Question

In this assessment you must calculate and interpret the following ratios for the same selected period of 2 years, besides presenting the trend analysis. 1.

In this assessment you must calculate and interpret the following ratios for the same selected period of 2 years, besides presenting the trend analysis.

1. Market Value Ratios

Besides ratio analysis, you must also conduct the following:

2. Use Du-Pont Equation to identify the key weaknesses or strengths of the company.

3. Perform the valuation of the firm according to the below given methodology. a. You are required to calculate the Price of the stock, assuming a constant growth perpetual dividend discount model, and compare it with the current market price. You must write in details whether the stock is currently undervalued or overvalued based on your analysis, and provide your investment advice.

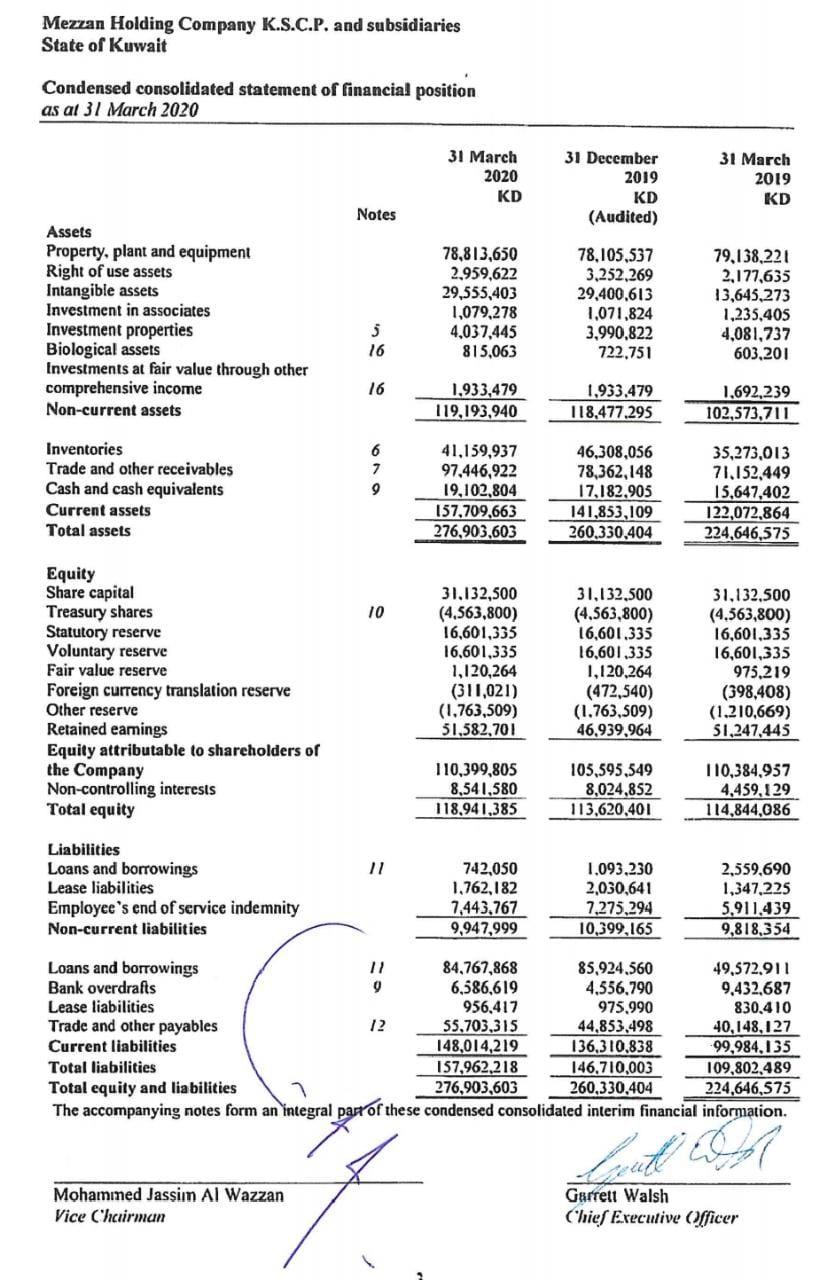

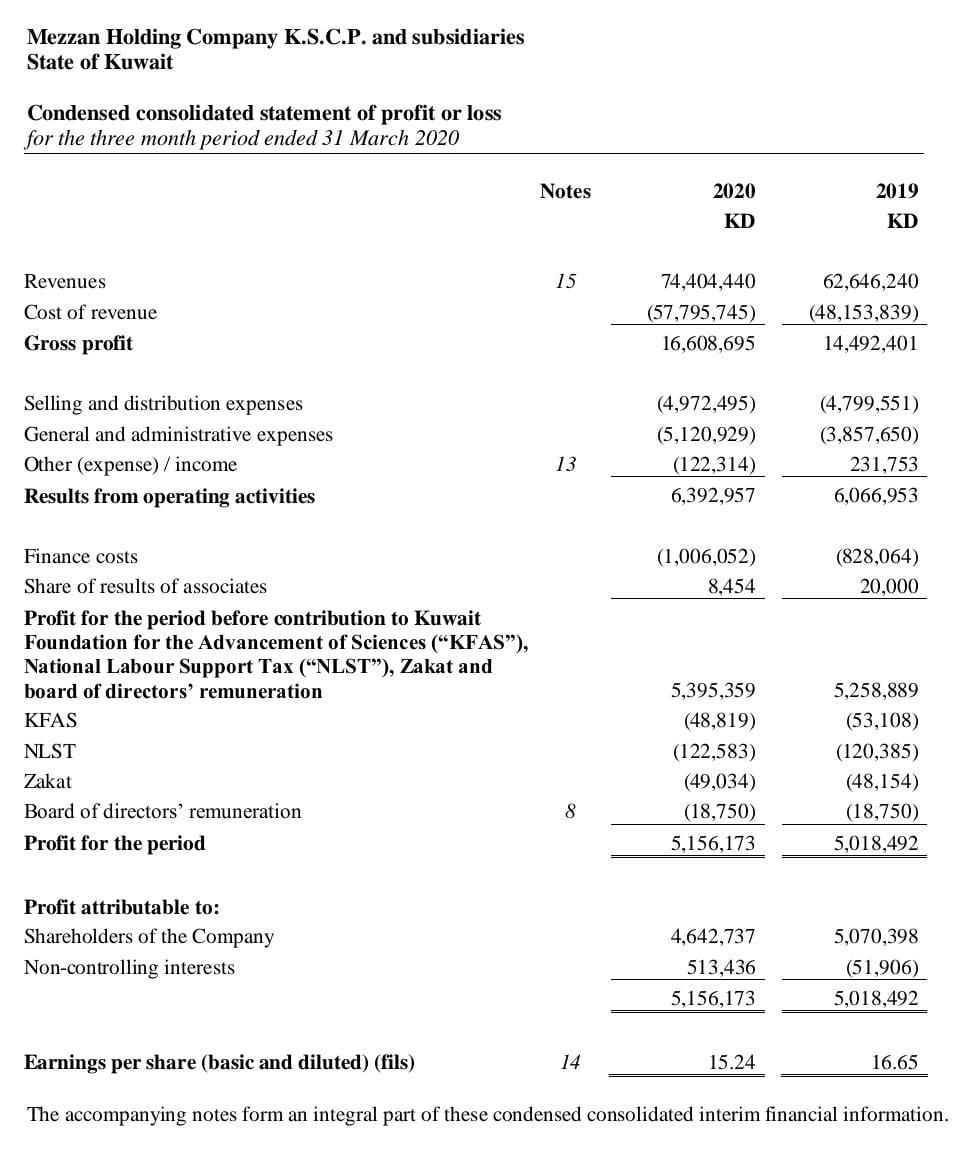

Mezzan Holding Company K.S.C.P. and subsidiaries State of Kuwait Condensed consolidated statement of financial position as al 31 March 2020 31 March 2020 KD 31 December 2019 KD (Audited) 31 March 2019 KD Notes Assets Property, plant and equipment Right of use assets Intangible assets Investment in associates Investment properties Biological assets Investments at fair value through other comprehensive income Non-current assets 78,813,650 2,959,622 29,555,403 1,079,278 4,037,445 815,063 78,105,537 3.252.269 29,400,613 1,071.824 3,990,822 722.751 79.138.221 2,177,635 13,645,273 1,235,405 4,081,737 603,201 5 16 16 1,933,479 119,193,940 1,933,479 118,477.295 1,692,239 102,573,711 Inventories Trade and other receivables Cash and cash equivalents Current assets Total assets 6 7 9 41,159,937 97,446,922 19,102,804 157,709,663 276,903,603 46,308,056 78,362,148 17,182,905 141,853,109 260.330,404 35,273,013 71.152.449 15,647,402 122,072,864 224,646,575 10 Equity Share capital Treasury shares Statutory reserve Voluntary reserve Fair value reserve Foreign currency translation reserve Other reserve Retained