NZD) Bid=0.0540 Ask=0.0560

Put Option premium (USD per NZD) Bid=0.0475 Ask=0.0495

Bank Rates USD NZD 12-month deposit interest rate USD =0.750% NZD=1.750%

12-month loan rate USD=2.750% NZD=3.750%

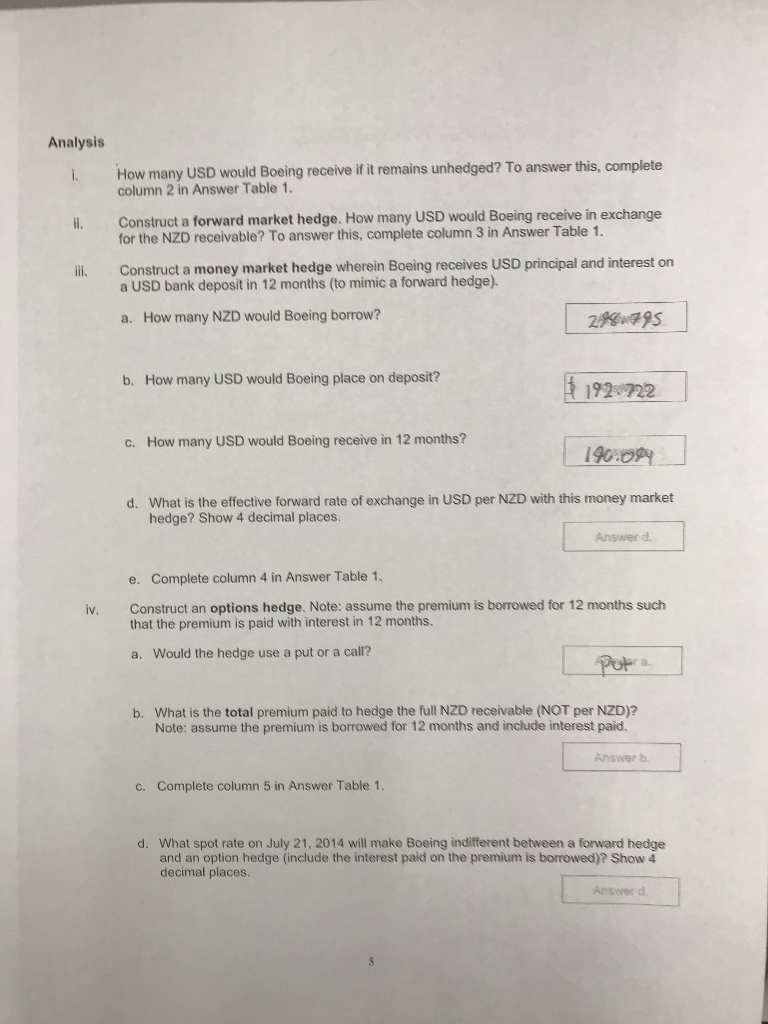

Analysis

How many USD would Boeing receive if it remains unhedged? To answer this, complete column 2 in Answer Table 1.

ii. Construct a forward market hedge. How many USD would Boeing receive in exchange for the NZD receivable? To answer this, complete column 3 in Answer Table 1.

iii. Construct a money market hedge wherein Boeing receives USD principal and interest on a USD bank deposit in 12 months (to mimic a forward hedge)

. a. How many NZD would Boeing borrow?

b. How many USD would Boeing place on deposit?

c. How many USD would Boeing receive in 12 months?

d. What is the effective forward rate of exchange in USD per NZD with this money market hedge? Show 4 decimal places.

e. Complete column 4 in Answer Table 1.

iv. Construct an options hedge. Note: assume the premium is borrowed for 12 months such that the premium is paid with interest in 12 months.

a. Would the hedge use a put or a call?

b. What is the total premium paid to hedge the full NZD receivable (NOT per NZD)? Note: assume the premium is borrowed for 12 months and include interest paid.

c. Complete column 5 in Answer Table 1.

d. What spot rate on July 21, 2014 will make Boeing indifferent between a forward hedge and an option hedge (include the interest paid on the premium is borrowed)? Show 4 decimal places.

Answer Table 1:

(1) Spot Rate USD (2) Unhedged USD 3)Forward USD 4)Money Markey Hedge USD 5)Option Hedge (Inclusive of premium with interest USD  per NZD

per NZD

| .5 | ||||

| .55 | ||||

| .6 | ||||

| .65 | ||||

| .7 | ||||

| .75 | ||||

| .8 |

Analysis How many USD would Boeing receive if it remains unhedged? To answer this, complete column 2 in Answer Table 1 Construct a forward market hedge. How many USD would Boeing receive in exchange for the NZD receivable? To answer this, complete column 3 in Answer Table 1 ii. ili. Construct a money market hedge wherein Boeing receives USD principal and interest on a USD bank deposit in 12 months (to mimic a forward hedge). a. How many NZD would Boeing borrow? b. How many USD would Boeing place on deposit? 192 722 c. How many USD would Boeing receive in 12 months? 190:0P d. What is the effective forward rate of exchange in USD per NZD with this money market hedge? Show 4 decimal places. Answer d e. Complete column 4 in Answer Table 1. Construct an options hedge. Note: assume the premium is borrowed for 12 months such that the premium is paid with interest in 12 months. iv. a. Would the hedge use a put or a call? Pot What is the total premium paid to hedge the full NZD receivable (NOT per NZD)? Note: assume the premium is borrowed for 12 months and include interest paid. b. Answer c. Complete column 5 in Answer Table 1. What spot rate on July 21, 2014 will make Boeing indifferent between a forward hedge and an option hedge (include the interest paid on the premium is borrowed)? Show 4 decimal places d. Answer d Analysis How many USD would Boeing receive if it remains unhedged? To answer this, complete column 2 in Answer Table 1 Construct a forward market hedge. How many USD would Boeing receive in exchange for the NZD receivable? To answer this, complete column 3 in Answer Table 1 ii. ili. Construct a money market hedge wherein Boeing receives USD principal and interest on a USD bank deposit in 12 months (to mimic a forward hedge). a. How many NZD would Boeing borrow? b. How many USD would Boeing place on deposit? 192 722 c. How many USD would Boeing receive in 12 months? 190:0P d. What is the effective forward rate of exchange in USD per NZD with this money market hedge? Show 4 decimal places. Answer d e. Complete column 4 in Answer Table 1. Construct an options hedge. Note: assume the premium is borrowed for 12 months such that the premium is paid with interest in 12 months. iv. a. Would the hedge use a put or a call? Pot What is the total premium paid to hedge the full NZD receivable (NOT per NZD)? Note: assume the premium is borrowed for 12 months and include interest paid. b. Answer c. Complete column 5 in Answer Table 1. What spot rate on July 21, 2014 will make Boeing indifferent between a forward hedge and an option hedge (include the interest paid on the premium is borrowed)? Show 4 decimal places d. Answer d

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started