eamings Equity attributable to shareholders of the Company Non-controlling interests Total equity 31,132,500 (4,563,800) 16,601,335 16,601,335 1,120,264 (311,021) (1,763,509) 51,582,701 31,132,500 (4.563,800) 16,601.335 16,601.335 1,120.264 (472,540) (1.763,509) 46,939,964 31,132,500 (4.563,800) 16,601,335 16,601,335 975.219 (398,408) (1.210,669) 51,247,445 110,399,805 8,541,580 118,941,385 105,595,549 8,024,852 113,620,401 110,384,957 4,459,129 114,844,086 Liabilities Loans and borrowings Lease liabilities Employee's end of service indemnity Non-current liabilities 742.050 1,762,182 7,443,767 9,947,999 1.093.230 2,030,641 7.275.294 10,399,165 2,559,690 1,347,225 5,911,439 9,818,354 Loans and borrowings 84,767,868 85.924,560 49,572.911 Bank overdrafts 9 6,586,619 4,556.790 9,432,687 Lease liabilities 956,417 975.990 830,410 Trade and other payables 12 55,703,315 44,853,498 40,148,127 Current liabilities 148,014,219 136,310,838 99,984,135 Total liabilities 157,962,218 146,710,003 109,802,489 Total equity and liabilities 276,903,603 260,330,404 224,646,575 The accompanying notes form an integral part of these condensed consolidated interim financial information. Mohamined Jassiin Al Wazzan Vice Chairman Garrett Walsh Chief Executive Officer Mezzan Holding Company K.S.C.P. and subsidiaries State of Kuwait Condensed consolidated statement of profit or loss for the three month period ended 31 March 2020 Notes 2020 2019 KD KD 15 Revenues Cost of revenue Gross profit 74,404,440 (57,795,745) 16,608,695 62,646,240 (48,153,839) 14,492,401 Selling and distribution expenses General and administrative expenses Other (expense) / income Results from operating activities (4,972,495) (5,120,929) (122,314) 6,392,957 (4,799,551) (3,857,650) 231,753 6,066,953 13 (1,006,052) 8,454 (828,064) 20,000 Finance costs Share of results of associates Profit for the period before contribution to Kuwait Foundation for the Advancement of Sciences ("KFAS), National Labour Support Tax ("NLST), Zakat and board of directors' remuneration KFAS NLST Zakat Board of directors' remuneration Profit for the period 5,395,359 (48,819) (122,583) (49,034) (18,750) 5,156,173 5,258,889 (53,108) (120,385) (48,154) (18,750) 5,018,492 8 Profit attributable to: Shareholders of the Company Non-controlling interests 4,642,737 513,436 5,156,173 5,070,398 (51,906) 5,018,492 Earnings per share (basic and diluted) (fils) 14 15.24 16.65 The accompanying notes form an integral part of these condensed consolidated interim financial information. Mezzan Holding Company K.S.C.P. and subsidiaries State of Kuwait Condensed consolidated statement of financial position as al 31 March 2020 31 March 2020 KD 31 December 2019 KD (Audited) 31 March 2019 KD Notes Assets Property, plant and equipment Right of use assets Intangible assets Investment in associates Investment properties Biological assets Investments at fair value through other comprehensive income Non-current assets 78,813,650 2,959,622 29,555,403 1,079,278 4,037,445 815,063 78,105,537 3.252.269 29,400,613 1,071.824 3,990,822 722.751 79.138.221 2,177,635 13,645,273 1,235,405 4,081,737 603,201 5 16 16 1,933,479 119,193,940 1,933,479 118,477.295 1,692,239 102,573,711 Inventories Trade and other receivables Cash and cash equivalents Current assets Total assets 6 7 9 41,159,937 97,446,922 19,102,804 157,709,663 276,903,603 46,308,056 78,362,148 17,182,905 141,853,109 260.330,404 35,273,013 71.152.449 15,647,402 122,072,864 224,646,575 10 Equity Share capital Treasury shares Statutory reserve Voluntary reserve Fair value reserve Foreign currency translation reserve Other reserve Retained eamings Equity attributable to shareholders of the Company Non-controlling interests Total equity 31,132,500 (4,563,800) 16,601,335 16,601,335 1,120,264 (311,021) (1,763,509) 51,582,701 31,132,500 (4.563,800) 16,601.335 16,601.335 1,120.264 (472,540) (1.763,509) 46,939,964 31,132,500 (4.563,800) 16,601,335 16,601,335 975.219 (398,408) (1.210,669) 51,247,445 110,399,805 8,541,580 118,941,385 105,595,549 8,024,852 113,620,401 110,384,957 4,459,129 114,844,086 Liabilities Loans and borrowings Lease liabilities Employee's end of service indemnity Non-current liabilities 742.050 1,762,182 7,443,767 9,947,999 1.093.230 2,030,641 7.275.294 10,399,165 2,559,690 1,347,225 5,911,439 9,818,354 Loans and borrowings 84,767,868 85.924,560 49,572.911 Bank overdrafts 9 6,586,619 4,556.790 9,432,687 Lease liabilities 956,417 975.990 830,410 Trade and other payables 12 55,703,315 44,853,498 40,148,127 Current liabilities 148,014,219 136,310,838 99,984,135 Total liabilities 157,962,218 146,710,003 109,802,489 Total equity and liabilities 276,903,603 260,330,404 224,646,575 The accompanying notes form an integral part of these condensed consolidated interim financial information. Mohamined Jassiin Al Wazzan Vice Chairman Garrett Walsh Chief Executive Officer Mezzan Holding Company K.S.C.P. and subsidiaries State of Kuwait Condensed consolidated statement of profit or loss for the three month period ended 31 March 2020 Notes 2020 2019 KD KD 15 Revenues Cost of revenue Gross profit 74,404,440 (57,795,745) 16,608,695 62,646,240 (48,153,839) 14,492,401 Selling and distribution expenses General and administrative expenses Other (expense) / income Results from operating activities (4,972,495) (5,120,929) (122,314) 6,392,957 (4,799,551) (3,857,650) 231,753 6,066,953 13 (1,006,052) 8,454 (828,064) 20,000 Finance costs Share of results of associates Profit for the period before contribution to Kuwait Foundation for the Advancement of Sciences ("KFAS), National Labour Support Tax ("NLST), Zakat and board of directors' remuneration KFAS NLST Zakat Board of directors' remuneration Profit for the period 5,395,359 (48,819) (122,583) (49,034) (18,750) 5,156,173 5,258,889 (53,108) (120,385) (48,154) (18,750) 5,018,492 8 Profit attributable to: Shareholders of the Company Non-controlling interests 4,642,737 513,436 5,156,173 5,070,398 (51,906) 5,018,492 Earnings per share (basic and diluted) (fils) 14 15.24 16.65 The accompanying notes form an integral part of these condensed consolidated interim financial informationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started